European Penny Stocks: 3 Hidden Gems With Market Caps Under €70M

Reviewed by Simply Wall St

The European market has shown resilience, with major indices like Germany’s DAX and Italy’s FTSE MIB posting gains, despite ongoing concerns about interest rate policies and trade jitters. In such a climate, investors often look to smaller companies for potential growth opportunities that might not be as evident in larger firms. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies that can offer unique growth prospects. By focusing on penny stocks with strong financials and solid fundamentals, investors can uncover hidden gems that may provide impressive returns without the heightened risks typically associated with this segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.14 | €1.43B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.17 | €17.38M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.27 | €43.43M | ✅ 5 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.59 | DKK116.05M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.86 | €39.41M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.34 | SEK203.2M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.04 | €83.92M | ✅ 3 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.22 | €306.85M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 272 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Lucisano Media Group (BIT:LMG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lucisano Media Group S.p.A. is involved in film production and cinema management activities in Italy, with a market cap of €17.38 million.

Operations: The company's revenue is derived from two main segments: €11.15 million from sales and €39.75 million from production and distribution activities.

Market Cap: €17.38M

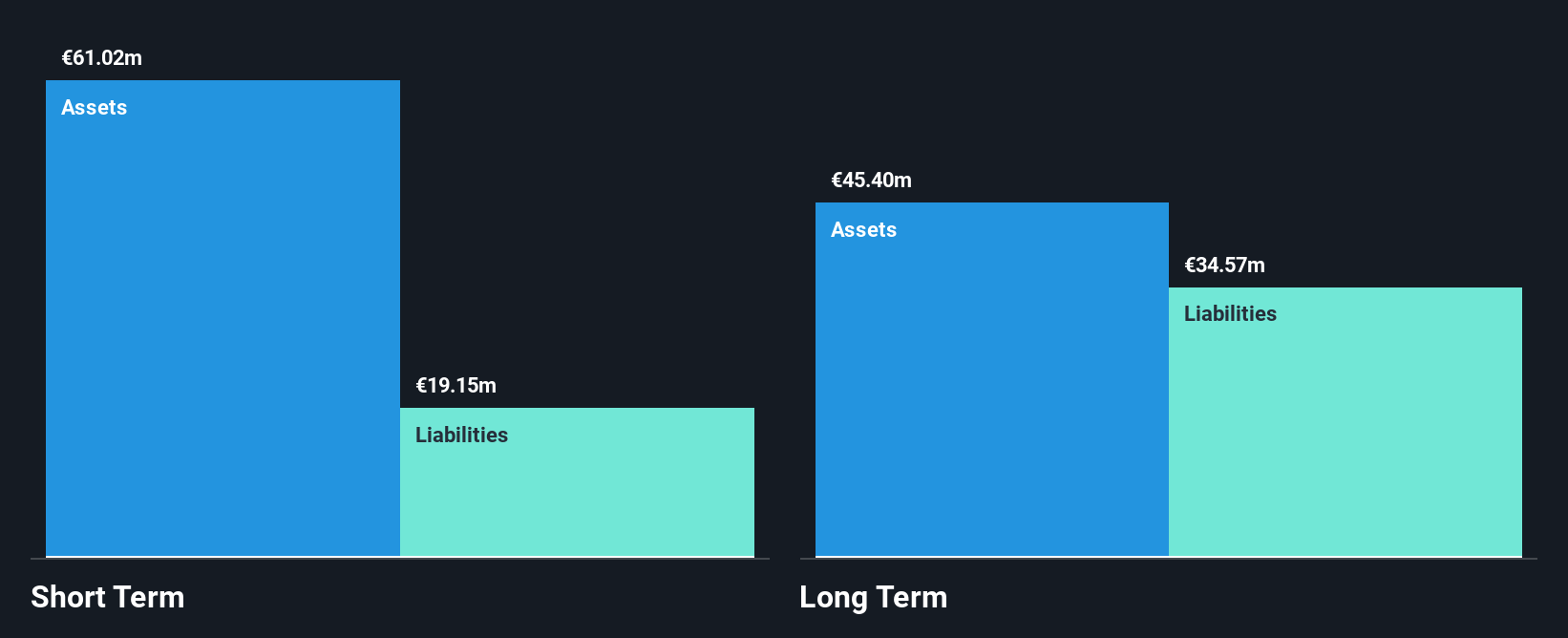

Lucisano Media Group S.p.A. presents a mixed picture for potential investors in the penny stock segment. With a market cap of €17.38 million, it generates significant revenue from sales and production/distribution activities, totaling €50.9 million. However, its financial metrics reveal challenges: high net debt to equity ratio (52.1%), low return on equity (5.1%), and declining profit margins (6.9% from 11.8% last year). While short-term assets exceed liabilities, interest coverage is weak at 2.2x EBIT, suggesting financial strain despite stable weekly volatility and no recent shareholder dilution concerns.

- Take a closer look at Lucisano Media Group's potential here in our financial health report.

- Understand Lucisano Media Group's earnings outlook by examining our growth report.

Patria Bank (BVB:PBK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Patria Bank SA is a Romanian credit institution offering banking and financial services to individuals, small and medium enterprises, agribusinesses, and corporate customers with a market cap of RON340.99 million.

Operations: Patria Bank generates its revenue primarily from its banking operations, amounting to RON240.37 million.

Market Cap: RON341M

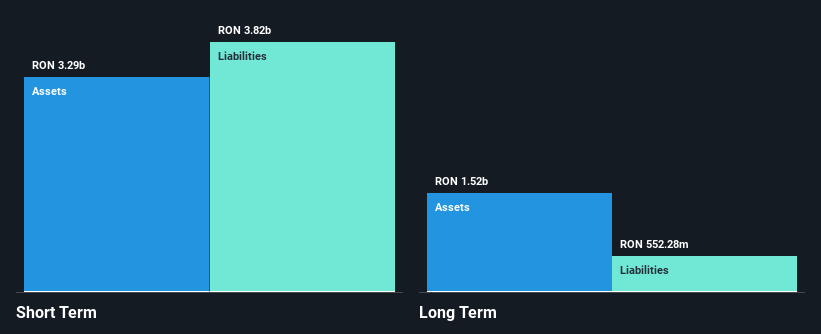

Patria Bank SA, with a market cap of RON340.99 million, offers an intriguing profile within the penny stock landscape. The bank's net interest income rose to RON95.32 million for the half year ending June 2025, reflecting strong revenue generation from its core banking operations. Its loans to deposits ratio of 74% and a sufficient allowance for bad loans at 106% indicate prudent financial management. While earnings growth has decelerated compared to its five-year average, it remains robust relative to industry peers. Despite high bad loan levels (4.3%), stable weekly volatility and low-risk funding sources bolster its investment appeal in this segment.

- Click here to discover the nuances of Patria Bank with our detailed analytical financial health report.

- Gain insights into Patria Bank's future direction by reviewing our growth report.

Investors House Oyj (HLSE:INVEST)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Investors House Oyj is a real estate investment company operating in Finland and Estonia with a market cap of €24.84 million.

Operations: The company generates revenue through its Services segment, which accounts for €2.61 million, and its Real Estate segment, contributing €7.49 million.

Market Cap: €24.84M

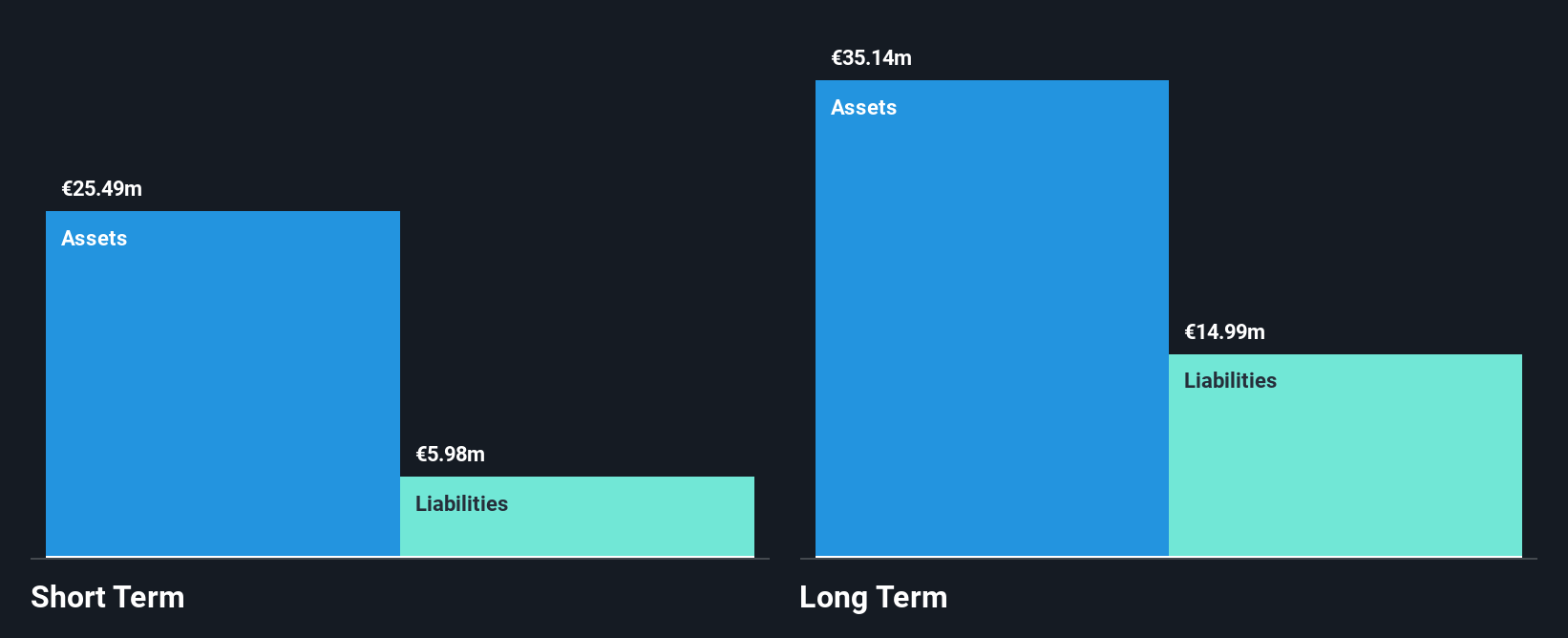

Investors House Oyj, with a market cap of €24.84 million, presents a mixed profile within the penny stock realm. The company reported net income of €3.36 million for Q2 2025 but faced declining earnings compared to the previous year. Despite its low price-to-earnings ratio (6.2x) relative to the Finnish market, profit margins have decreased significantly from last year due to large one-off items impacting results. While its debt is well covered by operating cash flow and short-term assets exceed liabilities, high share price volatility and forecasted earnings decline pose challenges for investors seeking stability in this segment.

- Click to explore a detailed breakdown of our findings in Investors House Oyj's financial health report.

- Evaluate Investors House Oyj's prospects by accessing our earnings growth report.

Seize The Opportunity

- Click this link to deep-dive into the 272 companies within our European Penny Stocks screener.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:PBK

Patria Bank

A credit institution, provides banking and other financial services to individual, small and medium enterprises, agribusinesses, and corporate customers in Romania.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives