- Italy

- /

- Capital Markets

- /

- BIT:DIAD

3 European Penny Stocks With Market Caps Below €40M

Reviewed by Simply Wall St

As the European markets navigate a period of mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower and major indexes showing varied results, investors are keenly observing potential opportunities within smaller market segments. Penny stocks, despite their somewhat outdated moniker, continue to capture interest as they often represent smaller or newer companies with unique growth potential. By focusing on those with robust financials and a clear growth trajectory, investors can uncover compelling opportunities in this niche segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.324 | €1.5B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.64 | €82.4M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.00 | €14.86M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.22 | SEK195.9M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.285 | €378.73M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.26 | €312.38M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.788 | €26.39M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 288 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Diadema Capital. Società Benefit (BIT:DIAD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Diadema Capital S.p.A. Società Benefit provides industrial consulting and strategic planning services for the agri-food and alternative and renewable energy sectors, with a market cap of €10.36 million.

Operations: Diadema Capital S.p.A. Società Benefit has not reported any specific revenue segments.

Market Cap: €10.36M

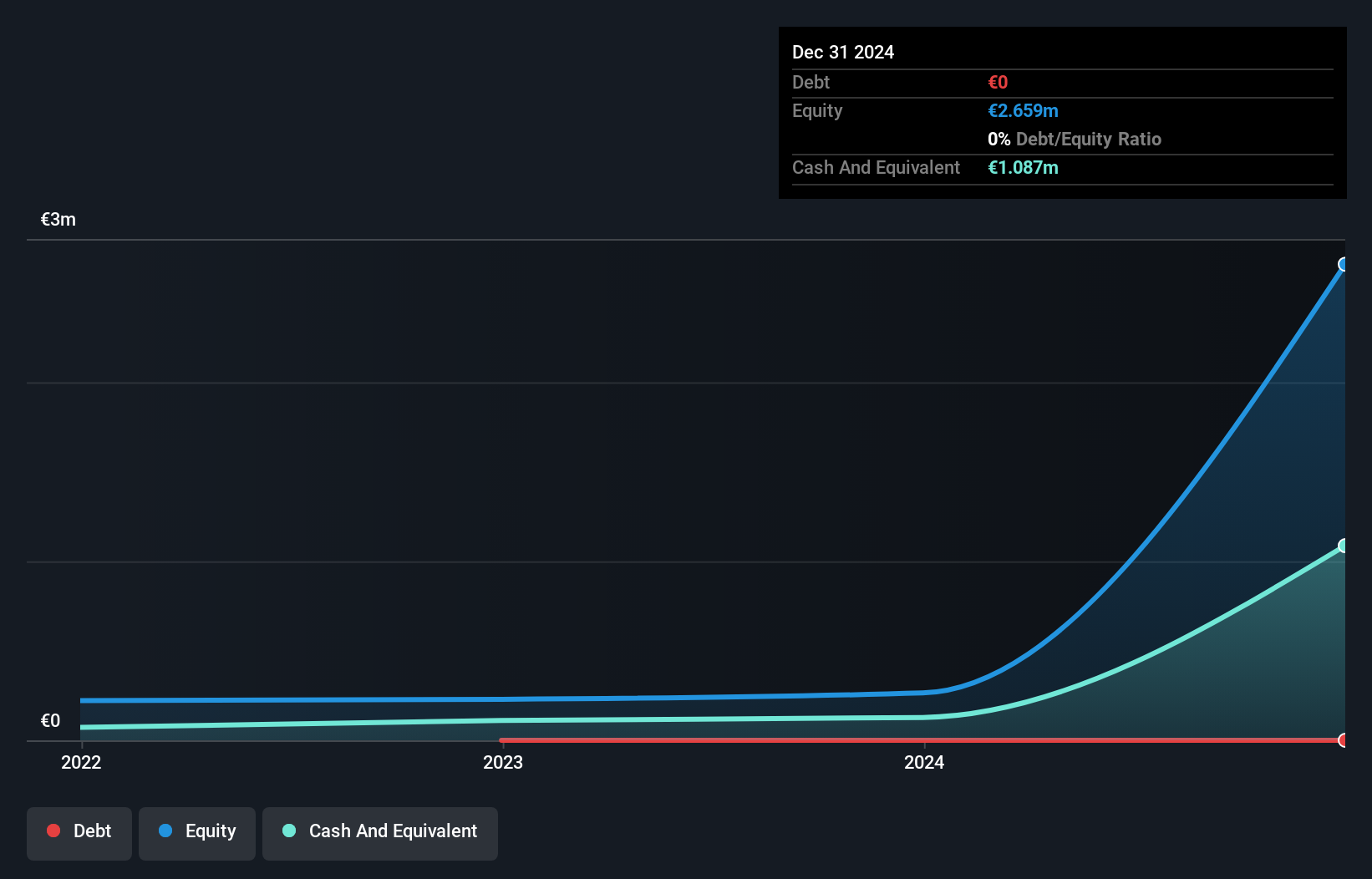

Diadema Capital S.p.A. Società Benefit, with a market cap of €10.36 million, operates in the agri-food and renewable energy sectors but remains pre-revenue with limited sales of €1.19 million for the first half of 2025. The company is unprofitable, evidenced by a negative return on equity and declining earnings over five years. Despite this, its short-term assets exceed liabilities, indicating some financial stability. Diadema's cash reserves surpass total debt levels, reducing immediate liquidity concerns. However, the board's inexperience might affect strategic direction as revenue is forecast to grow significantly at 35% annually amidst stable stock volatility.

- Take a closer look at Diadema Capital. Società Benefit's potential here in our financial health report.

- Examine Diadema Capital. Società Benefit's earnings growth report to understand how analysts expect it to perform.

Gabetti Property Solutions (BIT:GAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gabetti Property Solutions S.p.A. operates through its subsidiaries to offer real estate services both in Italy and internationally, with a market cap of €39.22 million.

Operations: The company generates revenue through its subsidiaries by providing real estate services across various geographical regions, primarily focusing on Italy and international markets.

Market Cap: €39.22M

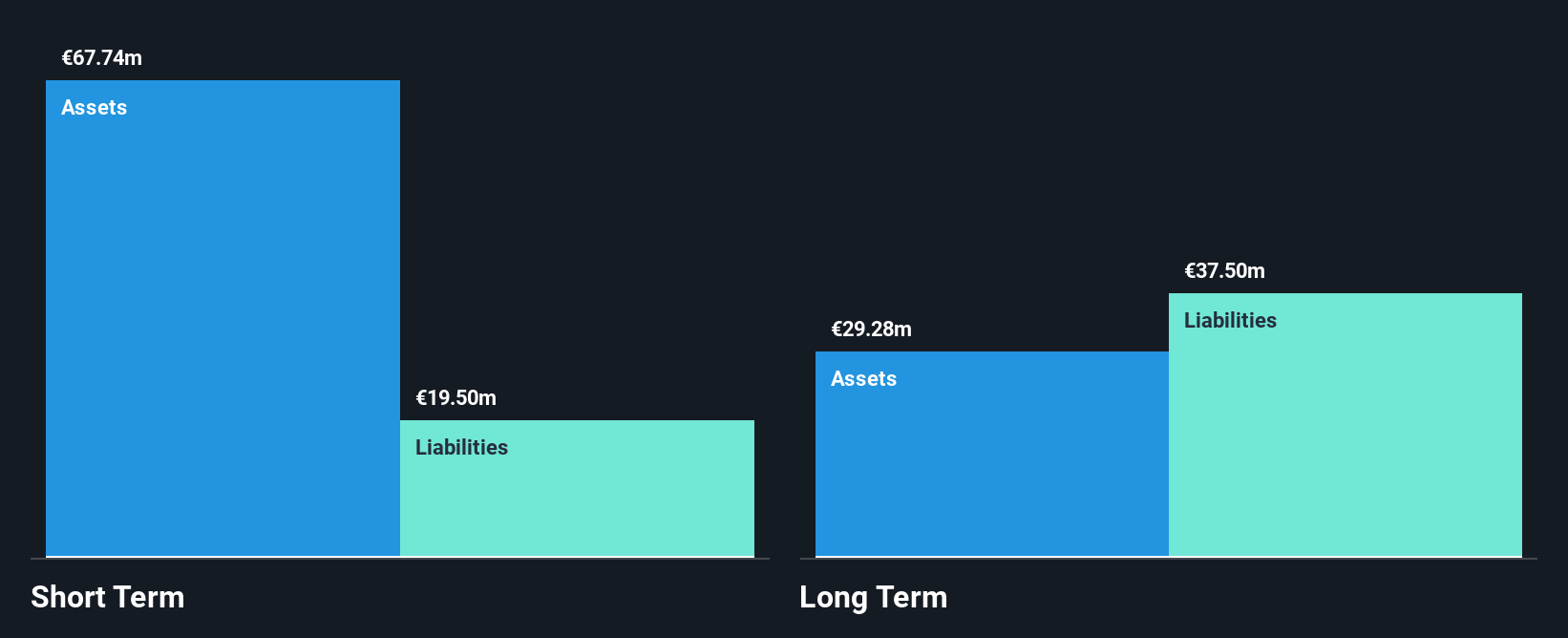

Gabetti Property Solutions S.p.A., with a market cap of €39.22 million, has demonstrated recent financial improvement by becoming profitable over the past year. The company's debt to equity ratio has decreased from 136.2% to 108.1% over five years, and its short-term assets exceed both short-term and long-term liabilities, suggesting solid financial footing despite high net debt to equity (70.1%). Recent earnings reports show increased sales (€4.01 million in Q3 2025) and a reduced net loss (€0.015 million), indicating operational progress amidst stable weekly volatility and trading at a significant discount compared to estimated fair value.

- Click to explore a detailed breakdown of our findings in Gabetti Property Solutions' financial health report.

- Evaluate Gabetti Property Solutions' prospects by accessing our earnings growth report.

Pearl Gold (DB:02P)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pearl Gold AG is a holding company that invests in gold mining projects across Africa, with a market cap of €14.50 million.

Operations: No revenue segments have been reported for the company.

Market Cap: €14.5M

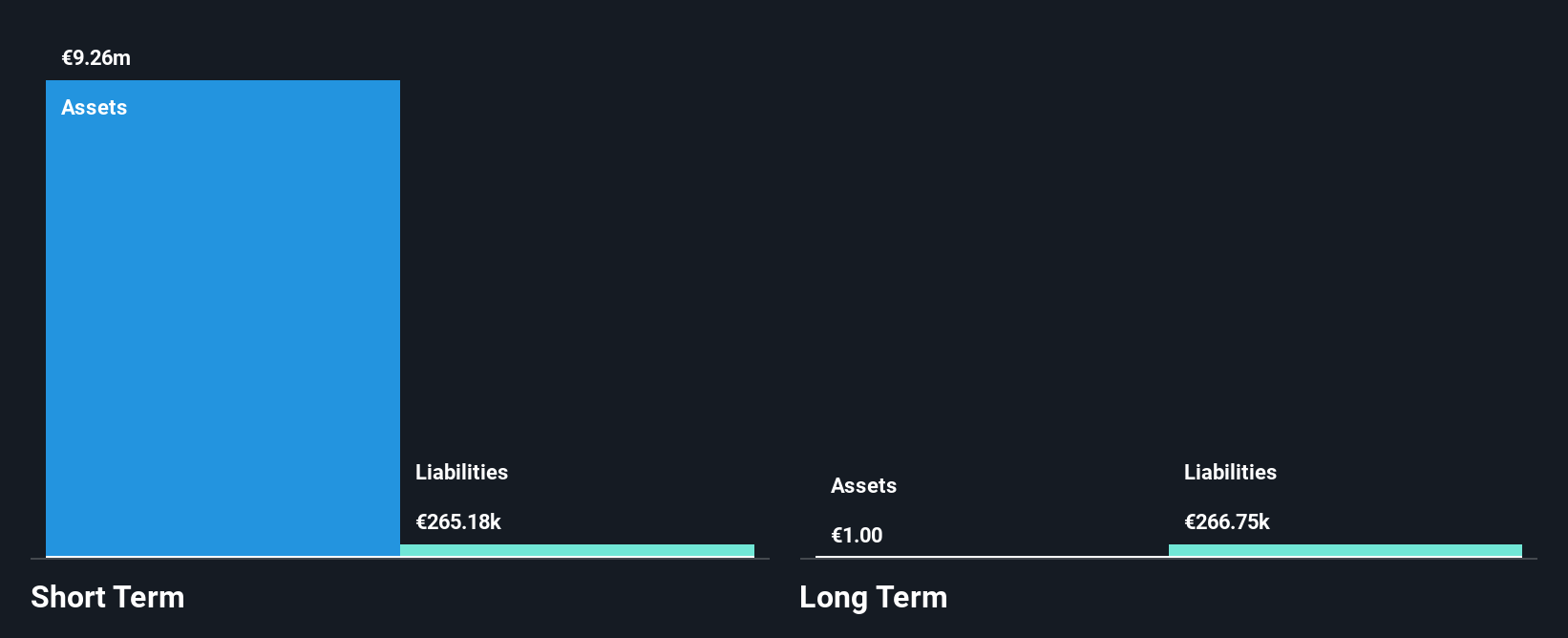

Pearl Gold AG, with a market cap of €14.50 million, is pre-revenue and unprofitable, having reported a net loss of €0.54 million for the first half of 2025. Despite its financial challenges, the company remains debt-free and its short-term assets (€8.5 million) comfortably cover both short-term (€214K) and long-term liabilities (€76K). Shareholders have not faced significant dilution over the past year, although the stock exhibits high volatility compared to most German stocks. The board is experienced with an average tenure of 7.9 years, yet management experience data is insufficient to assess leadership stability fully.

- Dive into the specifics of Pearl Gold here with our thorough balance sheet health report.

- Examine Pearl Gold's past performance report to understand how it has performed in prior years.

Summing It All Up

- Get an in-depth perspective on all 288 European Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 33 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DIAD

Diadema Capital. Società Benefit

Engages in industrial consulting and strategic planning services for the agri-food and alternative and renewable energy sectors.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)