Assessing Generali (BIT:G) Valuation as Stock Defies Broader Market Trends

Reviewed by Simply Wall St

Assicurazioni Generali (BIT:G) has been catching the eye of investors recently, not because of any earth-shaking announcement or sudden sector shakeup, but simply because its stock price moves have quietly defied the broader market’s trends. When there is no dramatic headline to pin these shifts on, investors often find themselves asking whether the narrative is changing beneath the surface or if it is simply a matter of the market slowly waking up to deeper value within one of Europe’s insurance giants.

This year, Assicurazioni Generali’s share price has gained solid ground, delivering a 19% increase year-to-date and a 36% total return over the past year. However, the stock has recently lost some steam, finishing the past month slightly down even as its long-term return over the last three years stands out at well above 150%. This momentum, mixed with a handful of quieter months, leaves investors balancing the story of sustained long-term growth against signs that appetite for the shares might be cooling off in the short term.

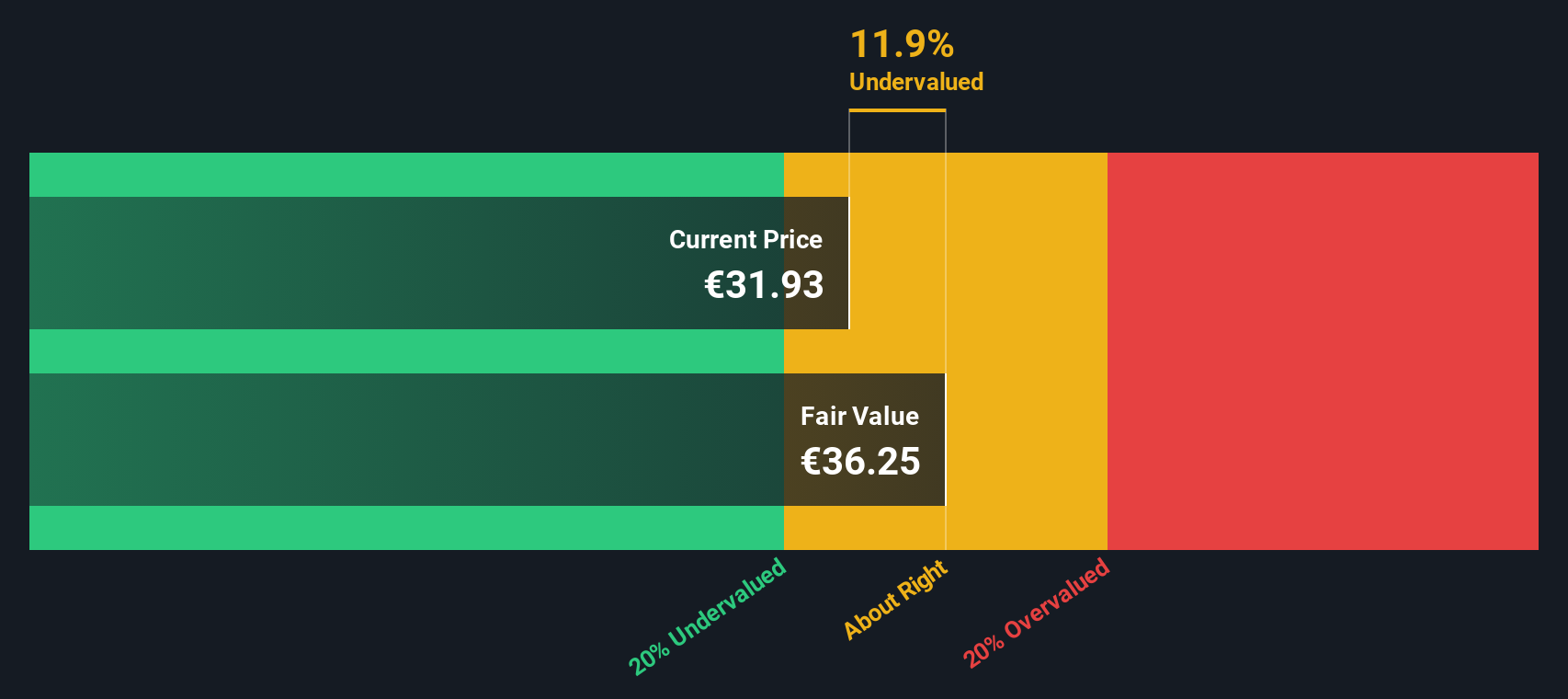

With all these price moves, the big question now is whether Assicurazioni Generali is still undervalued or if investors are already pricing in years of future growth ahead of the curve.

Most Popular Narrative: Fairly Valued

According to the most closely tracked narrative, Assicurazioni Generali shares are seen as fairly valued, with the current price almost exactly in line with the consensus fair value estimate.

Strategic investments in digitalization and artificial intelligence are enhancing distribution efficiency, pricing sophistication, and underwriting capabilities. These initiatives position Generali for future improvements in operational efficiency, lower expense ratios, and resilient net margins.

What is fueling this tight valuation call? There is a surprising forecast at the heart of this consensus, hinging on sustained growth in both topline and profitability, as well as a forward-looking profit multiple that might raise eyebrows. Wondering just how ambitious the assumptions are behind the analysts’ price target? Keep reading to discover the numbers that drive this assessment.

Result: Fair Value of €32.67 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising capital requirements and continued pressure on core insurance margins could quickly challenge the current upbeat consensus regarding Assicurazioni Generali’s valuation.

Find out about the key risks to this Assicurazioni Generali narrative.Another View: Discounted Cash Flow

There is another angle worth considering. Our DCF model suggests the stock could actually be trading below its fair value, which challenges the consensus that shares are accurately priced. Could the market be underestimating something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Assicurazioni Generali Narrative

If you see the story playing out differently, or would rather dive into the numbers yourself, you have the tools to construct a personal outlook in just a few minutes. Do it your way.

A great starting point for your Assicurazioni Generali research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Fresh Investment Ideas?

Seize the opportunity to stay ahead of the crowd with new investment leads. The Simply Wall Street Screener arms you with fresh picks, smart filters, and the confidence to spot great companies before everyone else.

- Uncover rare value by searching for undervalued stocks based on cash flows and identify stocks primed for a market rerating based on robust cash flow potential.

- Tap into future-defining breakthroughs by seeking out companies driving the AI revolution with AI penny stocks and find pioneers at the intersection of technology and growth.

- Get ahead of the curve with high-yield choices using dividend stocks with yields > 3% to pinpoint reliable stocks offering attractive dividend streams above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:G

Assicurazioni Generali

Provides various insurance solutions under the Generali brand in the Americas, Italy, rest of Europe, Africa, the Middle East, Asia, and the Oceania.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives