The board of Eni S.p.A. (BIT:ENI) has announced that it will pay a dividend on the 26th of November, with investors receiving €0.26 per share. The payment will take the dividend yield to 6.8%, which is in line with the average for the industry.

Eni's Projected Earnings Seem Likely To Cover Future Distributions

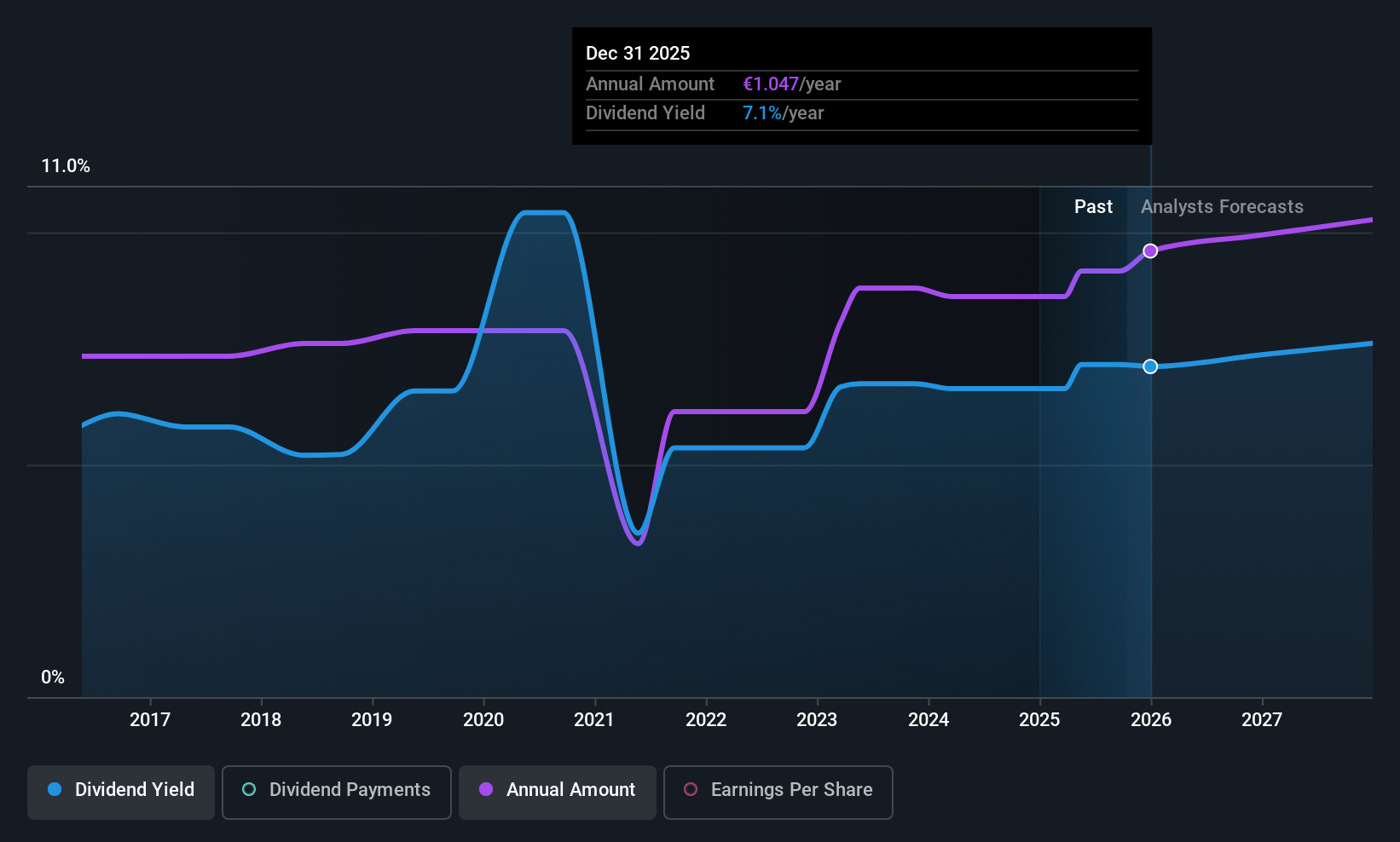

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, the company's dividend was higher than its profits, and made up 75% of cash flows. The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between.

Looking forward, earnings per share is forecast to rise by 149.3% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 55%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Check out our latest analysis for Eni

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2015, the dividend has gone from €1.12 total annually to €1.00. Doing the maths, this is a decline of about 1.1% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Eni's Dividend Might Lack Growth

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Eni has impressed us by growing EPS at 30% per year over the past five years. While EPS is growing rapidly, Eni paid out a very high 139% of its income as dividends. If earnings continue to grow, this dividend may be sustainable, but we think a payout this high definitely bears watching.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. Strong earnings growth means Eni has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 2 warning signs for Eni that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)