- Sweden

- /

- Tech Hardware

- /

- OM:DYVOX

Exploring Undiscovered Gems in Europe This May 2025

Reviewed by Simply Wall St

As Europe grapples with the impact of proposed U.S. tariffs, the pan-European STOXX Europe 600 Index recently snapped a five-week streak of gains, reflecting broader market uncertainties. In this climate, identifying hidden opportunities in small-cap stocks can be particularly rewarding for investors seeking growth potential amidst economic fluctuations and shifting trade policies.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Rosetti Marino (BIT:YRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Rosetti Marino SpA, along with its subsidiaries, operates in the energy, energy transition, and shipbuilding sectors across Italy, the European Union, and globally with a market capitalization of €235.60 million.

Operations: Rosetti Marino generates revenue primarily from its Oil & Gas Business Unit (€403.62 million) and Renewables and Carbon segment (€172.70 million), with smaller contributions from various services (€0.60 million) and shipbuilding (€2.96 million). The company's financial performance is significantly driven by the oil and gas sector, which constitutes a substantial portion of its revenue mix.

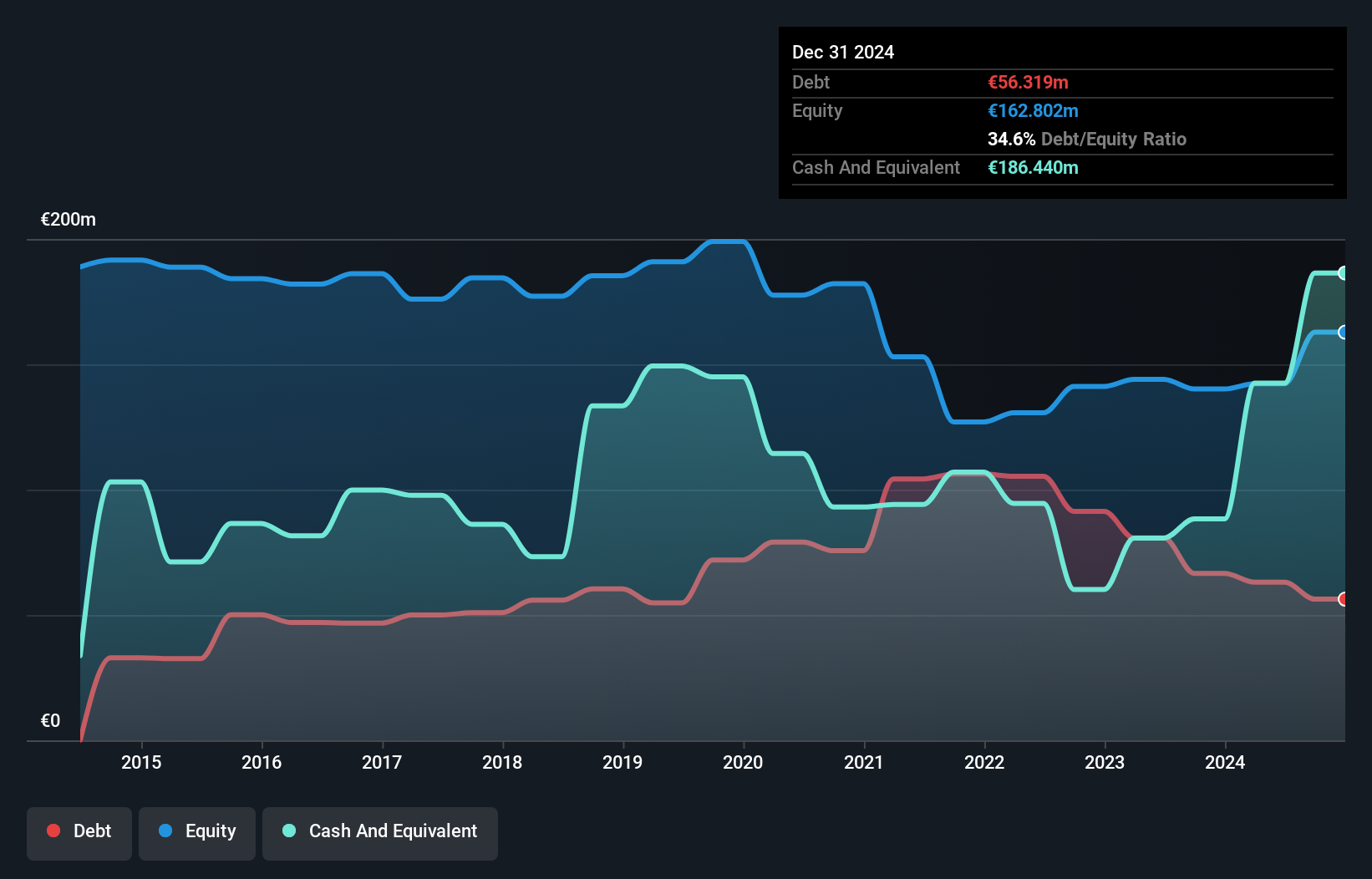

Rosetti Marino, a standout in the energy services sector, has shown impressive growth with earnings surging 323% over the past year, significantly outpacing the industry average of 15.4%. The company's debt to equity ratio improved from 36.2% to 34.6% over five years, reflecting prudent financial management. Trading at a price-to-earnings ratio of just 7.9x compared to the Italian market's 15.9x, it offers good value for investors seeking opportunities in smaller companies. Recent results show net income jumping from €7 million to €29.8 million annually, further highlighting its robust performance and potential for continued success in its field.

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SpareBank 1 Ringerike Hadeland is a financial institution offering a range of banking products and services to private and corporate customers in Norway, with a market cap of NOK6.16 billion.

Operations: The bank generates revenue primarily through interest income, fees, and commissions from its various banking products and services. It focuses on managing costs efficiently to support its financial performance.

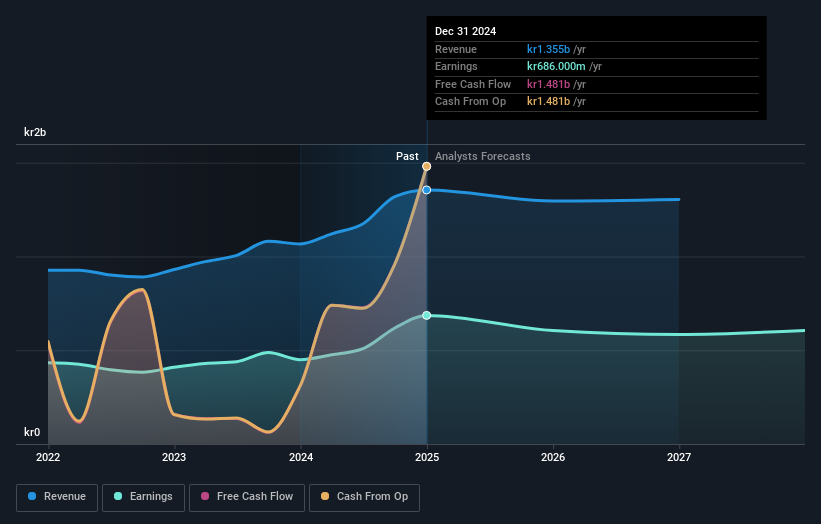

SpareBank 1 Ringerike Hadeland, with total assets of NOK31.7 billion and equity of NOK4.9 billion, is a compact player in the banking sector. Its financial health seems robust with 80% of its liabilities funded through customer deposits, minimizing risk compared to external borrowing. The bank's earnings surged by 44.9% last year, outpacing the industry’s modest 6.4% growth rate and showcasing high-quality past earnings despite an anticipated annual decline of 4.7% over the next three years. Trading at a notable discount to its estimated fair value by 32%, it remains free cash flow positive, indicating solid operational efficiency amidst competitive pressures.

Dynavox Group (OM:DYVOX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dynavox Group AB (publ) focuses on developing and selling assistive technology products for individuals with communication impairments, with a market capitalization of approximately SEK10.55 billion.

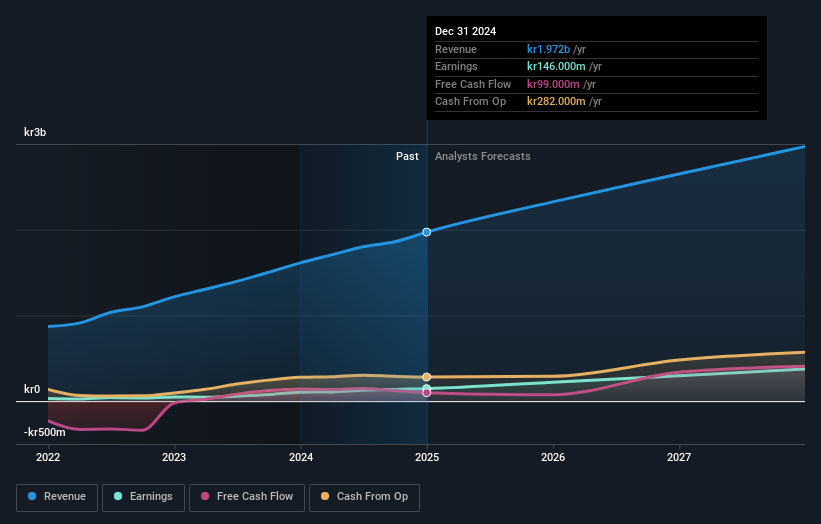

Operations: Dynavox Group generates revenue primarily from its computer hardware segment, amounting to SEK2.13 billion. The company's market capitalization stands at approximately SEK10.55 billion.

Dynavox Group, a promising player in the tech industry, is making strategic moves with its acquisition of Cenomy in France and investments in ERP systems. This expansion aims to bolster global presence and operational efficiency. The company reported first-quarter sales of SEK 581 million, up from SEK 428 million last year, with net income rising to SEK 24 million. Despite a high net debt-to-equity ratio of 123.7%, interest payments are well-covered by EBIT at 5.8 times coverage. Recent share repurchase initiatives reflect confidence in future growth prospects despite potential risks like healthcare reimbursement complexities and currency fluctuations impacting financial performance.

Where To Now?

- Navigate through the entire inventory of 325 European Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DYVOX

Dynavox Group

Through its subsidiaries, engages in the development and sale of assistive technology products for customers with impaired communication skills.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives