- Italy

- /

- Life Sciences

- /

- BIT:FF

Discovering Undiscovered European Gems This December 2025

Reviewed by Simply Wall St

As the European market navigates a landscape marked by mixed returns across major stock indexes and a slight uptick in eurozone inflation, investors are keenly observing how these dynamics might influence small-cap opportunities. In this environment, discovering stocks with strong fundamentals and growth potential becomes crucial, particularly those that can thrive despite broader economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Fine Foods & Pharmaceuticals N.T.M (BIT:FF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fine Foods & Pharmaceuticals N.T.M. S.p.A. is a company engaged in the development and manufacturing of nutraceutical, pharmaceutical, and cosmetic products with a market capitalization of €236.69 million.

Operations: Fine Foods generates revenue primarily from its Nutra segment (€142.98 million), followed by Pharma (€83.34 million) and Cosmetics (€29.96 million).

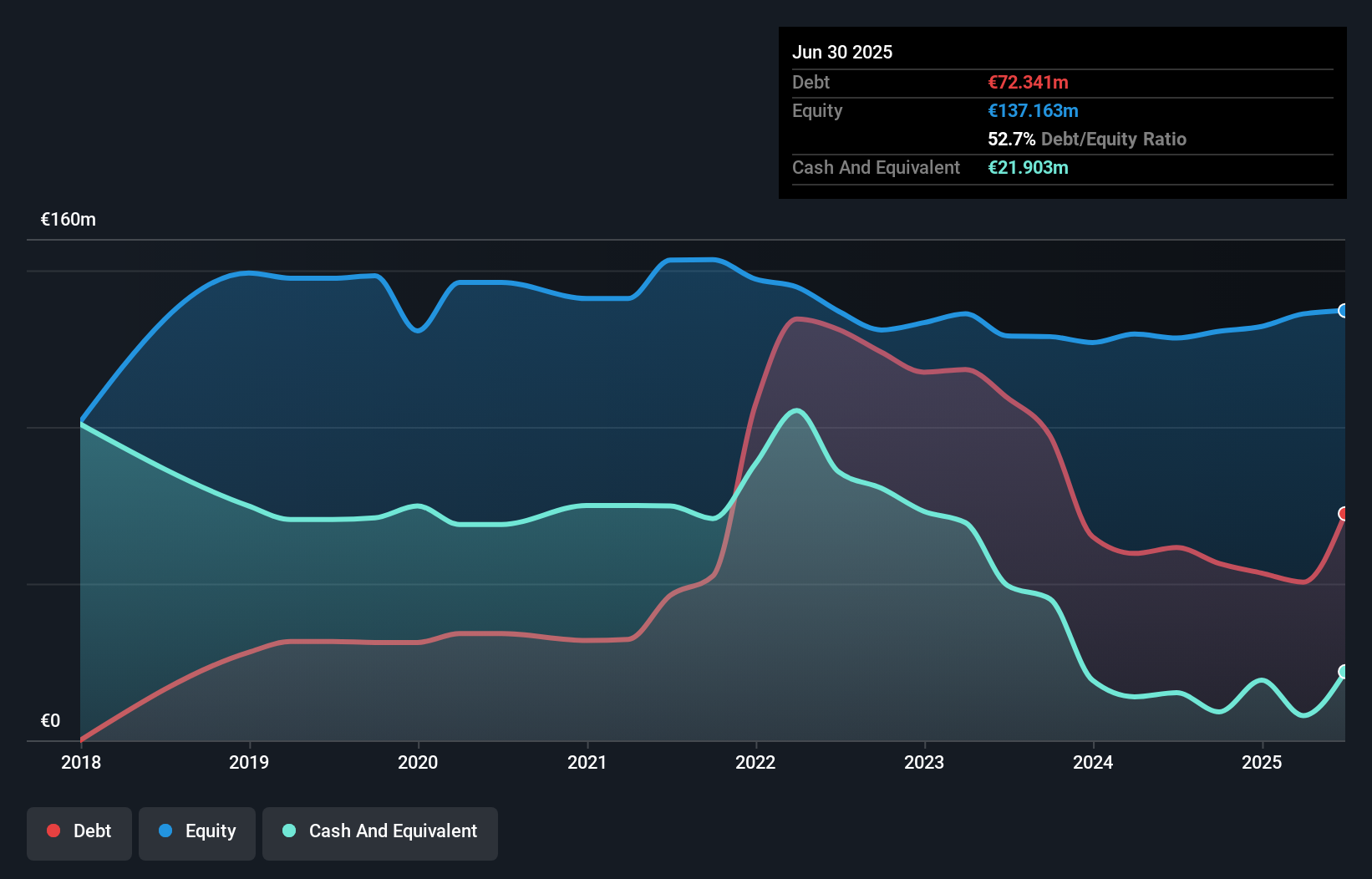

Fine Foods & Pharmaceuticals N.T.M., a nimble player in the Life Sciences sector, recently reported a net income of €10.98 million for the first nine months of 2025, up from €6.61 million last year, reflecting robust earnings growth of 158% over the past year. Its price-to-earnings ratio stands at 18.9x, offering good value compared to an industry average of 30.2x. The company's debt profile shows a net debt to equity ratio at a satisfactory level of 35.5%, while interest payments are comfortably covered by EBIT with a coverage ratio of 7.5x, indicating strong financial health and potential for continued growth.

- Take a closer look at Fine Foods & Pharmaceuticals N.T.M's potential here in our health report.

Understand Fine Foods & Pharmaceuticals N.T.M's track record by examining our Past report.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TF Bank AB (publ) is a digital bank that offers consumer banking services and e-commerce solutions via its proprietary IT platform in Sweden, with a market cap of SEK10.50 billion.

Operations: The bank generates revenue primarily from credit cards (SEK 815.79 million), consumer lending (SEK 605.52 million), and e-commerce solutions excluding credit cards (SEK 398.54 million).

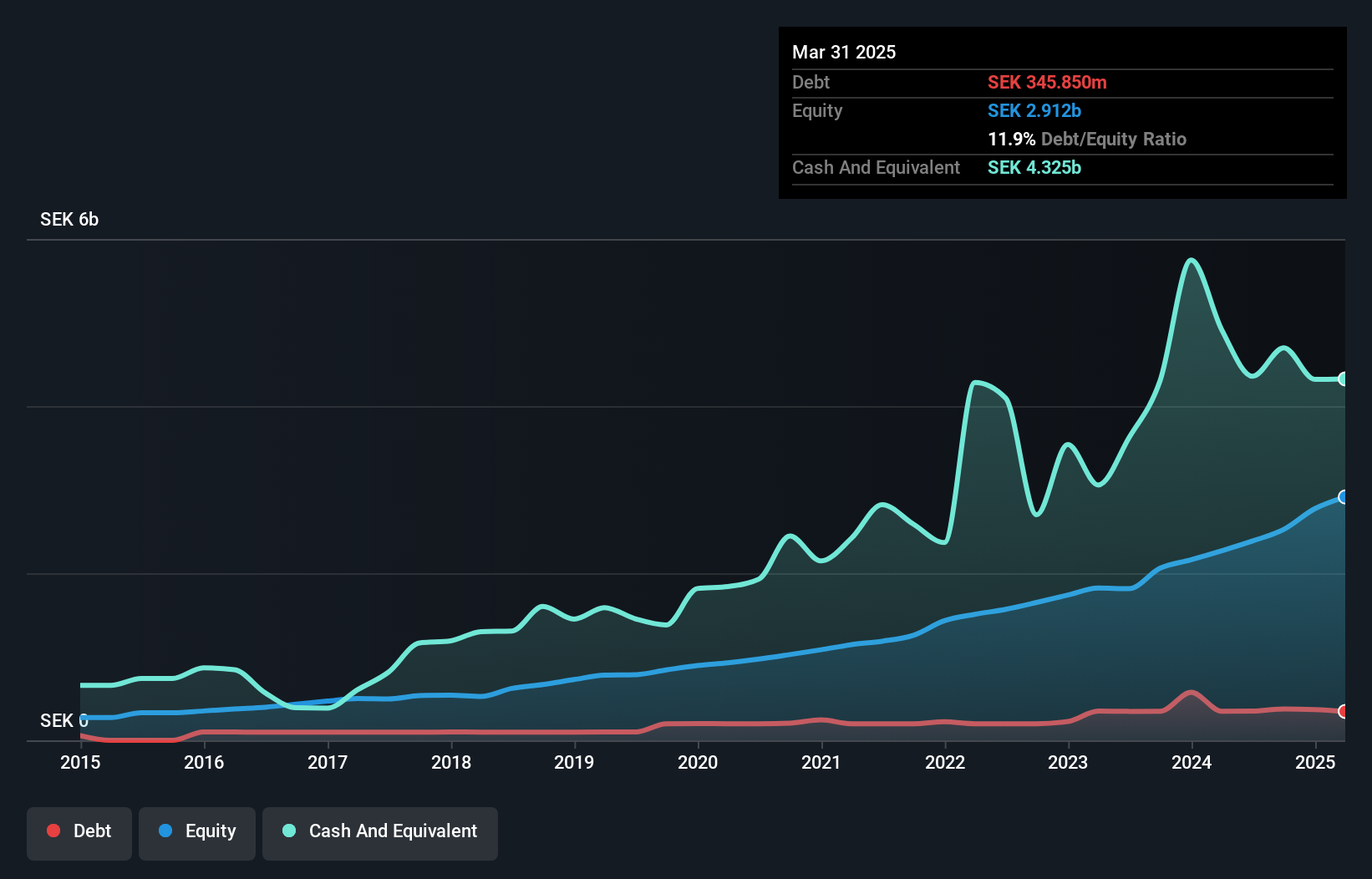

TF Bank, a promising player in the financial sector, boasts total assets of SEK27.8B and equity of SEK3.1B. With deposits at SEK23.4B and loans totaling SEK22.8B, the bank's liabilities are 95% funded by low-risk customer deposits, providing stability against market fluctuations. Despite a high bad loan ratio of 5.8%, it has maintained strong earnings growth at 49.4%, surpassing industry averages of 12.9%. The recent issuance of SEK150 million Tier 2 bonds is set to optimize its capital structure further while facilitating profitable growth as it transitions to Avarda Bank AB pending regulatory approval in mid-2026.

- Dive into the specifics of TF Bank here with our thorough health report.

Gain insights into TF Bank's past trends and performance with our Past report.

Huuuge (WSE:HUG)

Simply Wall St Value Rating: ★★★★★★

Overview: Huuuge, Inc. is a free-to-play games developer and publisher for mobile platforms with operations in North America, Europe, the Asia Pacific, and internationally, boasting a market cap of PLN1.02 billion.

Operations: Huuuge generates revenue primarily through its online mobile games segment, which reported $238.73 million.

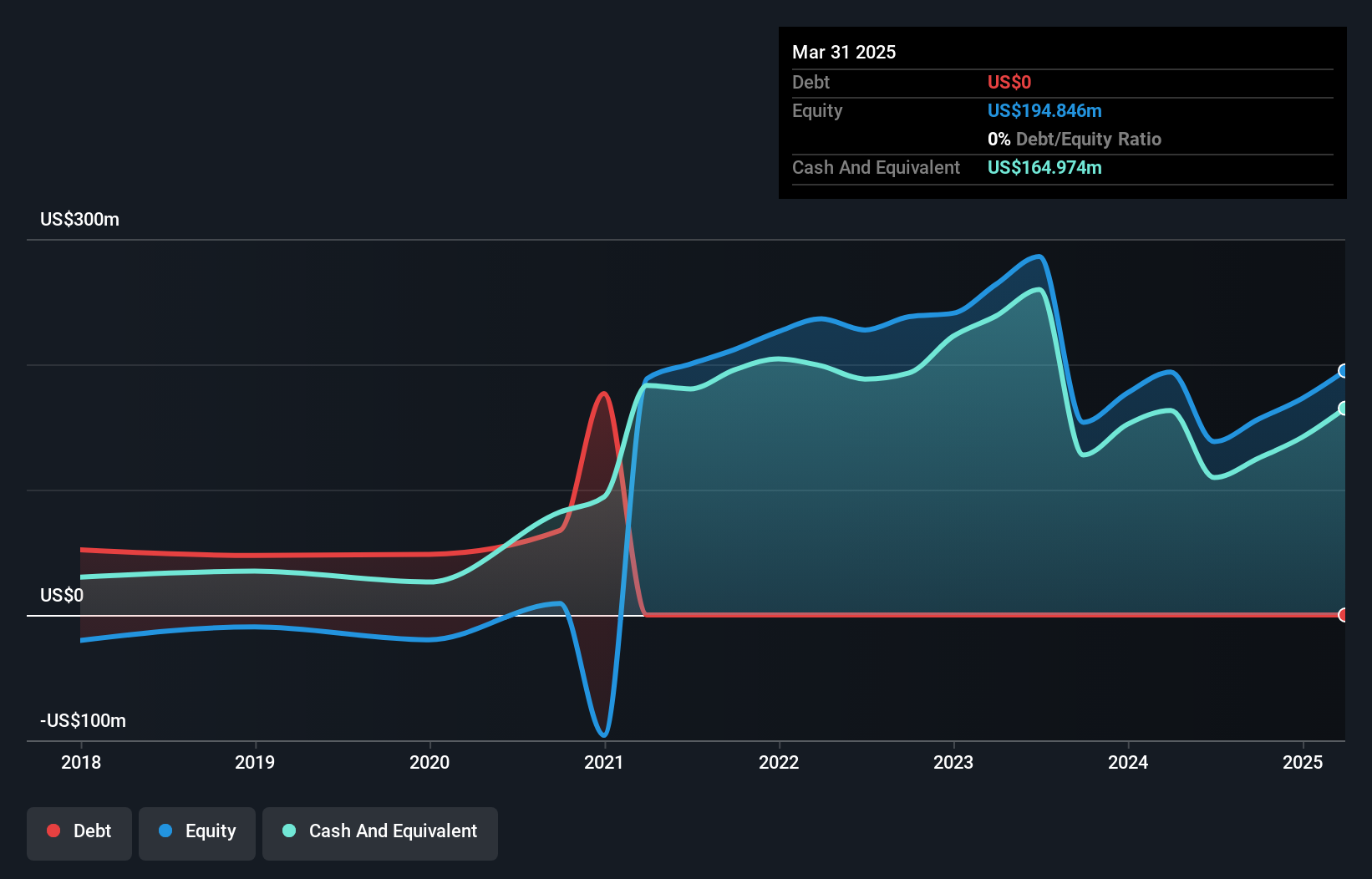

Huuuge, a nimble player in the gaming industry, showcases a blend of strengths and challenges. Despite no debt and trading at 40% below fair value estimates, earnings are projected to dip by nearly 20% annually over the next three years. The past year saw earnings grow by 6.5%, outpacing the broader entertainment sector's modest 0.7%. Recent reports show third-quarter sales at US$55.8 million with net income slightly down to US$15.05 million from last year's US$15.26 million, while nine-month figures reveal improved net income of US$52.12 million compared to US$46.87 million previously, reflecting robust operational efficiency despite revenue pressures.

- Navigate through the intricacies of Huuuge with our comprehensive health report here.

Review our historical performance report to gain insights into Huuuge's's past performance.

Key Takeaways

- Get an in-depth perspective on all 311 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FF

Fine Foods & Pharmaceuticals N.T.M

Fine Foods & Pharmaceuticals N.T.M. S.p.A.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026