- Italy

- /

- Healthcare Services

- /

- BIT:AMP

Amplifon S.p.A. (BIT:AMP) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

Amplifon S.p.A. (BIT:AMP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

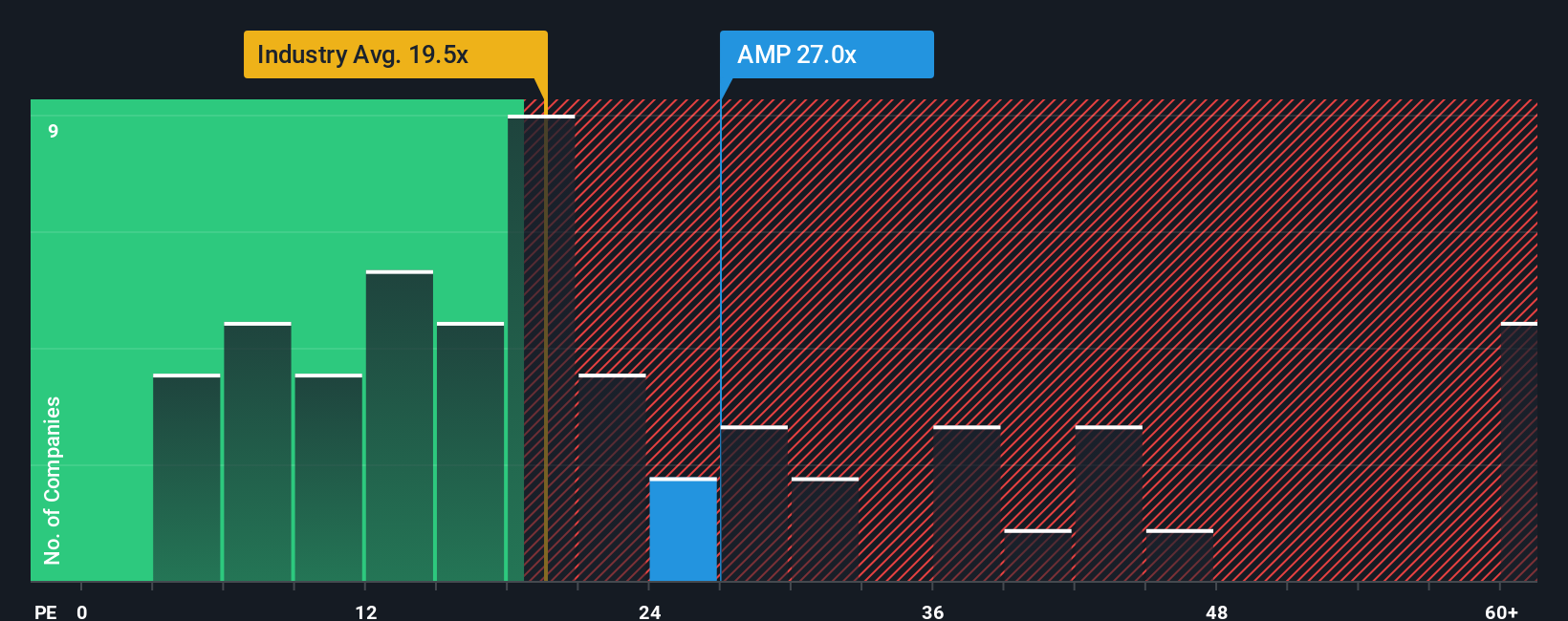

Although its price has dipped substantially, Amplifon's price-to-earnings (or "P/E") ratio of 27x might still make it look like a strong sell right now compared to the market in Italy, where around half of the companies have P/E ratios below 16x and even P/E's below 11x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Amplifon's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Amplifon

How Is Amplifon's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Amplifon's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. The last three years don't look nice either as the company has shrunk EPS by 28% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the analysts watching the company. That's shaping up to be similar to the 21% each year growth forecast for the broader market.

In light of this, it's curious that Amplifon's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Amplifon's P/E

Even after such a strong price drop, Amplifon's P/E still exceeds the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Amplifon's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 3 warning signs for Amplifon (1 shouldn't be ignored!) that you should be aware of.

Of course, you might also be able to find a better stock than Amplifon. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:AMP

Amplifon

Engages in the distribution of hearing solutions and the fitting of customized products that helps people to rediscover various emotions of sound in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026