- Italy

- /

- Oil and Gas

- /

- BIT:ENI

Is This the Right Moment to Consider Eni Stock After Its 20% Rally?

Reviewed by Bailey Pemberton

Wondering whether now is the right moment to make a move on Eni stock? You are not alone. With its stock closing most recently at 15.346, Eni has seen more than a few eyebrow-raising moves in the past few years, and investors are taking notice. If you are looking for evidence of momentum, look no further than the 14.0% gain year-to-date, and an even stronger 20.6% climb over the past year. In fact, zooming out to five years, Eni has racked up an impressive 224.7% return. These results show the stock’s capacity for long-term growth, but also reflect global market trends and shifts in investor sentiment around the energy sector.

Eni’s recent 3.8% move in the past week has caught the attention of traders, while the last month’s modest gain of 0.8% points to some short-term volatility and shifting expectations. Part of this jostling in share price stems from ongoing headlines about supply dynamics in global energy markets. The market’s perception of risk and opportunity is evolving, which can drive rapid price shifts. Sometimes these changes can happen seemingly overnight.

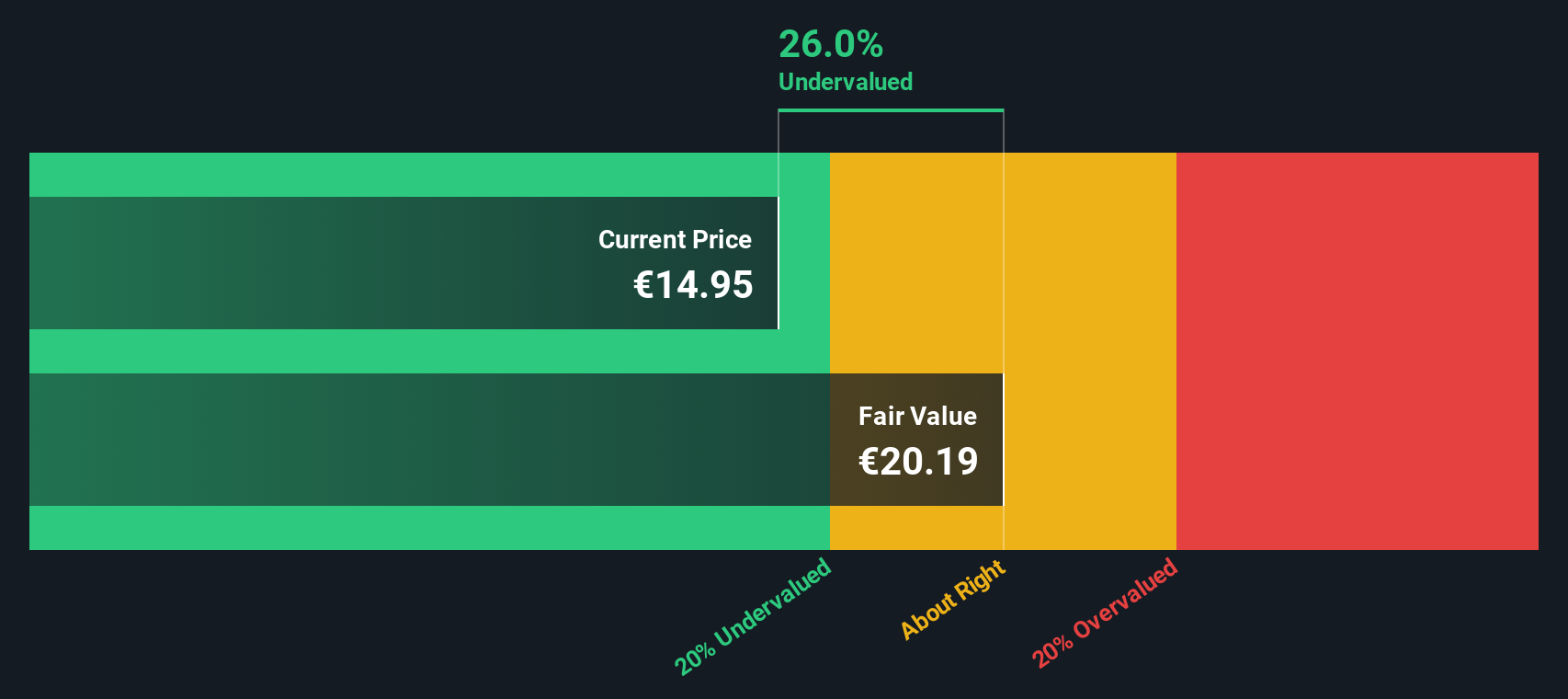

But despite these exciting moves, how does Eni look on a fundamental valuation basis? On a typical six-point valuation check, Eni only passes one. It is undervalued in just one out of six checks. What does this imply about the stock’s price relative to its real worth? Before you jump to conclusions, let’s explore the main valuation approaches analysts use. Later, I’ll share an even more effective way to gauge Eni’s true value.

Eni scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Eni Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today's value. It aims to determine what Eni is actually worth, based on realistic assumptions about how much cash the business will generate in the years ahead.

For Eni, the most recent Free Cash Flow stands at €4.77 billion. Analysts expect this number to grow over time, with projections showing Free Cash Flow of €4.99 billion in 2028 and up to €6.03 billion by 2035. While precise estimates only extend five years out, Simply Wall St’s model extrapolates beyond that to capture a fuller picture of Eni’s future cash-generating potential.

Based on these cash flow forecasts and using a 2 Stage Free Cash Flow to Equity model, the DCF calculation arrives at a fair value of €19.13 per share for Eni. With the stock currently trading at €15.35, the model implies that Eni is 19.8% undervalued. This suggests investors may be getting in below the company’s true worth, based on its ability to produce cash.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Eni.

Approach 2: Eni Price vs Earnings (P/E)

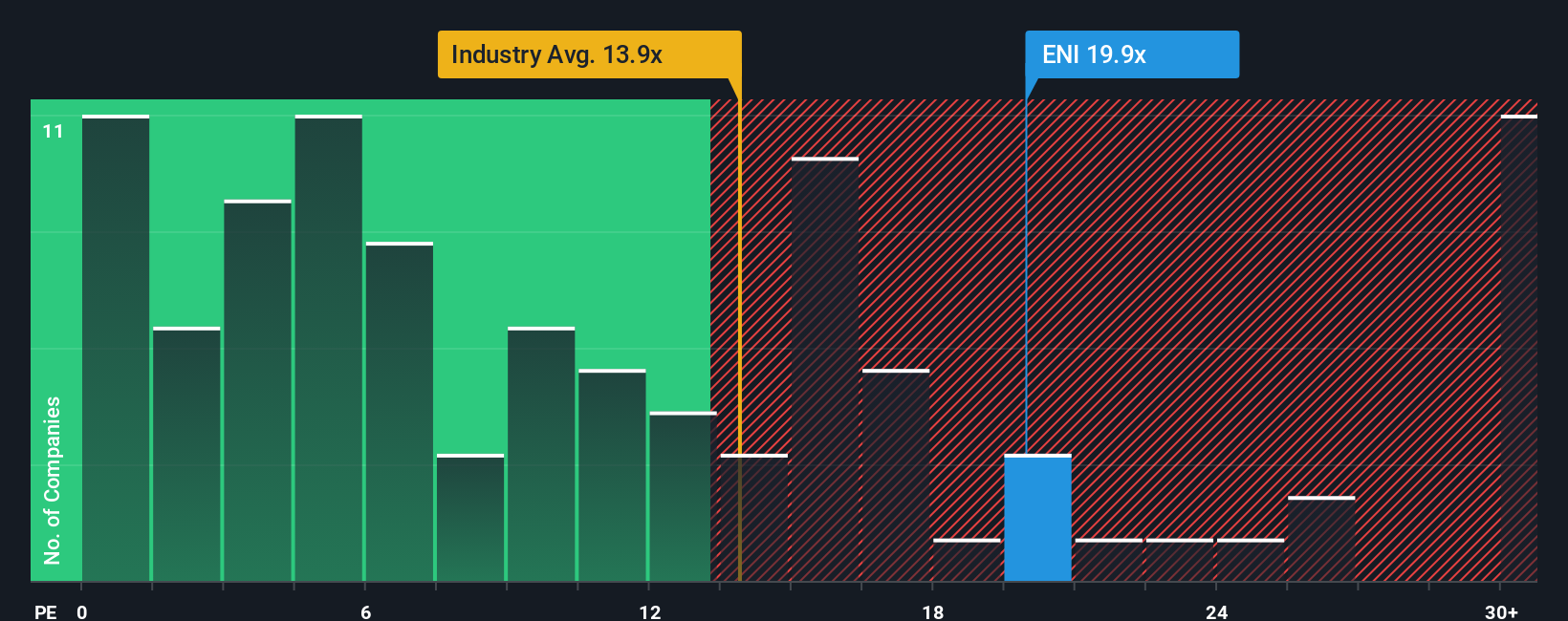

The Price-to-Earnings (P/E) ratio is a widely used valuation tool, particularly for companies that generate consistent profits like Eni. Because it relates a company’s share price to its earnings, the P/E ratio gives investors a snapshot of how much they are paying for each euro of profits. Growth outlook and company-specific risks both influence what is considered a “fair” P/E, as companies with faster expected growth or lower risk profiles generally justify higher ratios.

Currently, Eni trades at a P/E ratio of 20.47x. This is considerably higher than the Oil and Gas industry average of 12.95x and also above the average for its peer group, which stands at 15.14x. At first glance, this might make Eni look expensive relative to both its sector and similar companies.

However, Simply Wall St calculates a proprietary “Fair Ratio” for Eni, which reflects what the P/E should be based on factors like Eni’s future earnings growth, profit margins, company size and any relevant risks. For Eni, the Fair Ratio is 16.69x. The Fair Ratio provides a more tailored assessment than simple peer or industry comparisons, as it factors in key fundamentals unique to Eni's business and sector outlook.

Eni’s actual P/E of 20.47x is above its Fair Ratio, suggesting the market is pricing in more optimism than the stock’s fundamentals might warrant.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Eni Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is more than just a number; it is your story and outlook for a business, tying together your assumptions about Eni’s future revenue, profit margins, risks, and fair value. Narratives connect the company’s journey to financial forecasts, showing you what must happen for your investment to be a success.

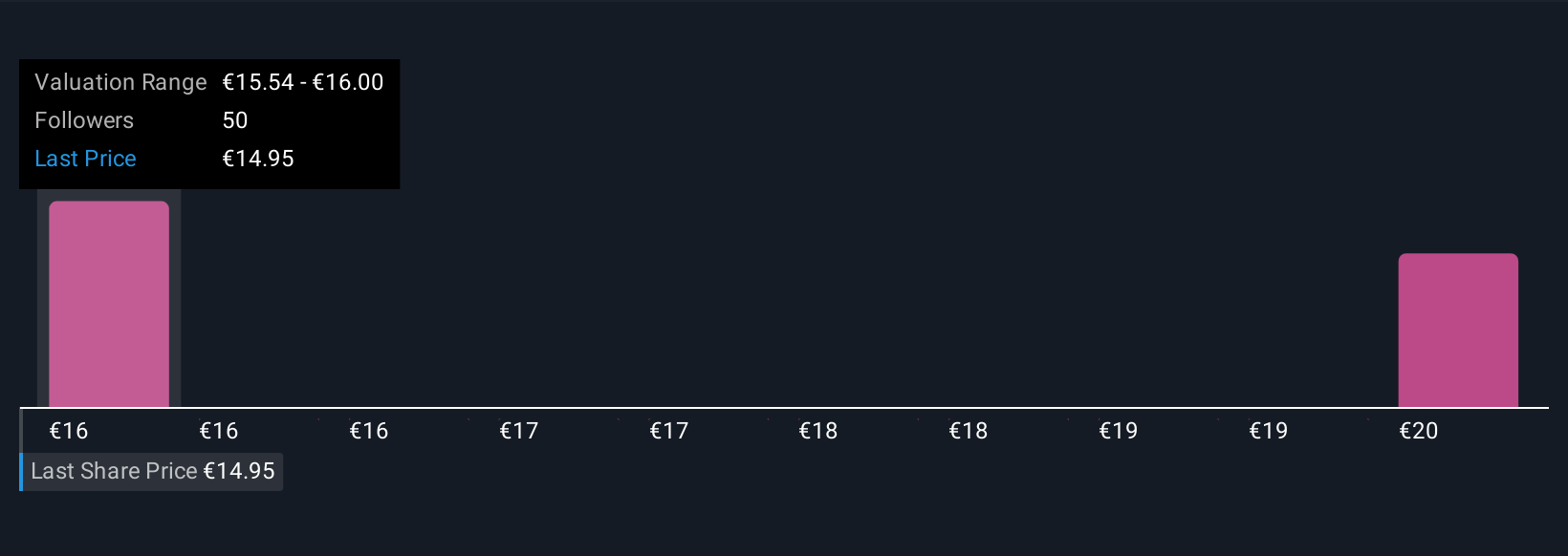

On Simply Wall St’s Community page, investors can easily build and update their own Eni Narrative using simple sliders and estimates, alongside millions of others. Narratives help you visualize exactly how your expectations for Eni turn into a Fair Value, and then compare that to the current price, making buy or sell decisions far more intuitive.

These Narratives update automatically when earnings reports, market news, or forecasts change, meaning your investment view stays current with the facts. For example, some investors expect Eni to be worth as much as €17.50 per share if LNG projects and biorefining pay off, while others see risks holding it back to just €13.50. You can explore and share your perspective, or see what others believe, in real time.

Do you think there's more to the story for Eni? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives