- France

- /

- Hospitality

- /

- ENXTPA:SW

3 European Dividend Stocks Yielding Up To 5.1%

Reviewed by Simply Wall St

Amid recent challenges in the European markets, including concerns over U.S. Federal Reserve independence and geopolitical tensions, the pan-European STOXX Europe 600 Index has seen a notable decline. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate market uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.38% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.08% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.76% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.12% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.06% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.66% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.69% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.74% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.68% | ★★★★★☆ |

| Afry (OM:AFRY) | 4.10% | ★★★★★☆ |

Click here to see the full list of 219 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Caltagirone (BIT:CALT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Caltagirone SpA operates in cement manufacturing, media, real estate, and publishing through its subsidiaries and has a market cap of €910.51 million.

Operations: Caltagirone SpA generates revenue from several segments, including €1.68 billion from Cement, Concrete and Inert, €301.44 million from Constructions, €111.96 million from Publishing, and €13.21 million from Management of Properties.

Dividend Yield: 3.6%

Caltagirone offers a stable and reliable dividend profile, with dividends per share consistently growing over the past decade. The company's low payout ratio of 24.9% and cash payout ratio of 8% indicate robust coverage by earnings and free cash flow, supporting sustainability. Despite trading at a significant discount to estimated fair value, its dividend yield of 3.56% is below the top tier in Italy's market but remains attractive for consistent income seekers.

- Navigate through the intricacies of Caltagirone with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Caltagirone's current price could be quite moderate.

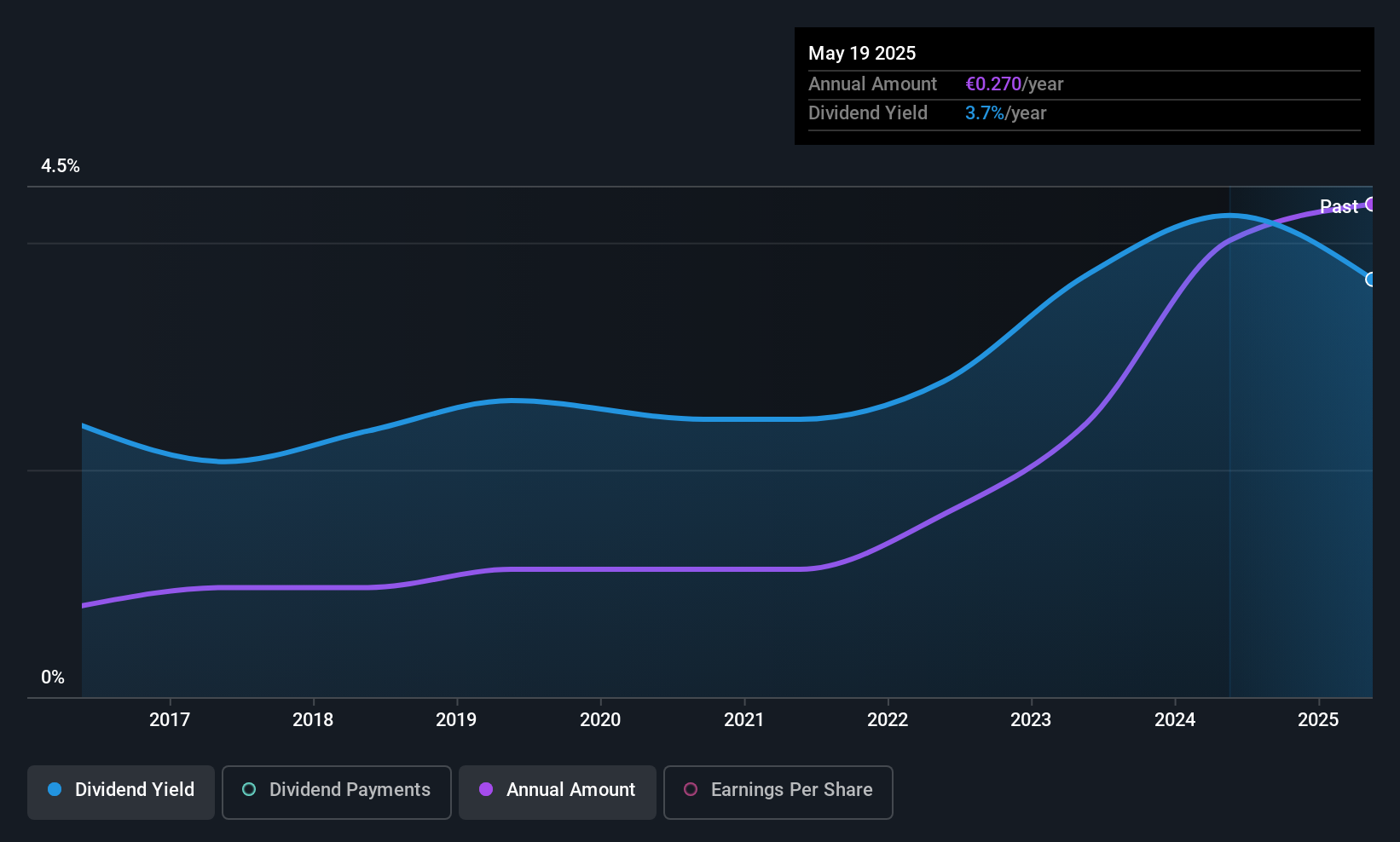

Sodexo (ENXTPA:SW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. is a global provider of food services and facilities management, with a market cap of €7.60 billion.

Operations: Sodexo generates its revenue from three main segments: Europe (€8.53 billion), North America (€11.33 billion), and the Rest of the World (€4.31 billion).

Dividend Yield: 5.1%

Sodexo's dividend payments have been volatile over the past decade, with a payout ratio of 57.3% and cash payout ratio of 58%, suggesting coverage by earnings and cash flows. Despite trading at a significant discount to its estimated fair value, Sodexo's dividend yield is slightly below the top quartile in France. Recent revenue growth has been modest, with Q3 2025 revenues reaching €6.12 billion, but future organic growth is expected at the lower end of guidance.

- Unlock comprehensive insights into our analysis of Sodexo stock in this dividend report.

- According our valuation report, there's an indication that Sodexo's share price might be on the cheaper side.

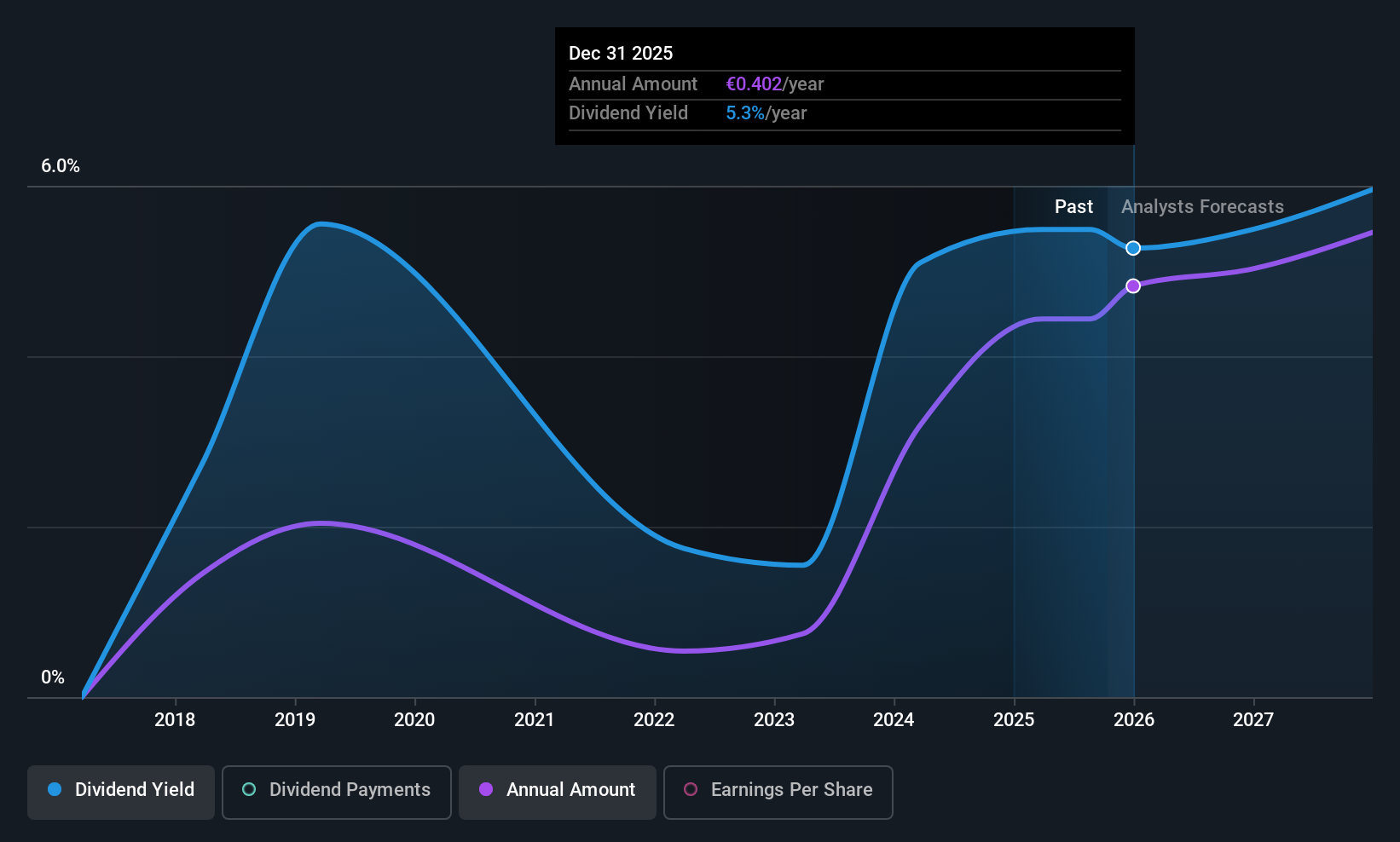

AIB Group (ISE:A5G)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AIB Group plc offers banking and financial products and services to retail, business, and corporate customers in the Republic of Ireland, the United Kingdom, and internationally, with a market cap of approximately €15.24 billion.

Operations: AIB Group's revenue segments include Retail (€2.97 billion), Capital Markets (€1.14 billion), AIB UK (€262 million), and Climate Capital (€141 million).

Dividend Yield: 5.2%

AIB Group's dividend is supported by a low payout ratio of 41.1%, with future coverage expected at 46.8%. Despite its top-tier yield in Ireland, the dividend has been unstable over its 8-year history. AIB trades at a significant discount to fair value and recently declared an interim dividend of €263 million. However, earnings are forecast to decline by 5% annually over the next three years, and it faces high bad loans at 2.8%.

- Click here and access our complete dividend analysis report to understand the dynamics of AIB Group.

- Insights from our recent valuation report point to the potential undervaluation of AIB Group shares in the market.

Taking Advantage

- Discover the full array of 219 Top European Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SW

Sodexo

Provides food services and facilities management services worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives