3 Reliable Dividend Stocks To Consider With Up To 8.4% Yield

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of fluctuating consumer confidence and economic indicators, investors are seeking stability amid moderate gains in major stock indexes. In such an environment, dividend stocks offer a compelling option for those looking to balance potential income with long-term growth, as they often provide consistent payouts even during periods of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

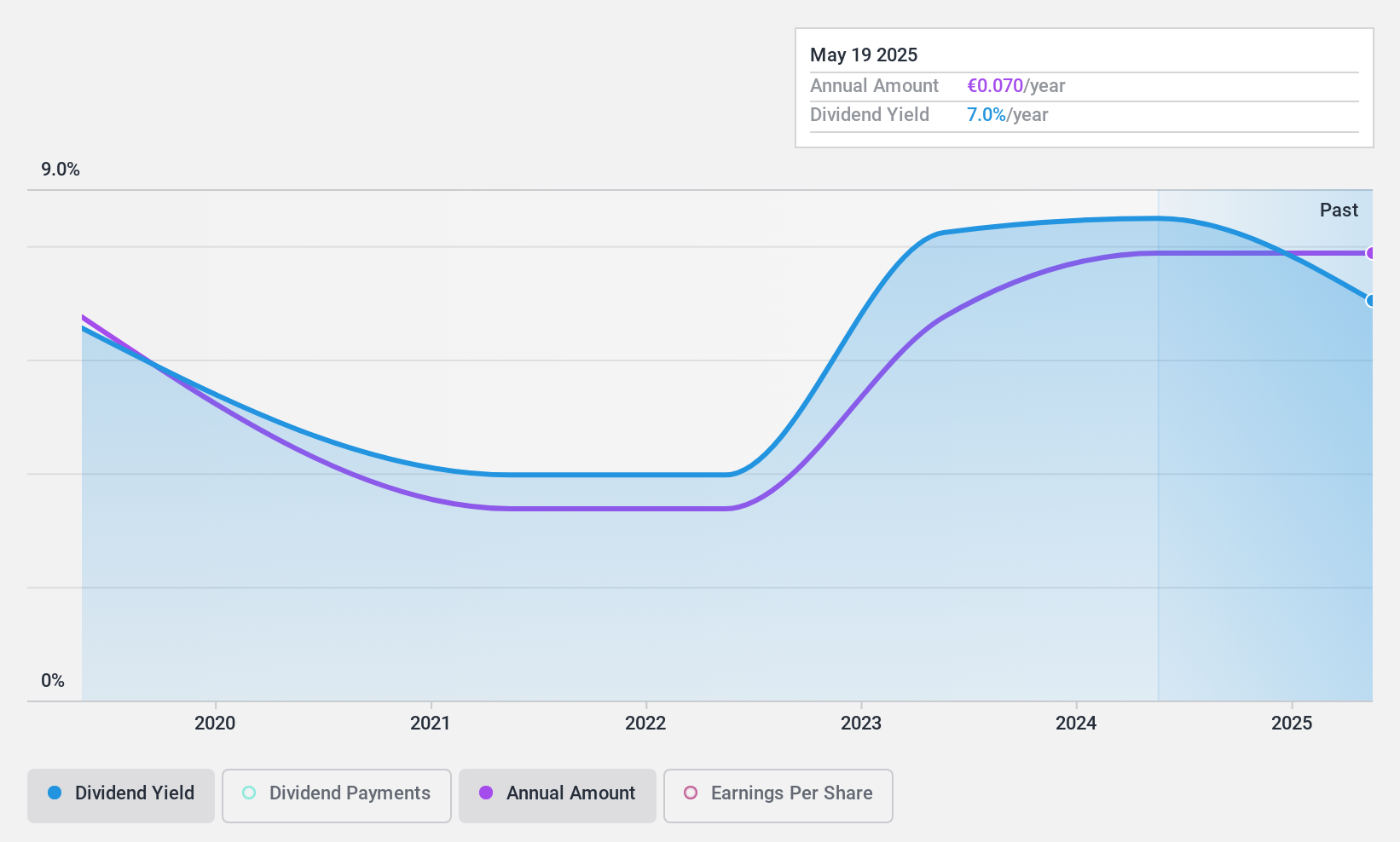

RCS MediaGroup (BIT:RCS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: RCS MediaGroup S.p.A. is a multimedia publishing company operating in Italy and internationally, with a market cap of €382.22 million.

Operations: RCS MediaGroup S.p.A. generates revenue through various segments, including €65.20 million from Magazines Italy, €371 million from Italy Newspapers, €220.60 million from Unidad Editorial, and €286.10 million from Advertising and Sport.

Dividend Yield: 7.9%

RCS MediaGroup's dividend payments are well covered by cash flows, with a cash payout ratio of 34.3%, and earnings, with a payout ratio of 58.6%. Despite being in the top 25% for dividend yield in Italy at 7.88%, its track record is unstable, having only paid dividends for six years with volatility over this period. Recent earnings growth and coverage suggest sustainability, but caution is advised due to past payment unreliability.

- Dive into the specifics of RCS MediaGroup here with our thorough dividend report.

- Upon reviewing our latest valuation report, RCS MediaGroup's share price might be too pessimistic.

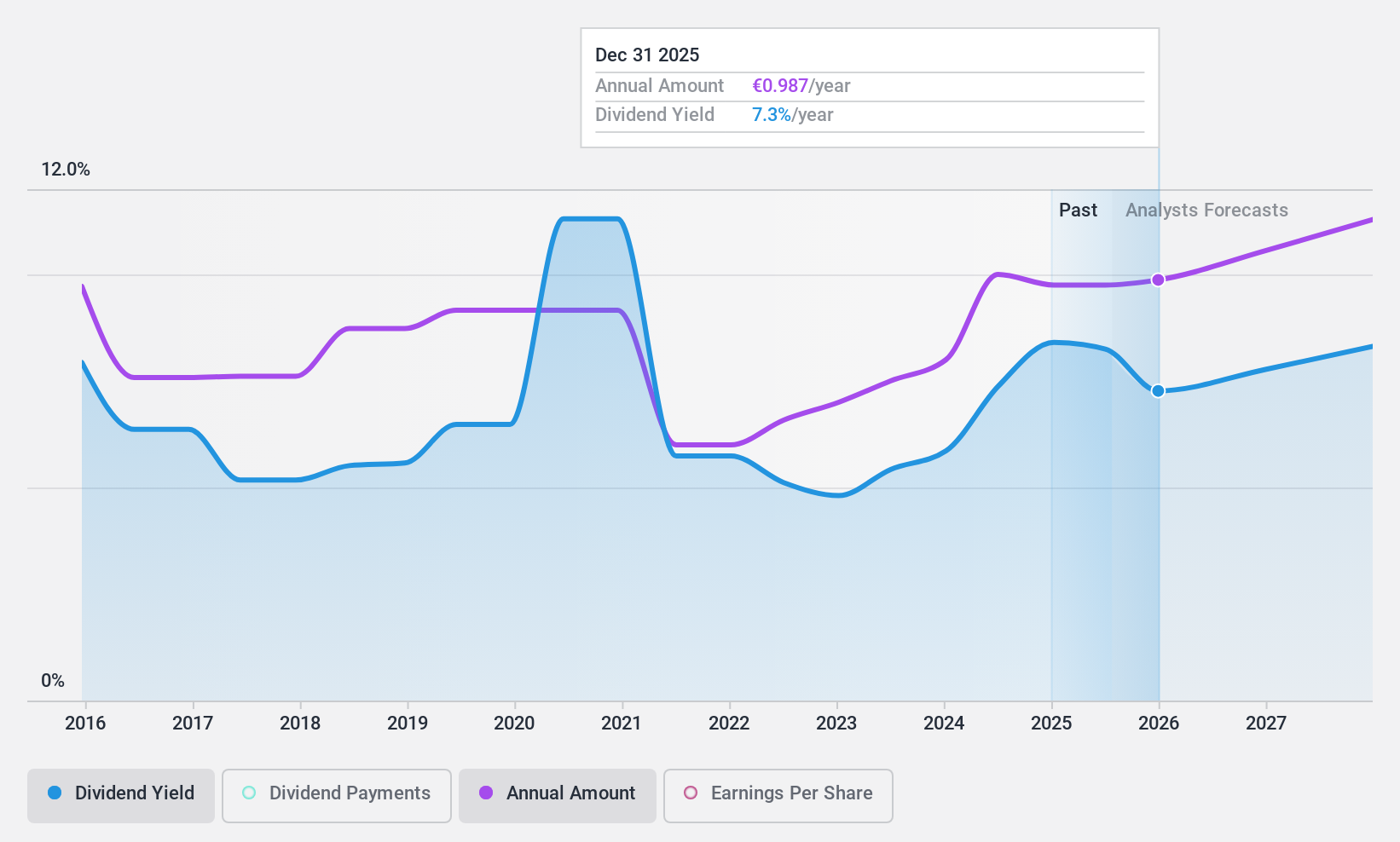

Repsol (BME:REP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Repsol, S.A. is a global multi-energy company with a market cap of approximately €13.29 billion.

Operations: Repsol, S.A. generates revenue through several key segments: Customer (€25.49 billion), Upstream (€4.64 billion), Industrial (€45.83 billion), and Low Carbon Generation (€656 million).

Dividend Yield: 8.5%

Repsol's dividend yield of 8.49% ranks in the top 25% of Spanish payers, but its sustainability is questionable due to a high cash payout ratio of 339.6%. Despite recent dividend growth, payments have been volatile over the past decade. Repsol's earnings cover dividends with a reasonable payout ratio of 55.6%, yet free cash flow coverage remains weak. Recent strategic alliances aim to enhance operational efficiency, potentially influencing future financial stability and dividend reliability.

- Navigate through the intricacies of Repsol with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Repsol's current price could be quite moderate.

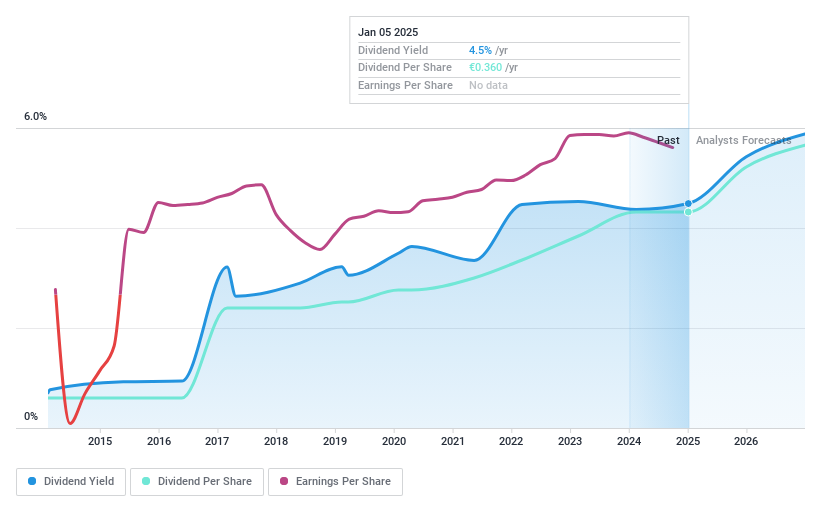

Telekom Austria (WBAG:TKA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Telekom Austria AG, with a market cap of €5.12 billion, offers fixed-line and mobile communications solutions across Austria and several Eastern European countries including Belarus, Bulgaria, Croatia, North Macedonia, Serbia, and Slovenia.

Operations: Telekom Austria AG generates revenue primarily from Wireless Communications Services, amounting to €5.22 billion.

Dividend Yield: 4.5%

Telekom Austria offers a reliable dividend with a yield of 4.52%, though it is below the top tier in the Austrian market. Dividends have grown steadily over the past decade, supported by a low payout ratio of 40.8% and a cash payout ratio of 29.9%, indicating strong coverage by earnings and cash flow. Recent financials show stable revenue growth, but net income has slightly declined, which may impact future dividend sustainability if trends continue.

- Click here to discover the nuances of Telekom Austria with our detailed analytical dividend report.

- Our expertly prepared valuation report Telekom Austria implies its share price may be lower than expected.

Make It Happen

- Access the full spectrum of 1949 Top Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RCS

RCS MediaGroup

Provides multimedia publishing services in Italy and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives