- Italy

- /

- Oil and Gas

- /

- BIT:GSP

Top European Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the STOXX Europe 600 Index gaining 2.11% amid strong corporate earnings and optimism surrounding geopolitical resolutions, investors are increasingly drawn to dividend stocks as a means of securing steady income in an evolving economic landscape. In such conditions, selecting dividend stocks that demonstrate robust financial health and consistent payout histories can be particularly appealing for those looking to balance growth potential with reliable returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.41% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 3.96% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.13% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.61% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.06% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.09% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.50% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.58% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.65% | ★★★★★☆ |

| Afry (OM:AFRY) | 4.04% | ★★★★★☆ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

B&C Speakers (BIT:BEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B&C Speakers S.p.A. produces and markets professional loudspeakers under the B&C brand across various global regions, with a market cap of €195.27 million.

Operations: The company's revenue is primarily derived from its Acoustic Transducers segment, which generated €102.34 million.

Dividend Yield: 5.6%

B&C Speakers offers a dividend yield of 5.57%, ranking in the top 25% of Italian dividend payers. However, its dividends are not well covered by free cash flows, with a high cash payout ratio of 104.7%. Despite this, the payout ratio is reasonable at 60.2% when considering earnings coverage. The company has shown strong earnings growth recently and trades at a favorable price-to-earnings ratio compared to peers, but its dividend history has been volatile and unreliable over the past decade.

- Get an in-depth perspective on B&C Speakers' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, B&C Speakers' share price might be too pessimistic.

Gas Plus (BIT:GSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gas Plus S.p.A. is involved in the exploration and production of natural gas in Italy, with a market cap of €197.39 million.

Operations: Gas Plus S.p.A.'s revenue segments include Retail (€44.54 million), Network & Transportation (€17.63 million), Exploration & Production in Italy (€45.74 million), and Exploration & Production abroad (€38.35 million).

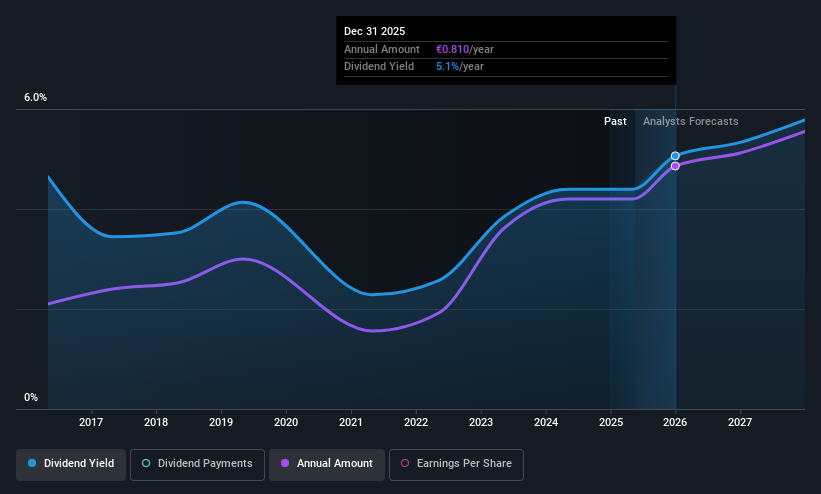

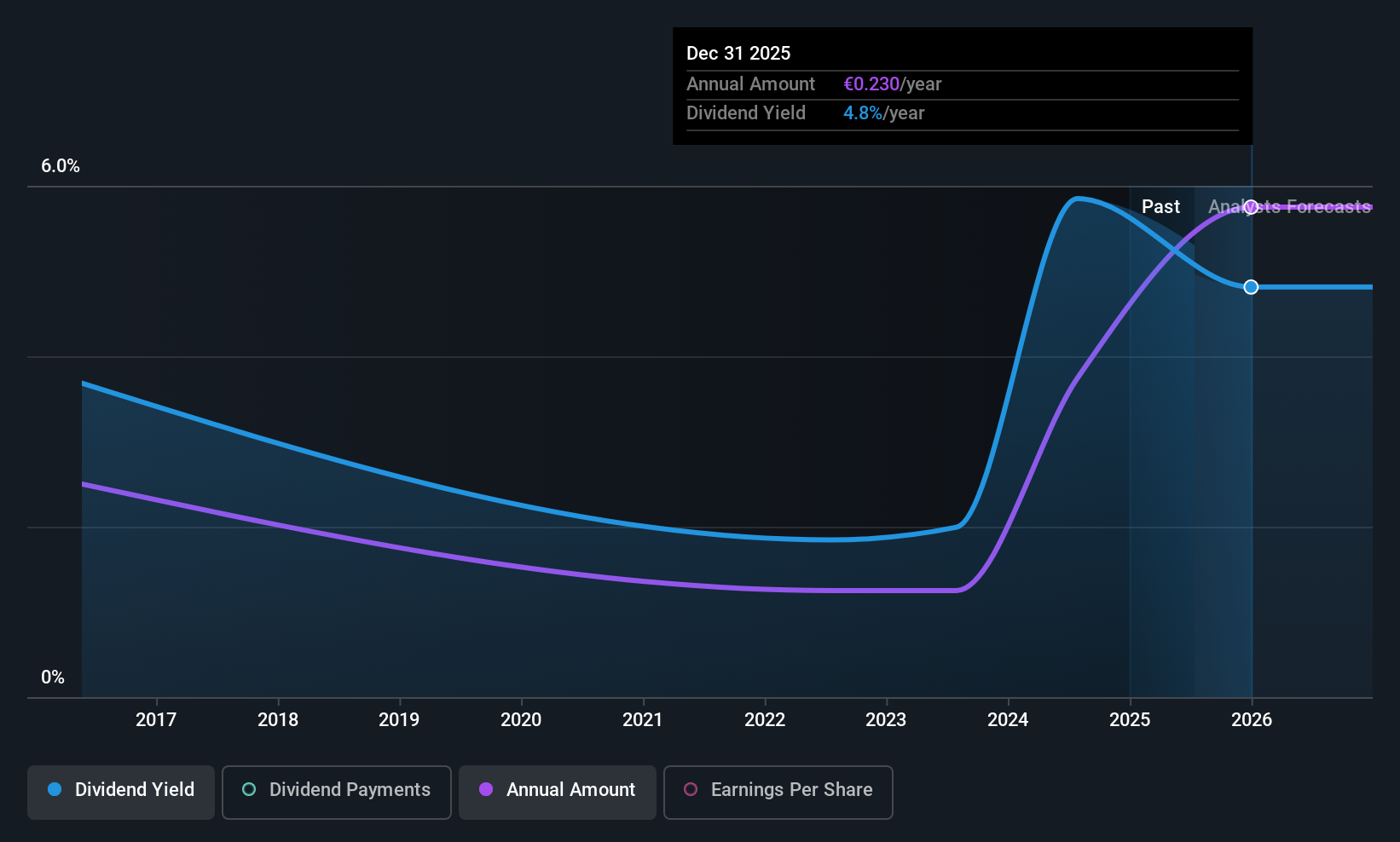

Dividend Yield: 4.4%

Gas Plus's dividend yield of 4.42% falls short of the top 25% in Italy, yet its dividends are well-supported by earnings and cash flows, with payout ratios of 69.5% and 26%, respectively. Despite a history of volatility in dividend payments over the past decade, they have shown growth. The stock trades at a significant discount to its estimated fair value, though recent profit margins have declined due to large one-off items impacting results.

- Take a closer look at Gas Plus' potential here in our dividend report.

- The analysis detailed in our Gas Plus valuation report hints at an inflated share price compared to its estimated value.

Decora (WSE:DCR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Decora S.A. operates in Poland, focusing on the production, distribution, sale, and export of flooring products and accessories with a market capitalization of PLN793.14 million.

Operations: Decora S.A.'s revenue is primarily derived from its flooring segment, which accounts for PLN463.62 million, and its wall segment, contributing PLN140.06 million.

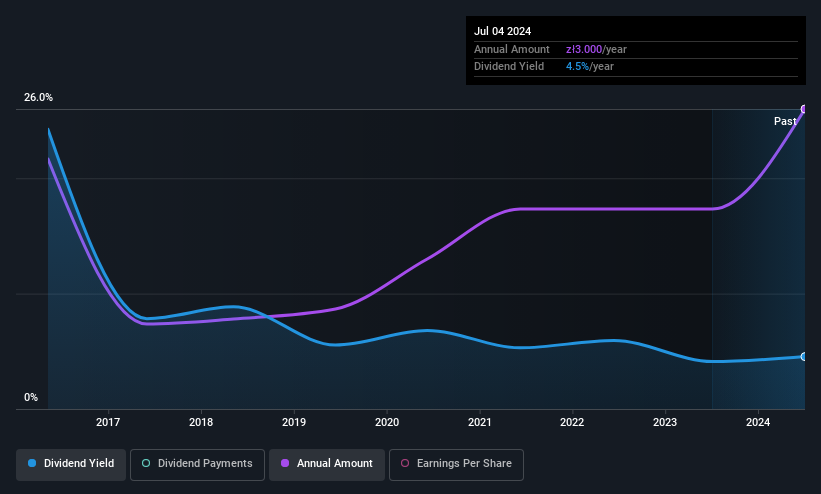

Dividend Yield: 5.3%

Decora's dividend yield of 5.32% is below the top 25% in Poland, and its dividend history has been volatile over the past decade despite showing growth. Dividends are supported by earnings and cash flows, with payout ratios of 53.6% and 65.4%, respectively. The stock trades at a lower price-to-earnings ratio (10.1x) than the Polish market average (12.9x). Recent earnings showed revenue growth but a slight decline in net income year-over-year to PLN 20.12 million.

- Navigate through the intricacies of Decora with our comprehensive dividend report here.

- According our valuation report, there's an indication that Decora's share price might be on the expensive side.

Turning Ideas Into Actions

- Reveal the 221 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:GSP

Gas Plus

Engages in the exploration and production of natural gas in Italy.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives