- Portugal

- /

- Food and Staples Retail

- /

- ENXTLS:JMT

European Stock Picks That May Be Undervalued In May 2025

Reviewed by Simply Wall St

As of mid-May 2025, European markets have shown resilience, with the pan-European STOXX Europe 600 Index climbing 2.10% following a positive shift in global trade relations and an uptick in economic activity across key regions. With major indices like Germany’s DAX and France’s CAC 40 experiencing gains, investors are increasingly focused on identifying stocks that may be undervalued despite broader market optimism. In this environment, a good stock might be one that has strong fundamentals and growth potential but has not yet fully reflected these attributes in its current valuation.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €52.80 | €104.47 | 49.5% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.90 | €3.70 | 48.7% |

| Lectra (ENXTPA:LSS) | €23.70 | €46.94 | 49.5% |

| adidas (XTRA:ADS) | €220.30 | €434.88 | 49.3% |

| Boreo Oyj (HLSE:BOREO) | €15.45 | €30.61 | 49.5% |

| Montana Aerospace (SWX:AERO) | CHF19.92 | CHF39.83 | 50% |

| Vestas Wind Systems (CPSE:VWS) | DKK107.80 | DKK212.34 | 49.2% |

| 3U Holding (XTRA:UUU) | €1.525 | €3.03 | 49.7% |

| HBX Group International (BME:HBX) | €9.88 | €19.25 | 48.7% |

| Northern Data (DB:NB2) | €25.52 | €49.64 | 48.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Recordati Industria Chimica e Farmaceutica (BIT:REC)

Overview: Recordati Industria Chimica e Farmaceutica S.p.A. is a pharmaceutical company that researches, develops, produces, and sells medications across various regions including Italy, the United States, and several European countries with a market cap of €10.82 billion.

Operations: The company's revenue is primarily derived from two segments: Rare Diseases, contributing €891.12 million, and Specialty & Primary Care, generating €1.52 billion.

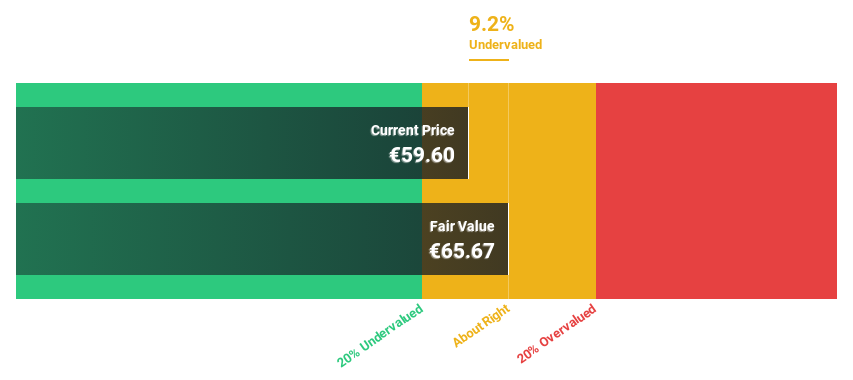

Estimated Discount To Fair Value: 14.6%

Recordati Industria Chimica e Farmaceutica is trading at €52.45, below its estimated fair value of €61.4, suggesting potential undervaluation based on cash flows. Despite a high level of debt and a dividend yield not well covered by free cash flows, the company's earnings are forecast to grow 12.1% annually, outpacing the Italian market's 7.4%. Recent FDA approval for Isturisa could bolster revenue growth further in its Rare Diseases segment.

- Upon reviewing our latest growth report, Recordati Industria Chimica e Farmaceutica's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Recordati Industria Chimica e Farmaceutica's balance sheet by reading our health report here.

Jerónimo Martins SGPS (ENXTLS:JMT)

Overview: Jerónimo Martins SGPS operates in the food distribution and specialized retail sectors across Portugal, Poland, Colombia, and internationally, with a market cap of €13.74 billion.

Operations: The company's revenue segments include Biedronka at €23.77 billion, Pingo Doce at €5.75 billion, Ara at €2.91 billion, Hebe at €598 million, and Recheio at €1.36 billion.

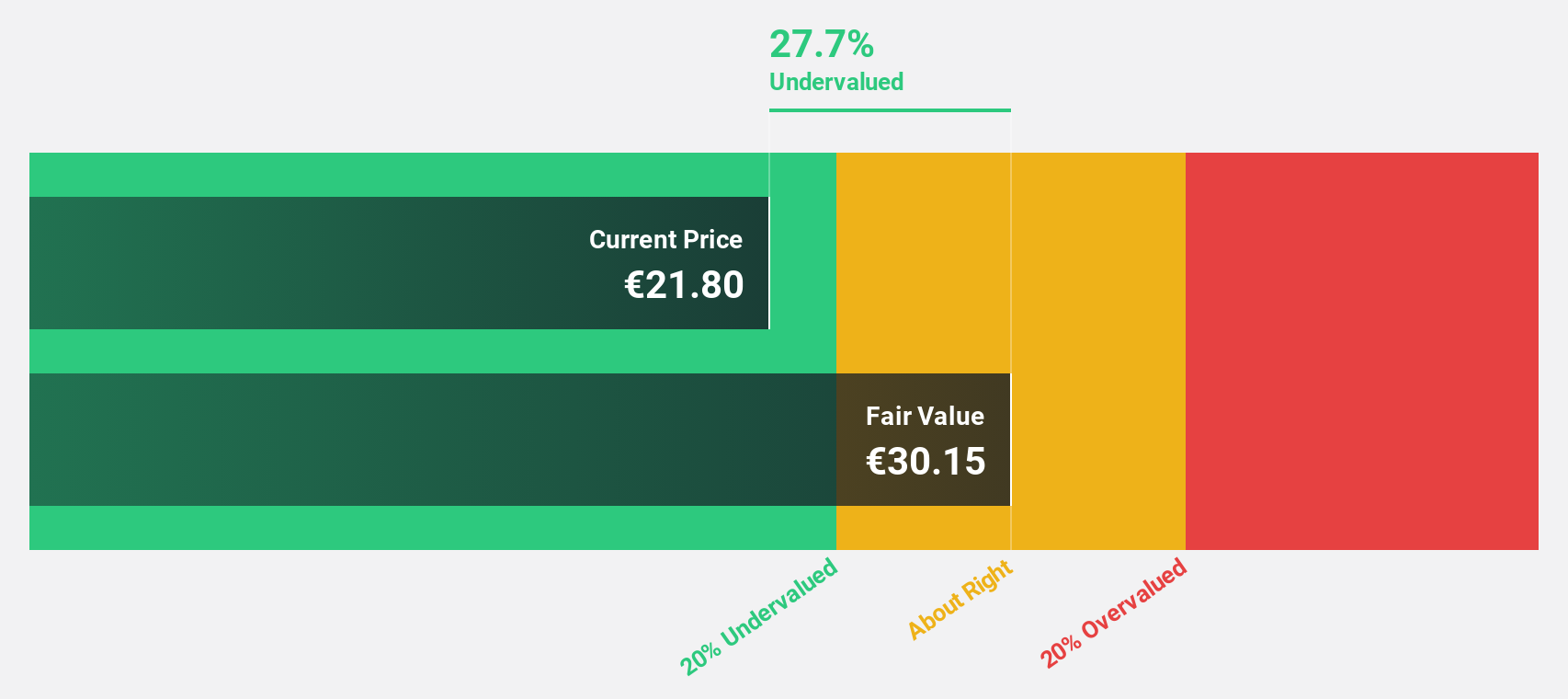

Estimated Discount To Fair Value: 20.5%

Jerónimo Martins SGPS is trading at €21.86, which is 20.5% below its estimated fair value of €27.5, highlighting potential undervaluation based on cash flows. The company's recent earnings report showed net income growth to €127 million from €97 million year-over-year, with revenue increasing to €8.38 billion from €8.07 billion. Despite a dividend decrease, forecasted annual earnings growth of 12.53% remains above the Portuguese market average of 11.4%.

- Our comprehensive growth report raises the possibility that Jerónimo Martins SGPS is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Jerónimo Martins SGPS.

BioArctic (OM:BIOA B)

Overview: BioArctic AB (publ) is a Swedish company that develops biological drugs for central nervous system disorders, with a market cap of SEK18.18 billion.

Operations: BioArctic AB (publ) generates revenue through the development of biological drugs targeting central nervous system disorders in Sweden.

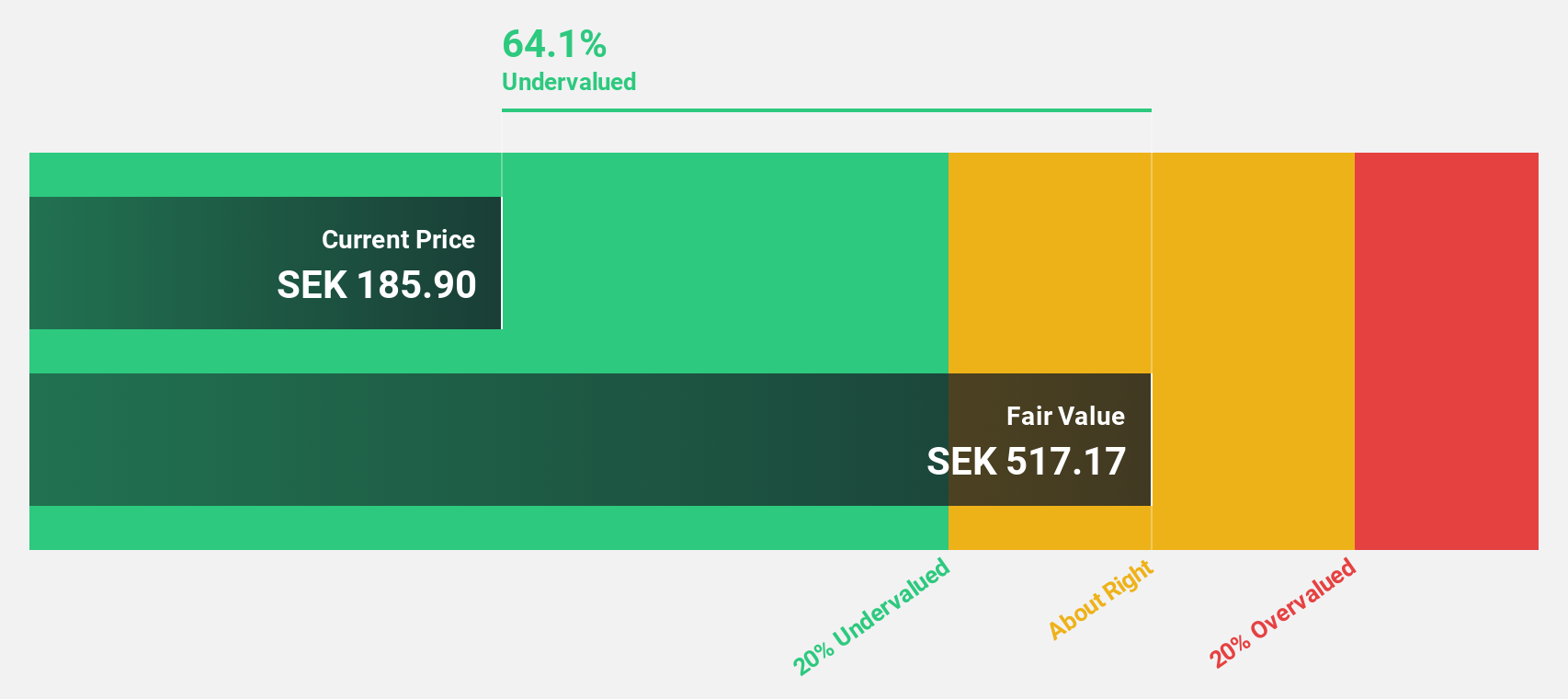

Estimated Discount To Fair Value: 17.5%

BioArctic AB is trading at SEK205.4, approximately 17.5% below its fair value estimate of SEK248.95, suggesting potential undervaluation based on cash flows. Recent earnings showed significant improvement with sales reaching SEK1.29 billion and net income at SEK1.02 billion for Q1 2025, compared to a loss the previous year. Although revenue growth is modest at 7.5% annually, it surpasses the Swedish market average and aligns with expectations of profitability within three years despite forecasted earnings decline.

- Our growth report here indicates BioArctic may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of BioArctic stock in this financial health report.

Make It Happen

- Embark on your investment journey to our 185 Undervalued European Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:JMT

Jerónimo Martins SGPS

Operates in the food distribution and specialized retail sectors in Portugal, Poland, Colombia, and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives