- Italy

- /

- Oil and Gas

- /

- BIT:ENI

Is It Too Late To Consider Eni After Five Year 158% Share Price Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Eni is still good value after such a strong run, or if you have missed the boat, this breakdown will help you decide whether the current price still stacks up against its fundamentals.

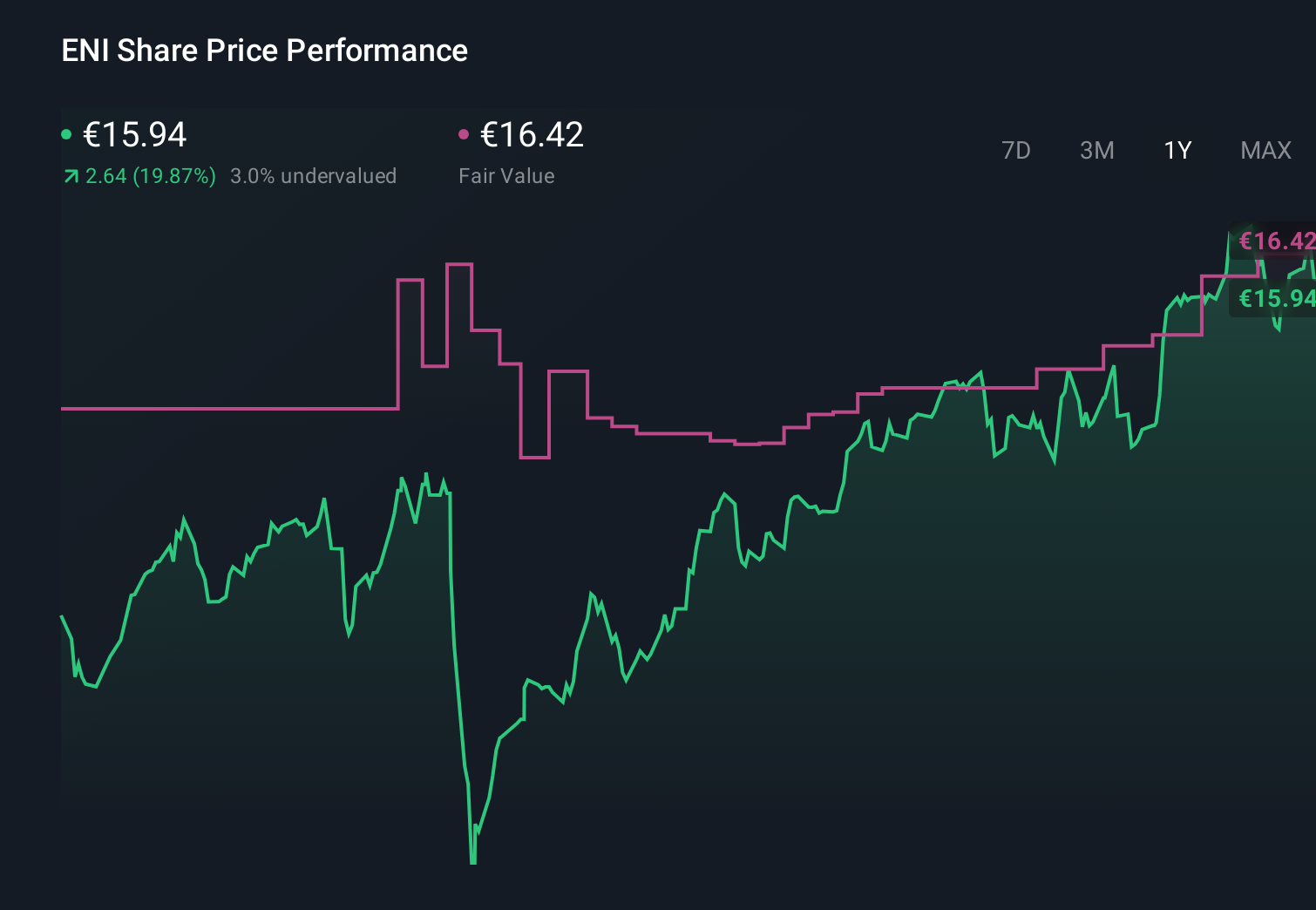

- Despite a soft pullback of around 1% over the last week and 3% over the last month, the stock is still up about 18.4% year to date and roughly 28.6% over the last year, with a hefty 158.3% gain over five years that has clearly rewarded patient holders.

- Recent moves have been shaped by Eni doubling down on its energy transition strategy, including continued investment in low carbon and renewables, while also reshaping its portfolio with selective asset sales and partnerships to unlock value. At the same time, shifting sentiment around oil prices and European energy security has kept the stock on investors' radar as a potential blend of yield, cyclicality, and transition exposure.

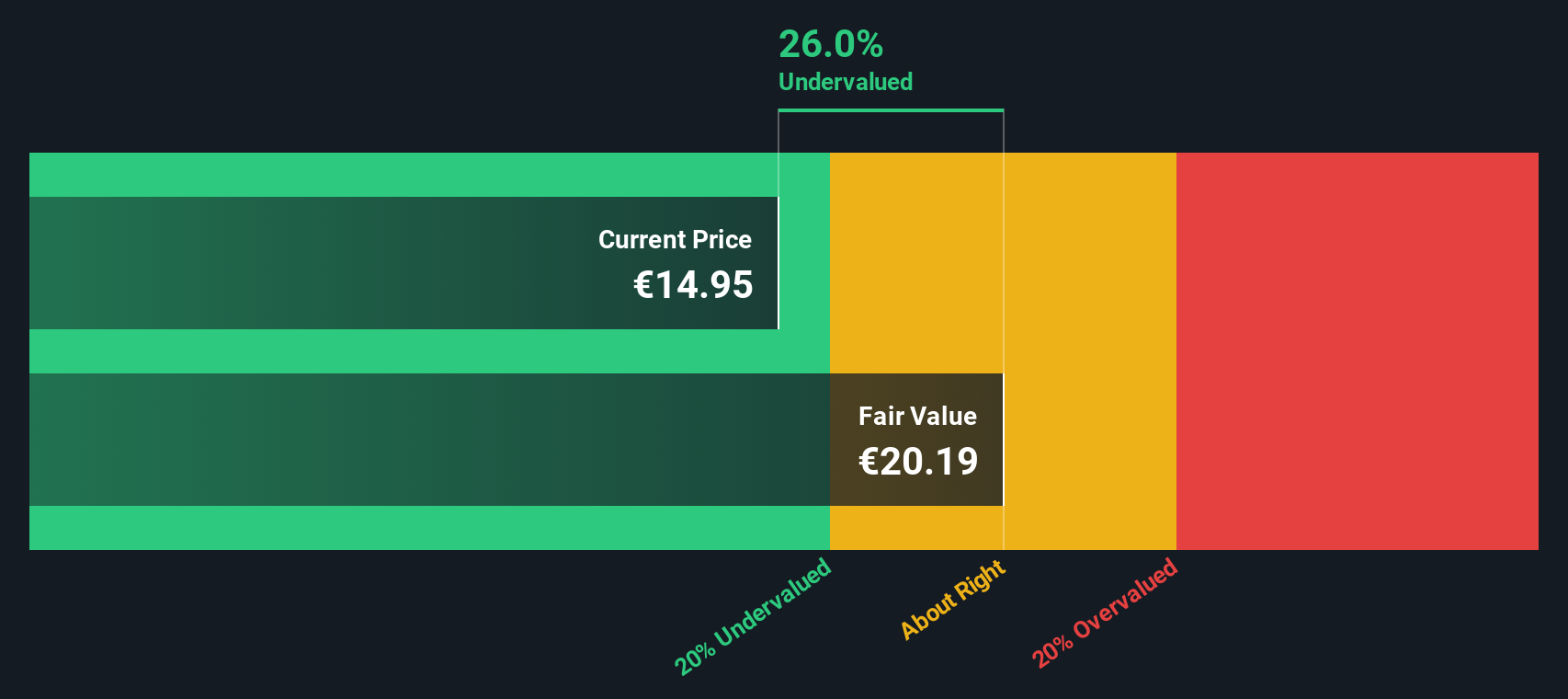

- Right now Eni scores a 3/6 valuation score, suggesting it looks undervalued on some checks but not all. Next we will dig into the different valuation lenses behind that score and, by the end, look at an even better way to think about what the market is really pricing in.

Approach 1: Eni Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in €, to reflect risk and the time value of money.

For Eni, the model used is a 2 Stage Free Cash Flow to Equity approach. The company generated roughly €4.4 billion in free cash flow over the last twelve months, and analysts see this staying robust, with projections around €5.2 billion by 2028. Beyond the analyst horizon, Simply Wall St extrapolates further, with free cash flow in the early 2030s still hovering a little above €5 billion, which would be consistent with steady rather than explosive growth as the business matures.

When all of these projected cash flows are discounted back, the DCF model suggests an intrinsic value of about €21.98 per share. Compared to the current market price, this implies Eni is trading at roughly a 27.5% discount, which on this basis indicates that the stock may be materially undervalued on cash flow grounds.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eni is undervalued by 27.5%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Eni Price vs Earnings

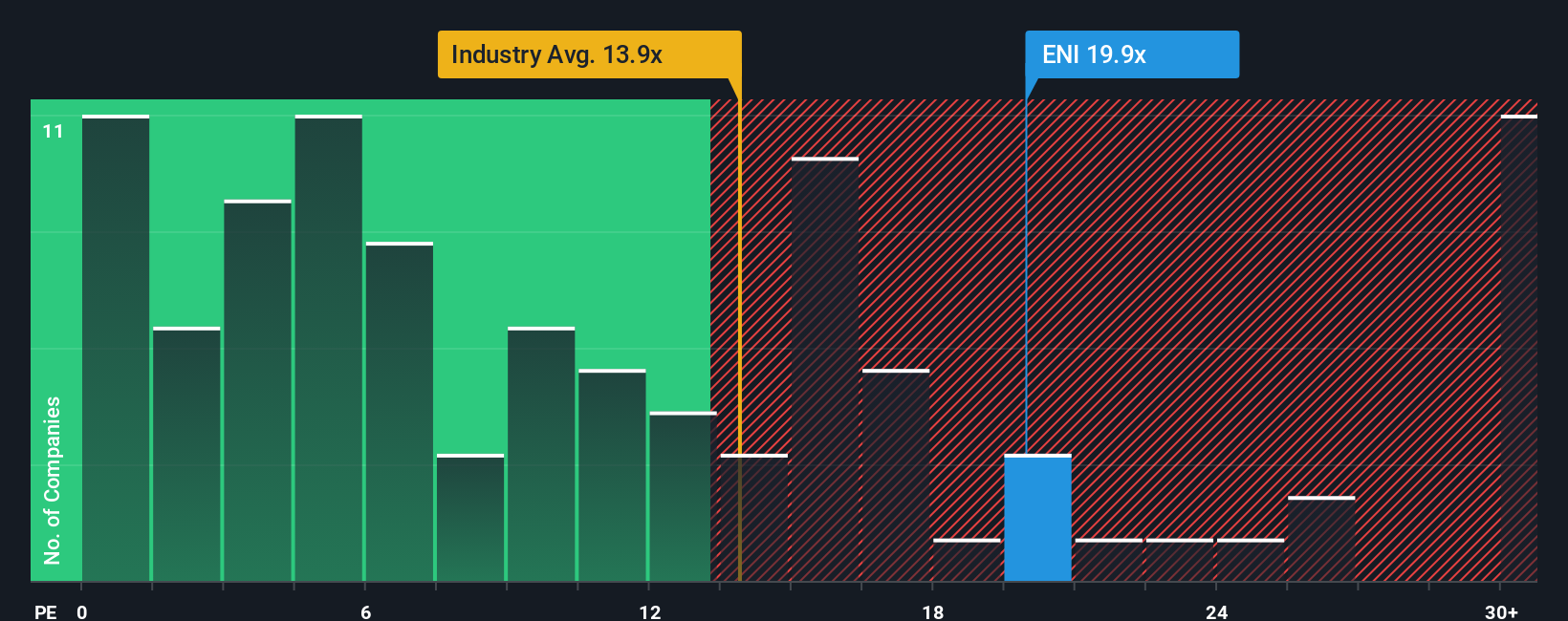

For a profitable company like Eni, the Price to Earnings ratio is a practical way to gauge how much investors are willing to pay today for each euro of current earnings. In general, faster growing and lower risk businesses can justify a higher PE, while slower growth, cyclical or riskier names tend to trade on lower multiples.

Eni currently trades on a PE of about 18.5x, compared with roughly 13.3x for the wider Oil and Gas industry and around 13.0x for its peer group, which on a simple comparison makes the stock look a bit expensive. However, Simply Wall St also calculates a Fair Ratio, a proprietary PE level of about 20.7x that reflects Eni’s specific earnings growth outlook, profitability, risk profile, industry, and market cap. This Fair Ratio is more informative than a blunt peer or industry comparison because it adjusts for the company’s own strengths and risks rather than assuming all oil and gas stocks deserve the same multiple.

Since Eni’s actual PE of 18.5x sits below its 20.7x Fair Ratio, the shares look modestly undervalued on this earnings based lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eni Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you turn your view of a company into a story backed by numbers. It links what you believe about Eni’s strategy and risks to a concrete forecast for its future revenue, earnings and margins, and then to a Fair Value you can compare with today’s share price to inform whether to buy, hold or sell. The platform keeps your Narrative updated automatically as new news or earnings arrive. Different investors can express very different yet valid takes on the same stock. For example, a more optimistic Narrative might lean into Eni’s LNG expansion, biorefining growth and improving margins to arrive at a Fair Value well above the current price. In contrast, a more cautious Narrative might focus on revenue headwinds, geopolitical risk and long dated renewables returns to produce a much lower Fair Value, closer to the most bearish analyst target of about €13.5. The gap between each Narrative’s Fair Value and the market price clearly shows whether that particular story sees Eni as undervalued or fully priced.

Do you think there's more to the story for Eni? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)