- Italy

- /

- Healthtech

- /

- BIT:GPI

High Growth European Tech Stocks In April 2025

Reviewed by Simply Wall St

As of April 2025, European markets have shown resilience, with the pan-European STOXX Europe 600 Index climbing 2.77% amid easing trade tensions and positive signals from major economies like Germany and France. In this environment, high-growth tech stocks in Europe are attracting attention as investors seek opportunities that can thrive amidst economic uncertainties and evolving global trade dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Bonesupport Holding | 28.91% | 53.88% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.29% | 96.54% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

GPI (BIT:GPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GPI S.p.A. is an Italian company offering social-healthcare and information technology hi-tech services both domestically and internationally, with a market capitalization of approximately €261.02 million.

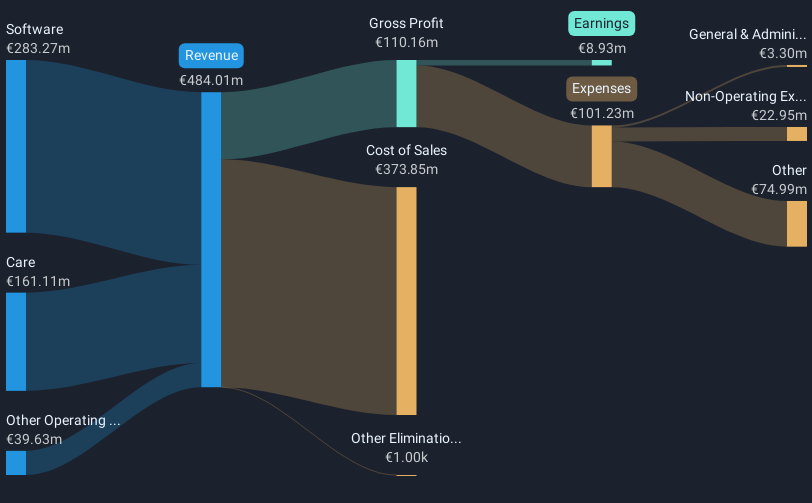

Operations: GPI S.p.A. generates revenue primarily from its Software segment, accounting for €304.10 million, followed by the Care segment at €162.20 million.

GPI S.p.A. has demonstrated a robust financial trajectory, with earnings soaring by 485.4% over the past year, significantly outpacing the Healthcare Services industry's growth of 28.4%. This surge is anchored in a solid annual revenue increase of 4.4%, slightly above the Italian market's growth rate of 4.3%. Despite these impressive gains, GPI faces challenges such as interest payments not being well covered by earnings, indicating potential financial stress points. However, recent strategic moves like issuing €50 million in sustainable senior bonds suggest proactive management in bolstering their financial base for future endeavors. As GPI continues to expand its footprint in healthcare services, backed by high-quality earnings and an anticipated annual profit growth of 24%—exceeding the broader Italian market's forecast of 7.3%—its commitment to innovation and sustainability may well drive continued success in a competitive landscape.

- Dive into the specifics of GPI here with our thorough health report.

Examine GPI's past performance report to understand how it has performed in the past.

Paradox Interactive (OM:PDX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Paradox Interactive AB (publ) is a company that develops and publishes strategy and management games for PC and consoles across various regions, including North and Latin America, Europe, the Middle East, Africa, and the Asia Pacific; it has a market cap of approximately SEK19.71 billion.

Operations: The company focuses on developing and publishing strategy and management games for PC and consoles, with a significant revenue stream from computer graphics amounting to SEK2.18 billion.

Paradox Interactive, a trailblazer in strategy gaming, recently unveiled its latest expansion, "Khans of the Steppe" for Crusader Kings III. This release enhances gameplay with unique mechanics tailored to nomadic cultures and has been well-received by the gaming community. Despite a slight dip in Q1 sales to SEK 463.6 million from SEK 482.1 million year-over-year, net income remained robust at SEK 123.68 million. The company's commitment to innovation is evident in its R&D spending trends which have consistently aligned with revenue growth, ensuring sustained development and enhancement of their gaming franchises. As Paradox continues to expand its portfolio with culturally rich and historically immersive content, it remains poised to captivate a growing global audience in the dynamic entertainment sector.

- Take a closer look at Paradox Interactive's potential here in our health report.

Gain insights into Paradox Interactive's past trends and performance with our Past report.

IONOS Group (XTRA:IOS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IONOS Group SE operates in the web presence and productivity, and cloud solutions sectors across several countries including Germany, the United States, and the United Kingdom, with a market cap of €4.04 billion.

Operations: IONOS Group SE generates revenue primarily from its Digital Solutions & Cloud segment, contributing €1.25 billion, and Adtech segment with €312.23 million. The company's operations span multiple countries including Germany, the United States, and the United Kingdom.

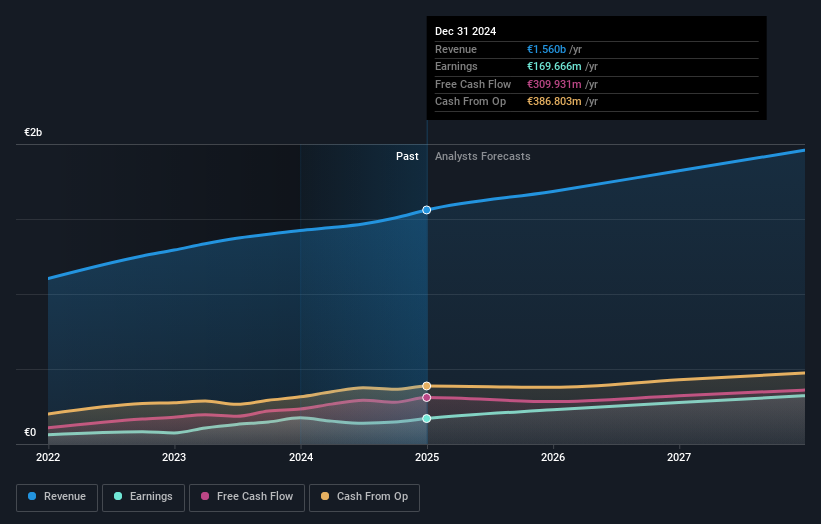

IONOS Group SE, amid a challenging tech landscape, reported a solid revenue increase to €1.56 billion from €1.42 billion year-over-year, demonstrating a 7.1% growth rate that surpasses the German market's 5.8%. This growth is underpinned by strategic moves like seeking acquisitions to enhance their web presence and productivity sectors in Europe, reflecting an aggressive expansion strategy. Furthermore, with earnings expected to surge by 20.4% annually, IONOS is not just keeping pace but setting benchmarks in its sector through innovation and smart integrations of new acquisitions into its robust Internet Factory platform—ensuring they remain at the forefront of the tech industry's evolution.

- Click here to discover the nuances of IONOS Group with our detailed analytical health report.

Explore historical data to track IONOS Group's performance over time in our Past section.

Seize The Opportunity

- Investigate our full lineup of 218 European High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GPI

GPI

Provides social-healthcare and information technology hi-tech services in Italy and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives