Health Italia S.p.A.'s (BIT:HI) healthy profit numbers didn't contain any surprises for investors. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

The Power Of Non-Operating Revenue

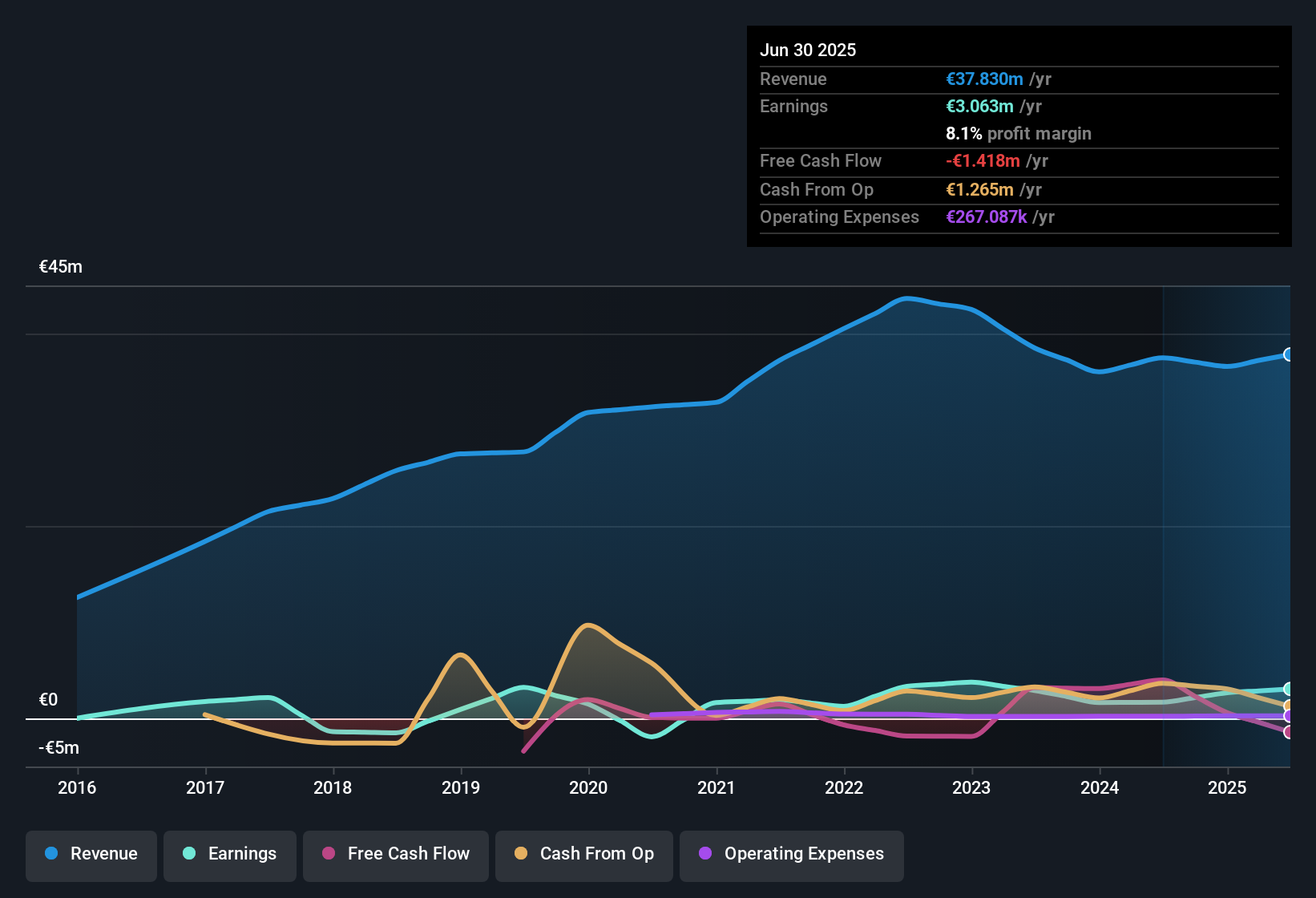

At most companies, some revenue streams, such as government grants, are accounted for as non-operating revenue, while the core business is said to produce operating revenue. Where possible, we prefer rely on operating revenue to get a better understanding of how the business is functioning. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. It's worth noting that Health Italia saw a big increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from €364.0k last year to €2.33m this year. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Health Italia.

Our Take On Health Italia's Profit Performance

When considering the nature of Health Italia's earnings, we'd absolutely keep in mind that it saw an increase in non-operating revenue in the last year, which would in turn have boosted its profit, potentially in an unsustainable manner. Because of this, we think that it may be that Health Italia's statutory profits are better than its underlying earnings power. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Health Italia, you'd also look into what risks it is currently facing. For example - Health Italia has 1 warning sign we think you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Health Italia's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Health Italia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:HI

Health Italia

Engages in providing supplementary health plans for families and businesses, corporate welfare services, and wellness solutions in Italy.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives