Should UnipolSai Assicurazioni (BIT:US) Be Disappointed With Their 21% Profit?

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the UnipolSai Assicurazioni S.p.A. (BIT:US) share price is up 21% in the last three years, clearly besting the market return of around 6.3% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 18% , including dividends .

Check out our latest analysis for UnipolSai Assicurazioni

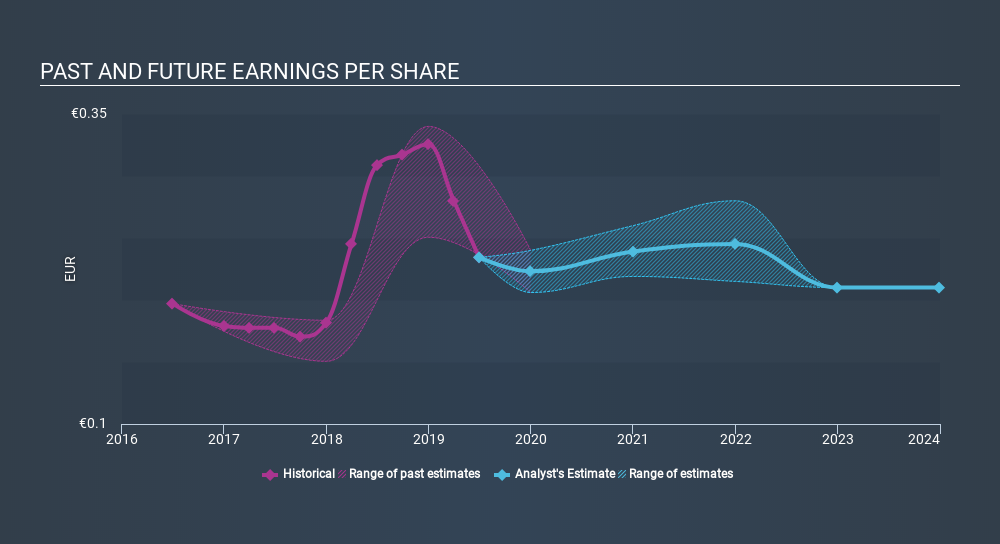

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, UnipolSai Assicurazioni achieved compound earnings per share growth of 6.0% per year. We note that the 6.6% yearly (average) share price gain isn't too far from the EPS growth rate. Coincidence? Probably not. That suggests that the market sentiment around the company hasn't changed much over that time. Quite to the contrary, the share price has arguably reflected the EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on UnipolSai Assicurazioni's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, UnipolSai Assicurazioni's TSR for the last 3 years was 47%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

UnipolSai Assicurazioni provided a TSR of 18% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 7.6% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand UnipolSai Assicurazioni better, we need to consider many other factors. For instance, we've identified 2 warning signs for UnipolSai Assicurazioni that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:US

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives