SOL (BIT:SOL) Valuation in Focus After Strong Half-Year Earnings Growth

Reviewed by Simply Wall St

SOL (BIT:SOL) caught investors’ eyes this week with its half-year earnings announcement, revealing across-the-board improvements in sales, revenue, net income, and earnings per share when compared to last year’s figures. Delivering sales of €874.08 million and net income of €83.52 million points to a business that continues to expand its financial footprint. For shareholders deciding their next move, these results may serve as a signal on whether to stay the course or take a fresh look at valuation.

The upbeat numbers arrive as SOL’s share price builds on its upward momentum. Over the past year, SOL shares are up an impressive 58%, with gains of 43% since the beginning of the year and 11% in the past three months. A series of consistent improvements in the company’s top and bottom lines have kept investor interest strong, suggesting the market is warming up to this growth story.

With these gains already on the board, the big question for investors is whether SOL’s recent performance leaves more room to run or if current prices already reflect the company’s future earnings power.

Price-to-Earnings of 30.4x: Is it Justified?

According to the most recent data, SOL trades at a Price-to-Earnings (P/E) ratio of 30.4x, which is significantly higher than the European Chemicals industry average of 20x. This indicates that SOL is priced at a premium compared to its sector peers.

The Price-to-Earnings ratio measures how much investors are willing to pay per euro of earnings. It is a widely used metric for comparing relative valuation and growth prospects among companies. A higher P/E typically signals market optimism about future earnings growth or company quality, but can also reflect overvaluation if growth does not materialize as expected.

With SOL’s P/E above both the industry average and its own estimated fair ratio, the market appears to be factoring in strong future performance or a perceived edge in quality. However, this premium may be difficult to justify unless earnings growth accelerates beyond current forecasts.

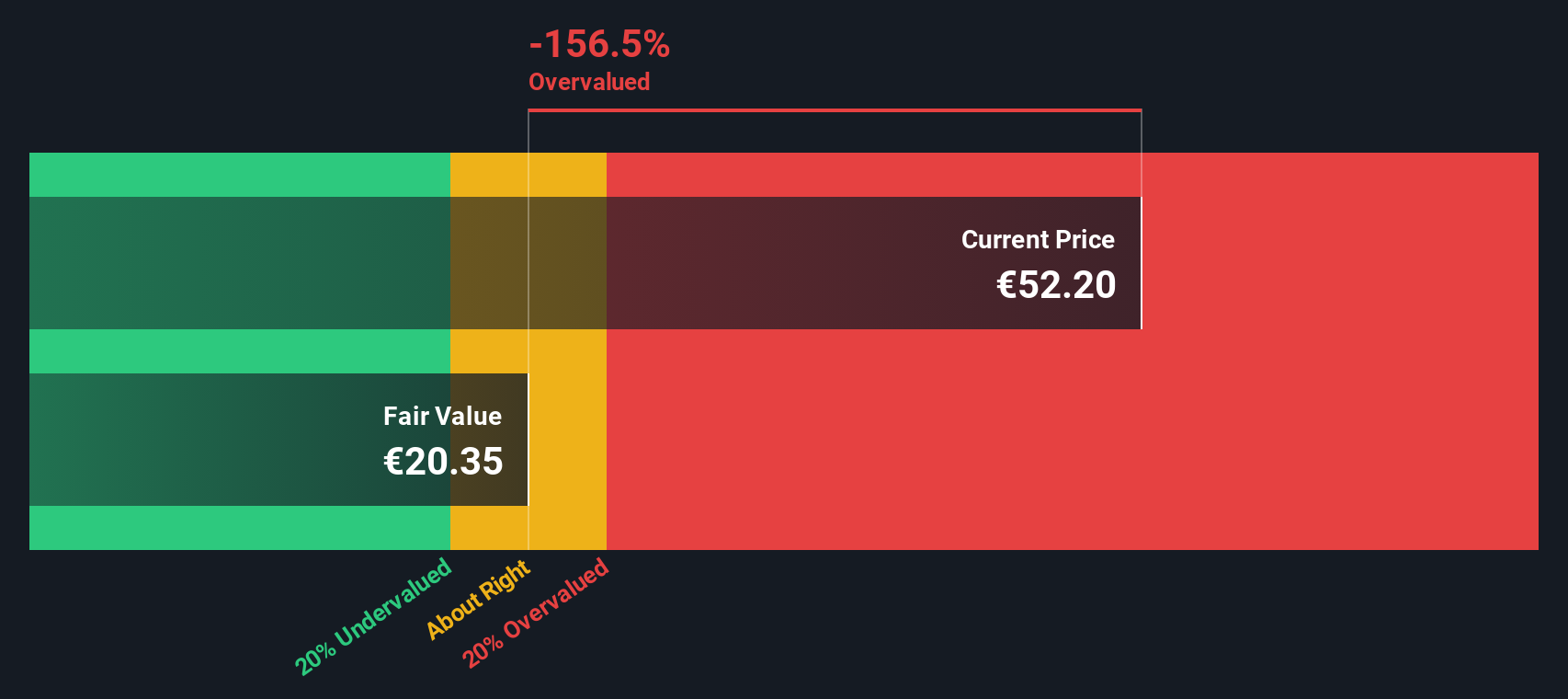

Result: Fair Value of €21.68 (OVERVALUED)

See our latest analysis for SOL.However, slowing annual revenue growth and future earnings disappointments could both challenge the recent optimism around SOL’s premium valuation.

Find out about the key risks to this SOL narrative.Another View: Checking with the SWS DCF Model

Looking from a different angle, our DCF model gives its own verdict on SOL's true worth. This approach focuses on expected future cash flows rather than earnings multiples. It offers a separate lens on whether the current valuation is too high or not. Will this method support or challenge the premium price tag investors are paying?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SOL Narrative

Of course, if our analysis does not reflect your perspective, or you prefer to test your own assumptions, it is quick and easy to build your own view. Your narrative could take shape in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding SOL.

Looking for More Smart Investment Opportunities?

You are just a step away from uncovering more eye-catching stocks that could help strengthen your portfolio and unlock new growth possibilities. Don’t let today’s big movers distract you from tomorrow’s game changers. Expand your search for better potential now.

- Spot undervalued businesses poised for a turnaround by using our undervalued stocks based on cash flows screener built for value seekers.

- Tap into the explosive potential of emerging digital assets and blockchain technologies by checking out our cryptocurrency and blockchain stocks selection.

- Accelerate your hunt for future tech giants shaping artificial intelligence by exploring our handpicked AI penny stocks group.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SOL

SOL

Engages in the applied research, production, and marketing of technical and medical gases in Italy and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives