A Look at Generali’s (BIT:G) Valuation Following Deputy CEO Appointment and Leadership Changes

Reviewed by Simply Wall St

Assicurazioni Generali (BIT:G) has named Giulio Terzariol as its new deputy CEO, entrusting him with oversight of Banca Generali, the group’s private banking subsidiary. Such executive appointments often invite investor attention, particularly around potential shifts in strategic direction.

See our latest analysis for Assicurazioni Generali.

Momentum has been steadily building for Assicurazioni Generali, with the stock gaining 22.6% year-to-date and delivering an impressive 38.3% total shareholder return over the past year. Recent leadership shifts and solid results appear to have added fresh optimism to what is already a strong multi-year performance.

If Generali’s strategy updates have you thinking bigger, now is a great time to look further afield and discover fast growing stocks with high insider ownership

But with shares outperforming for several years, the key question is whether Generali still trades at attractive value, or if the market has already fully accounted for its ongoing growth. Does a buying opportunity remain, or is future progress already priced in?

Most Popular Narrative: Fairly Valued

Assicurazioni Generali’s prevailing narrative pegs its fair value nearly even with the latest market close, suggesting bulls and bears currently see eye to eye. There is palpable tension as recent optimism meets high valuation expectations. Below is a snapshot of what’s driving these calls.

Strategic investments in digitalization and artificial intelligence are enhancing distribution efficiency, pricing sophistication, and underwriting capabilities, setting Generali up for future improvements in operational efficiency, lower expense ratios, and resilient net margins.

What’s hiding behind this razor-thin fair value call? The math points to accelerated transformation and high-stakes future assumptions about margins and technology’s bottom-line impact. Want to see the exact scenario these projections depend on?

Result: Fair Value of $33.16 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low yields on government bonds or underperformance in key segments could still challenge Generali’s margin resilience and near term growth story.

Find out about the key risks to this Assicurazioni Generali narrative.

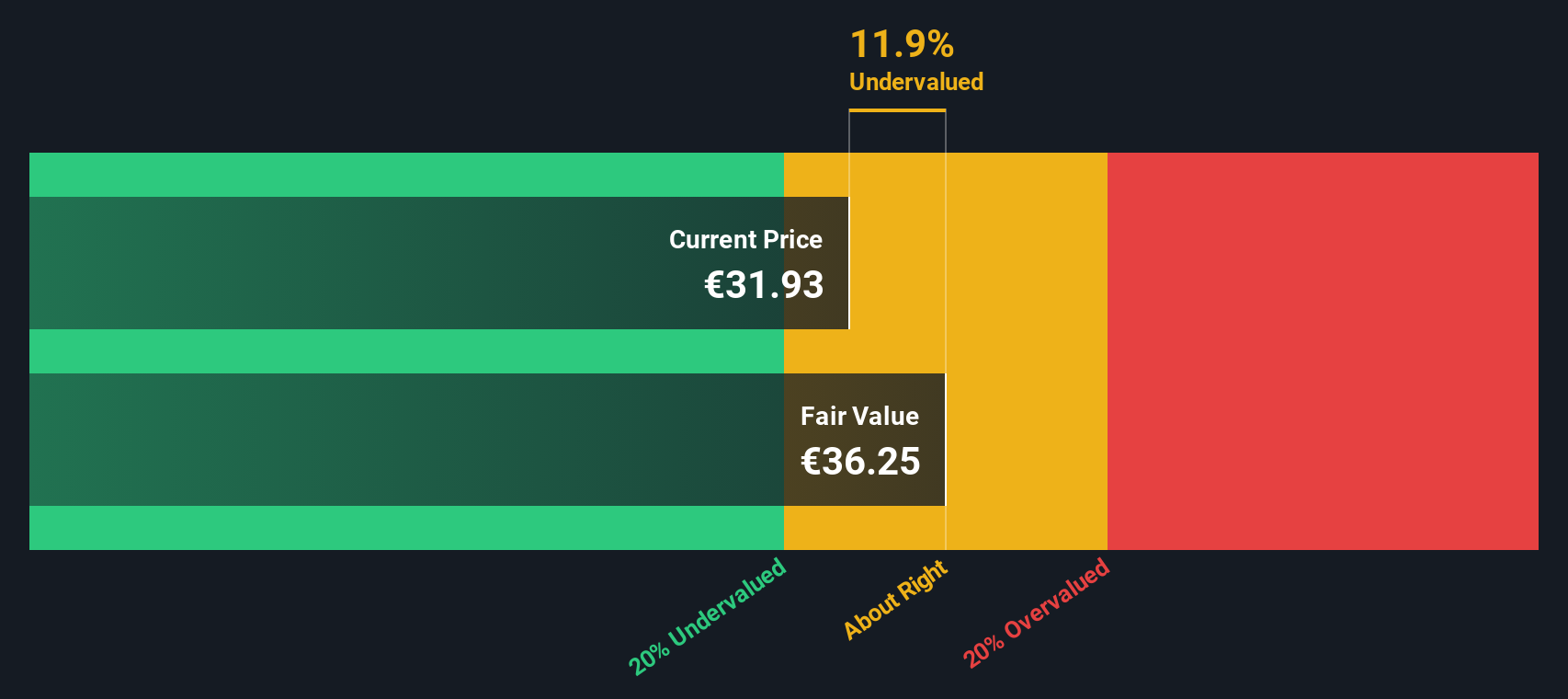

Another View: Discounted Cash Flow Perspective

Taking a different angle, our DCF model suggests Generali may actually be undervalued, with shares trading nearly 9.5% below the estimated fair value of €37.40. This result is in sharp contrast to the analyst consensus, which sees the stock as fairly priced by the market. Could the SWS DCF be highlighting an overlooked opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Assicurazioni Generali for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 864 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Assicurazioni Generali Narrative

If you think the story could unfold differently or want to dig into the data yourself, you can shape your own narrative in just a few minutes, your way with Do it your way.

A great starting point for your Assicurazioni Generali research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means keeping your radar wide. Check out these handpicked opportunities from Simply Wall Street before your next move. You could find your next big winner hiding in plain sight.

- Boost your long-term returns by focusing on passive income opportunities through these 14 dividend stocks with yields > 3%, where solid yields meet strong fundamentals.

- Tap into breakthrough medical innovation by getting an edge with these 32 healthcare AI stocks, which are driving the future of healthcare with artificial intelligence.

- Catch the wave of digital transformation and ride the momentum with these 26 AI penny stocks poised to redefine entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:G

Assicurazioni Generali

Provides various insurance solutions under the Generali brand in the Americas, Italy, rest of Europe, Africa, the Middle East, Asia, and the Oceania.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives