- Italy

- /

- Basic Materials

- /

- BIT:CALT

European Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As European markets experience a positive upswing, with major indices like Germany’s DAX and France’s CAC 40 posting notable gains, investors are keenly observing the easing of trade tensions that have recently buoyed sentiment. In this context, dividend stocks can offer stability and potential income amidst the broader market's fluctuations, making them an attractive consideration for those looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.00% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.51% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.72% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.00% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.96% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.86% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.22% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.18% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.46% | ★★★★★★ |

Click here to see the full list of 247 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

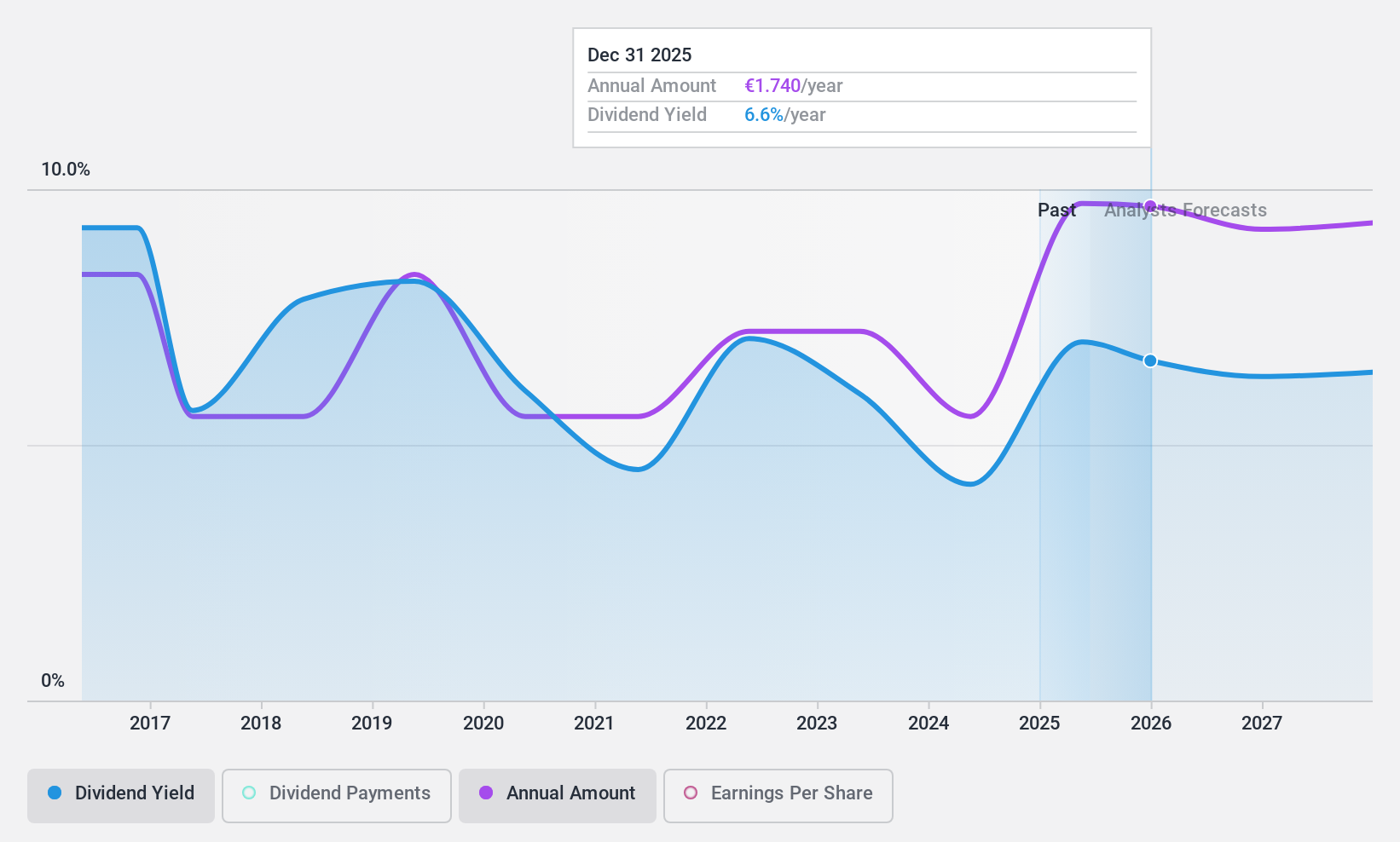

Azimut Holding (BIT:AZM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azimut Holding S.p.A. operates in the asset management industry and has a market capitalization of €3.39 billion.

Operations: Azimut Holding S.p.A. generates its revenue primarily from the asset management segment, with reported earnings of €1.39 billion.

Dividend Yield: 7.3%

Azimut Holding's recent announcement of a €1.75 per share dividend, totaling up to €251 million, aligns with its ongoing dividend policy despite historical volatility in payouts. While the company boasts a low payout ratio of 43.7%, indicating dividends are well covered by earnings, the lack of free cash flow coverage raises sustainability concerns. Trading at 39.6% below fair value and offering a high yield in the Italian market, Azimut's dividends remain attractive yet unreliable over time due to non-cash earnings influences.

- Delve into the full analysis dividend report here for a deeper understanding of Azimut Holding.

- Insights from our recent valuation report point to the potential undervaluation of Azimut Holding shares in the market.

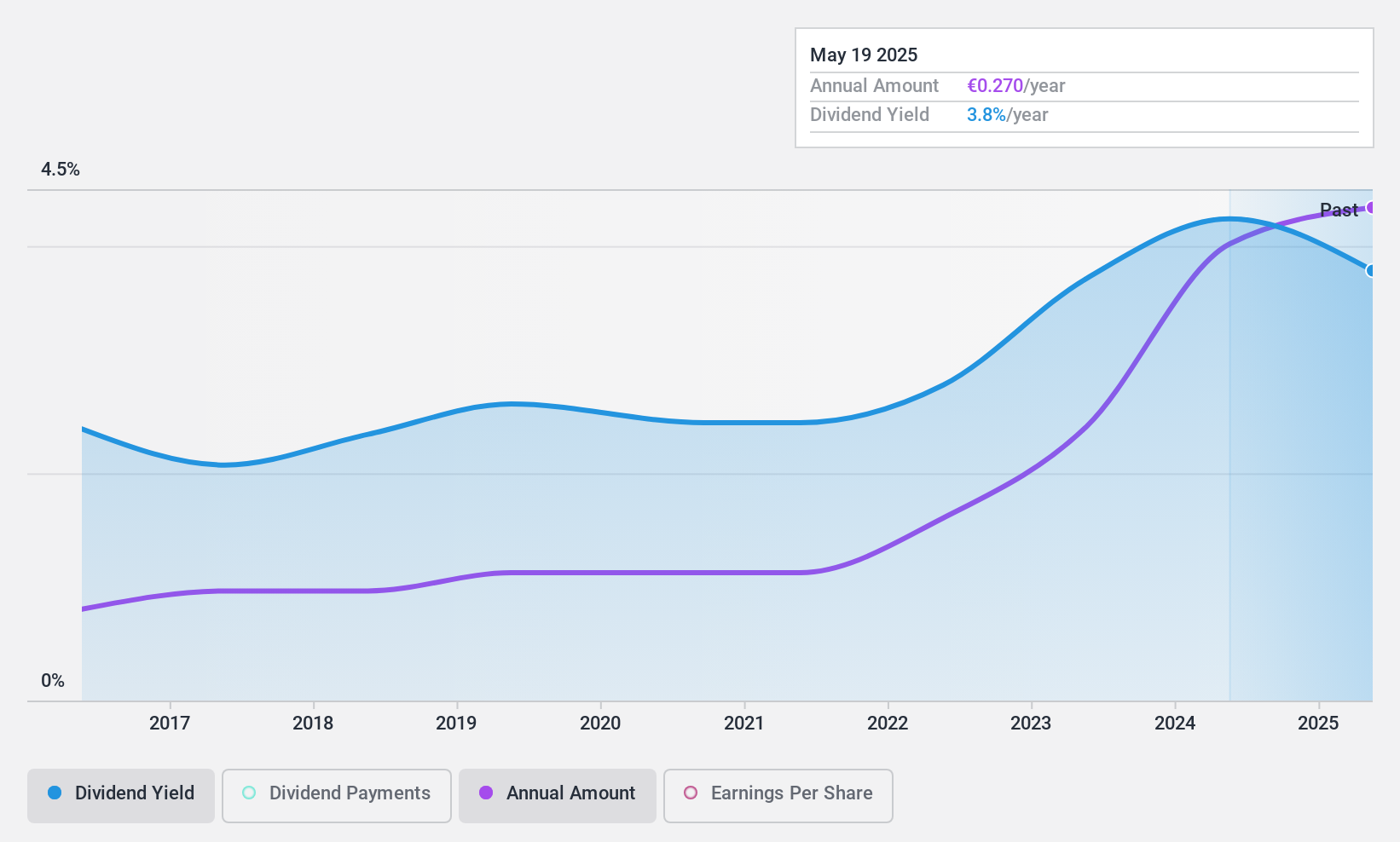

Caltagirone (BIT:CALT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caltagirone SpA operates through its subsidiaries in cement manufacturing, media, real estate, and publishing sectors with a market cap of €857.66 million.

Operations: Caltagirone SpA generates its revenue from several segments, including €1.64 billion from Cement, Concrete and Aggregates, €186.77 million from Constructions, €112.65 million from Publishing, and €35.27 million from Management of Properties.

Dividend Yield: 3.8%

Caltagirone's dividend payments have been stable and growing over the past decade, with a recent announcement of an annual dividend of €0.27 per share payable in May 2025. Although its 3.78% yield is lower than the top tier in Italy, the low payout ratio of 21.7% suggests dividends are well covered by earnings. However, outdated financial data limits insight into cash flow coverage, which could affect sustainability assessments despite trading significantly below estimated fair value.

- Get an in-depth perspective on Caltagirone's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Caltagirone is trading behind its estimated value.

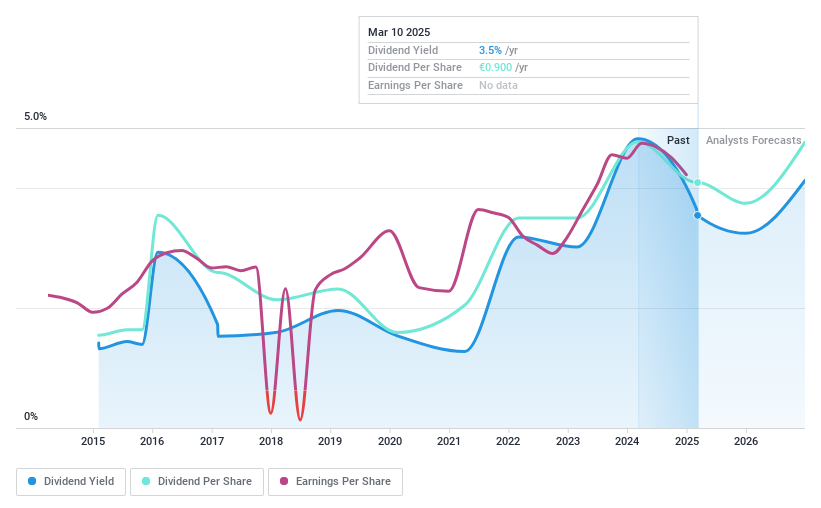

Palfinger (WBAG:PAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Palfinger AG is an Austrian company that produces and sells crane and lifting solutions both domestically and internationally, with a market cap of approximately €990.85 million.

Operations: Palfinger AG's revenue segments include cranes (€1.42 billion), lifting solutions (€1.05 billion), and services (€0.78 billion).

Dividend Yield: 3.2%

Palfinger's dividend payments have been volatile over the past decade, with a recent decrease to €0.90 per share for 2024. Despite this, dividends are well covered by earnings and cash flows, given payout ratios of 31.3% and 41.1%, respectively. The company faces high debt levels but trades at a significant discount to estimated fair value. Recent board changes and strategic adjustments could impact future financial stability and dividend reliability amidst challenging market conditions in early 2025.

- Click to explore a detailed breakdown of our findings in Palfinger's dividend report.

- Our expertly prepared valuation report Palfinger implies its share price may be lower than expected.

Seize The Opportunity

- Discover the full array of 247 Top European Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CALT

Caltagirone

Through its subsidiaries, engages in the cement manufacturing, media, real estate, and publishing activities.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion