Franchi Umberto Marmi S.p.A. (BIT:FUM) announced a healthy earnings result recently, and the market rewarded it with a strong stock price reaction. This reaction by the market reaction is understandable when looking at headline profits and we have found some further encouraging factors.

Check out our latest analysis for Franchi Umberto Marmi

Zooming In On Franchi Umberto Marmi's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

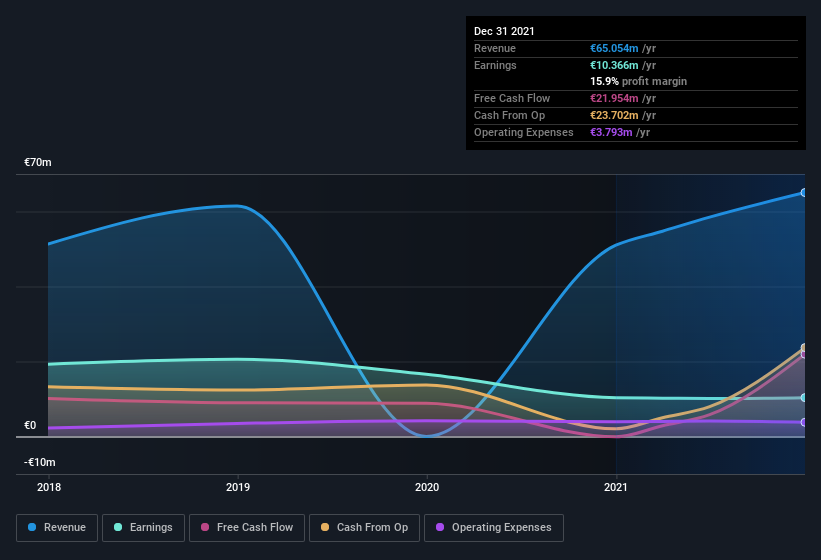

Franchi Umberto Marmi has an accrual ratio of -0.13 for the year to December 2021. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. To wit, it produced free cash flow of €22m during the period, dwarfing its reported profit of €10.4m. Given that Franchi Umberto Marmi had negative free cash flow in the prior corresponding period, the trailing twelve month resul of €22m would seem to be a step in the right direction. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Franchi Umberto Marmi expanded the number of shares on issue by 10% over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Franchi Umberto Marmi's historical EPS growth by clicking on this link.

A Look At The Impact Of Franchi Umberto Marmi's Dilution on Its Earnings Per Share (EPS).

Unfortunately, Franchi Umberto Marmi's profit is down 50% per year over three years. But over the last year profit has held pretty steady. But EPS was considerably worse, since it declined 6.0% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

If Franchi Umberto Marmi's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Franchi Umberto Marmi's Profit Performance

In conclusion, Franchi Umberto Marmi has a strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share are dropping faster than its profit. Given the contrasting considerations, we don't have a strong view as to whether Franchi Umberto Marmi's profits are an apt reflection of its underlying potential for profit. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. In terms of investment risks, we've identified 2 warning signs with Franchi Umberto Marmi, and understanding them should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:FUM

Franchi Umberto Marmi

Provides marble slabs and blocks in Italy and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion