- Italy

- /

- Real Estate

- /

- BIT:GAB

Gabetti Property Solutions Leads These 3 European Penny Stocks To Consider

Reviewed by Simply Wall St

As European markets experience a boost, with the STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns, investors are exploring diverse opportunities for growth. Penny stocks, often associated with smaller or newer companies, present unique potential in this context despite their vintage name. These stocks can offer unexpected value and growth prospects when backed by strong financial fundamentals and resilience.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Transferator (NGM:TRAN A) | SEK2.77 | SEK263.63M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.78 | SEK283.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.74 | SEK227.54M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.68 | PLN124.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.56 | €53.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.20 | €24.32M | ✅ 3 ⚠️ 3 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.58 | €17.13M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22.01M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.16 | €298.22M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 435 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Gabetti Property Solutions (BIT:GAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gabetti Property Solutions S.p.A., with a market cap of €37.41 million, operates through its subsidiaries to offer real estate services both in Italy and internationally.

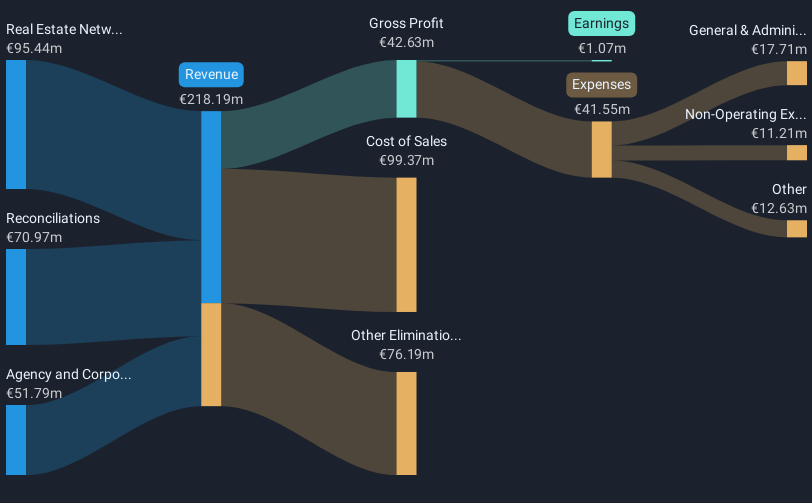

Operations: The company generates revenue through its Real Estate Network Services (€95.44 million), Agency and Corporate Services (€51.79 million), and Reconciliations (€70.97 million) segments.

Market Cap: €37.41M

Gabetti Property Solutions S.p.A., with a market cap of €37.41 million, has shown steady revenue growth, reaching €218.19 million in 2024 from €192.99 million the previous year, despite a decrease in sales to €142 million from €188.35 million. The company maintains profitability with net income rising slightly to €1.07 million and earnings per share improving marginally to EUR 0.018 from EUR 0.017 year-over-year. However, challenges include high debt levels with a net debt to equity ratio of 40.8% and large one-off losses impacting financial results, alongside management's lack of experience and high share price volatility recently observed.

- Take a closer look at Gabetti Property Solutions' potential here in our financial health report.

- Understand Gabetti Property Solutions' earnings outlook by examining our growth report.

Arcure (ENXTPA:ALCUR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Arcure S.A. develops AI solutions to enhance the autonomy of industrial machinery globally and has a market cap of €24.32 million.

Operations: The company's revenue is derived from its Electronic Security Devices segment, totaling €18.71 million.

Market Cap: €24.32M

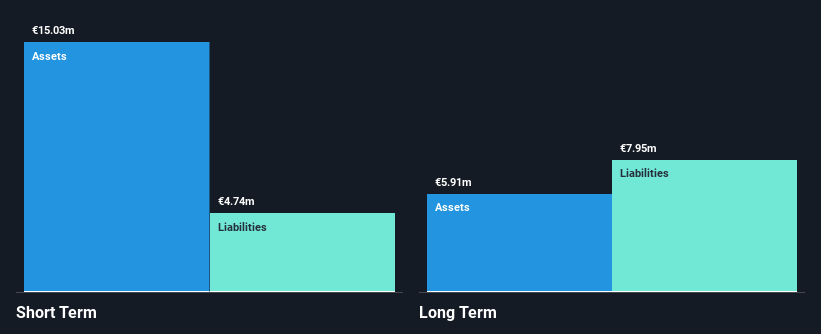

Arcure S.A. has a market cap of €24.32 million and generates revenue from its Electronic Security Devices segment, totaling €18.71 million, indicating it is not pre-revenue. The company trades at a significant discount to estimated fair value and maintains strong financial metrics with short-term assets exceeding both short and long-term liabilities. Despite high debt levels with an increased net debt to equity ratio of 58%, interest payments are well covered by EBIT, suggesting manageable debt servicing capability. However, earnings growth has been negative recently, contrasting with the broader Electrical industry trend, while share price volatility remains high over the past year.

- Jump into the full analysis health report here for a deeper understanding of Arcure.

- Gain insights into Arcure's future direction by reviewing our growth report.

Arbona (NGM:ARBO A)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arbona AB (publ) is an investment company focusing on small and medium-sized listed and unlisted companies in Sweden, with a market cap of approximately SEK1.73 billion.

Operations: The company generates revenue of SEK636.21 million from its operations in Sweden.

Market Cap: SEK1.73B

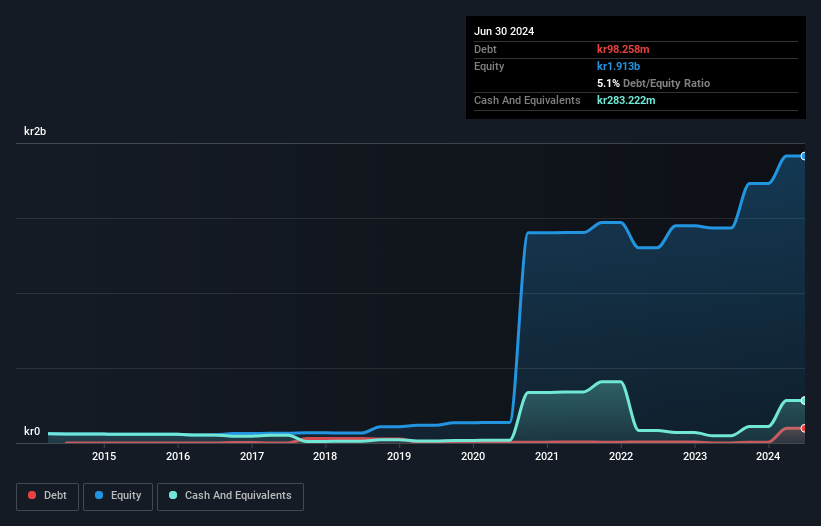

Arbona AB (publ), with a market cap of approximately SEK1.73 billion, has demonstrated substantial revenue growth, reporting SEK636.21 million for 2024 compared to SEK49.57 million the previous year. Despite this increase, earnings growth has been negative recently due to a significant one-off gain affecting financial results and lower profit margins at 27.5%. The company is debt-free, ensuring no interest payment concerns, and its short-term assets comfortably cover both short and long-term liabilities. Trading at a discount to estimated fair value suggests potential upside; however, its return on equity remains low at 9%.

- Click to explore a detailed breakdown of our findings in Arbona's financial health report.

- Learn about Arbona's historical performance here.

Make It Happen

- Explore the 435 names from our European Penny Stocks screener here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GAB

Gabetti Property Solutions

Through its subsidiaries, provides real estate services in Italy and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives