- Italy

- /

- Energy Services

- /

- BIT:SPM

Saipem (BIT:SPM): Unpacking the Valuation Story After Recent Share Price Dip

Reviewed by Kshitija Bhandaru

Saipem (BIT:SPM) shares have moved modestly over the past week, catching the attention of investors curious about the company's performance and valuation. With a mixed recent return profile, Saipem presents a case worth examining.

See our latest analysis for Saipem.

Saipem's share price recently dipped to €2.45, down 4% for the day. This comes after a year marked by impressive resilience. While the share price has slipped nearly 8% year-to-date, the company has generated a remarkable 30% total shareholder return over the past twelve months and delivered over a 300% total return in the last three years. This signals underlying momentum even amid short-term volatility.

If Saipem's recent swing has you looking for what else might be gaining traction, it's a great opportunity to expand your search and discover fast growing stocks with high insider ownership

With shares trading nearly 50% below some intrinsic value estimates and a notable gap to analyst targets, the question for investors is clear: is Saipem undervalued, or is future growth already reflected in the price?

Most Popular Narrative: 20.9% Undervalued

The narrative’s fair value for Saipem stands noticeably above the last close at €2.45, highlighting a significant valuation gap. Investors are left contemplating whether the underlying assumptions justify the upside potential displayed in these estimates.

A record-high, well-diversified order backlog and robust commercial pipeline (€53 billion) provide strong revenue visibility into 2025 and 2026. This positions Saipem to benefit from global energy infrastructure demand driven by population growth, urbanization, and heightened focus on energy security, supporting sustained revenue growth.

Want to peek behind the curtain at the financial forecasts driving this target? There’s a catch: bold projections in earnings, margins, and market leadership fuel this price. Find out what assumptions give this narrative its edge.

Result: Fair Value of €3.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative faces risks if legacy project costs recur or if increased leasing expenses put pressure on profits and free cash flow in tighter markets.

Find out about the key risks to this Saipem narrative.

Another View: Closer Look at Earnings Multiples

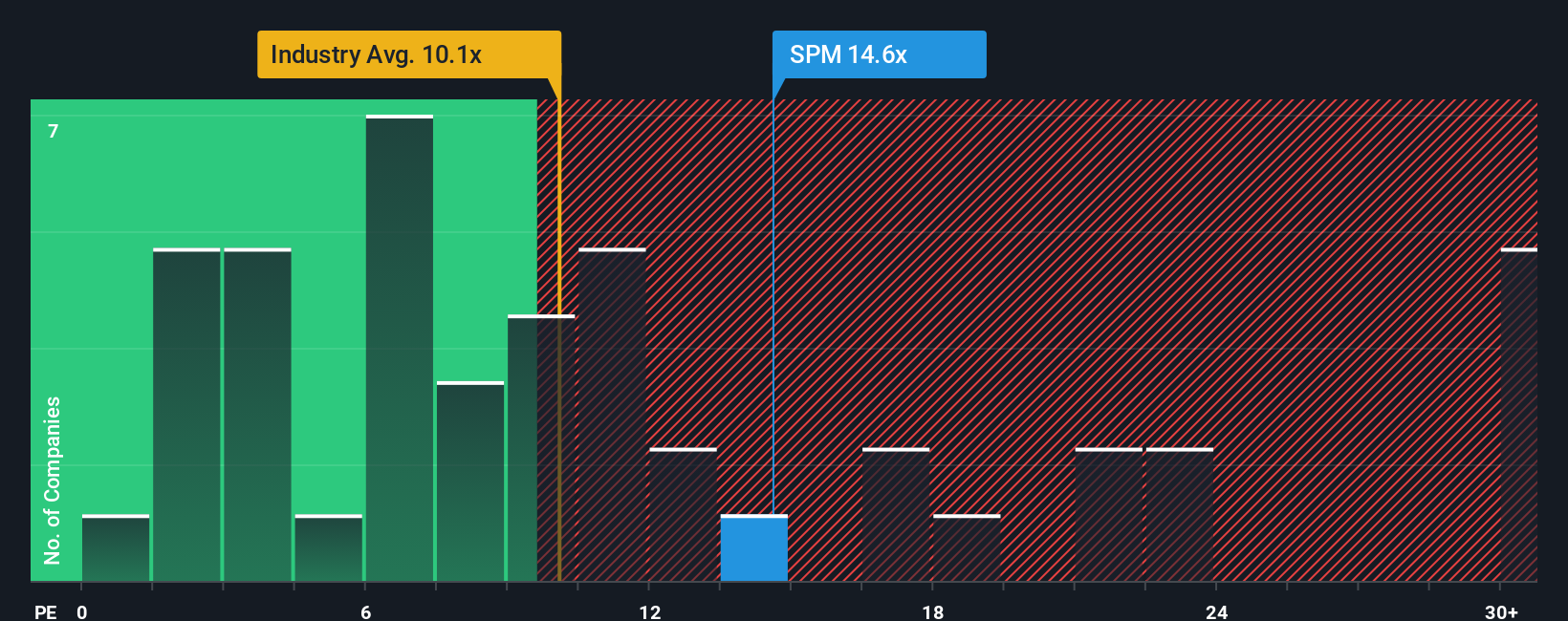

While discounted cash flow suggests significant upside, the company's current price-to-earnings ratio sits at 14.6 times. This is more expensive than the European Energy Services industry average of 10.1 times, but attractively priced compared to the peer average of 20.9 times and a fair ratio of 16.1. Is this a risk that pays off, or a sign of caution for value-focused investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Saipem Narrative

If you think there's more to the story, or if you want to test your own view using the numbers, you can shape your own narrative in just a few minutes: Do it your way

A great starting point for your Saipem research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunity pass you by. Expand your horizon today and tap into fresh stock ideas waiting just beyond your current watchlist. Powering up your strategy now could mean catching the next wave of outperformance.

- Capture exciting returns from high-potential companies when you review these 898 undervalued stocks based on cash flows offering solid value that the market may be overlooking.

- Unlock future-ready growth stories as you check out these 24 AI penny stocks built on artificial intelligence breakthroughs and innovation leadership.

- Boost your passive income stream by targeting these 19 dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SPM

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)