- Italy

- /

- Life Sciences

- /

- BIT:FF

A Look At Fine Foods & Pharmaceuticals N.T.M's (BIT:FF) Share Price Returns

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Fine Foods & Pharmaceuticals N.T.M. S.p.A. (BIT:FF) shareholders over the last year, as the share price declined 14%. That falls noticeably short of the market decline of around 8.5%. We wouldn't rush to judgement on Fine Foods & Pharmaceuticals N.T.M because we don't have a long term history to look at.

See our latest analysis for Fine Foods & Pharmaceuticals N.T.M

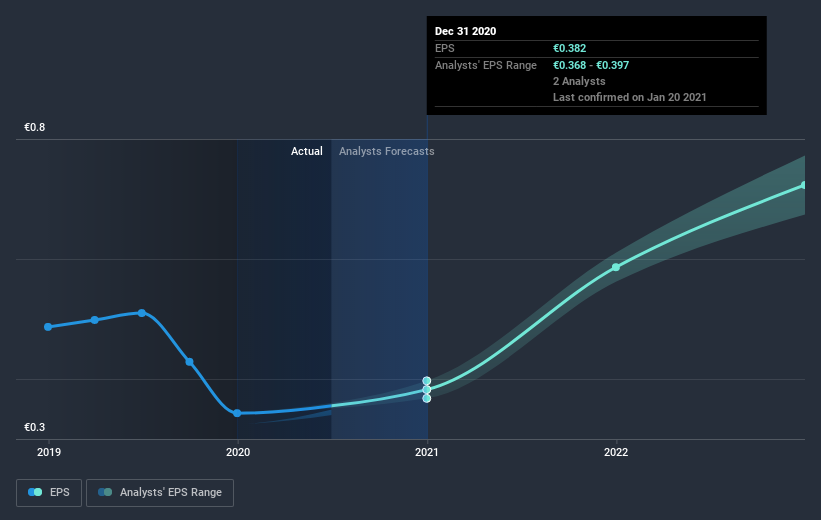

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately Fine Foods & Pharmaceuticals N.T.M reported an EPS drop of 30% for the last year. The share price fall of 14% isn't as bad as the reduction in earnings per share. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Fine Foods & Pharmaceuticals N.T.M's earnings, revenue and cash flow.

A Different Perspective

We doubt Fine Foods & Pharmaceuticals N.T.M shareholders are happy with the loss of 13% over twelve months (even including dividends). That falls short of the market, which lost 8.5%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 8.8% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Fine Foods & Pharmaceuticals N.T.M you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

When trading Fine Foods & Pharmaceuticals N.T.M or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:FF

Fine Foods & Pharmaceuticals N.T.M

Fine Foods & Pharmaceuticals N.T.M. S.p.A.

Undervalued with excellent balance sheet.