- Italy

- /

- Oil and Gas

- /

- BIT:ENI

Eni (BIT:ENI): Evaluating Current Valuation After Subtle Shifts in Market Sentiment

Reviewed by Simply Wall St

Most Popular Narrative: 4.2% Undervalued

According to the most widely followed valuation narrative, Eni shares are currently trading below fair value, with analysts projecting a modest upside based on future earnings growth and sector catalysts.

"Eni's strategic expansion in LNG, highlighted by leading floating LNG investments in Africa, the Eastern Mediterranean, and new ventures in Argentina and Southeast Asia, positions the company to capture rising global demand for diverse and secure natural gas supplies. This geographic and product diversification is expected to drive future revenue and stabilize earnings amid energy transition volatility."

Ready for a deep dive into what could power Eni's next big move? The secret behind this undervaluation lies in bold growth bets, shifting margins, and analyst forecasts that could surprise even seasoned investors. Are you wondering what key assumptions are fueling this fair value? Unlock the detailed narrative to see why Eni’s future might not be what the market expects.

Result: Fair Value of €15.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent losses in legacy businesses and delayed renewable cash flows could quickly shift investor sentiment. This makes current optimism vulnerable to emerging downside risks.

Find out about the key risks to this Eni narrative.Another View: Market Multiples

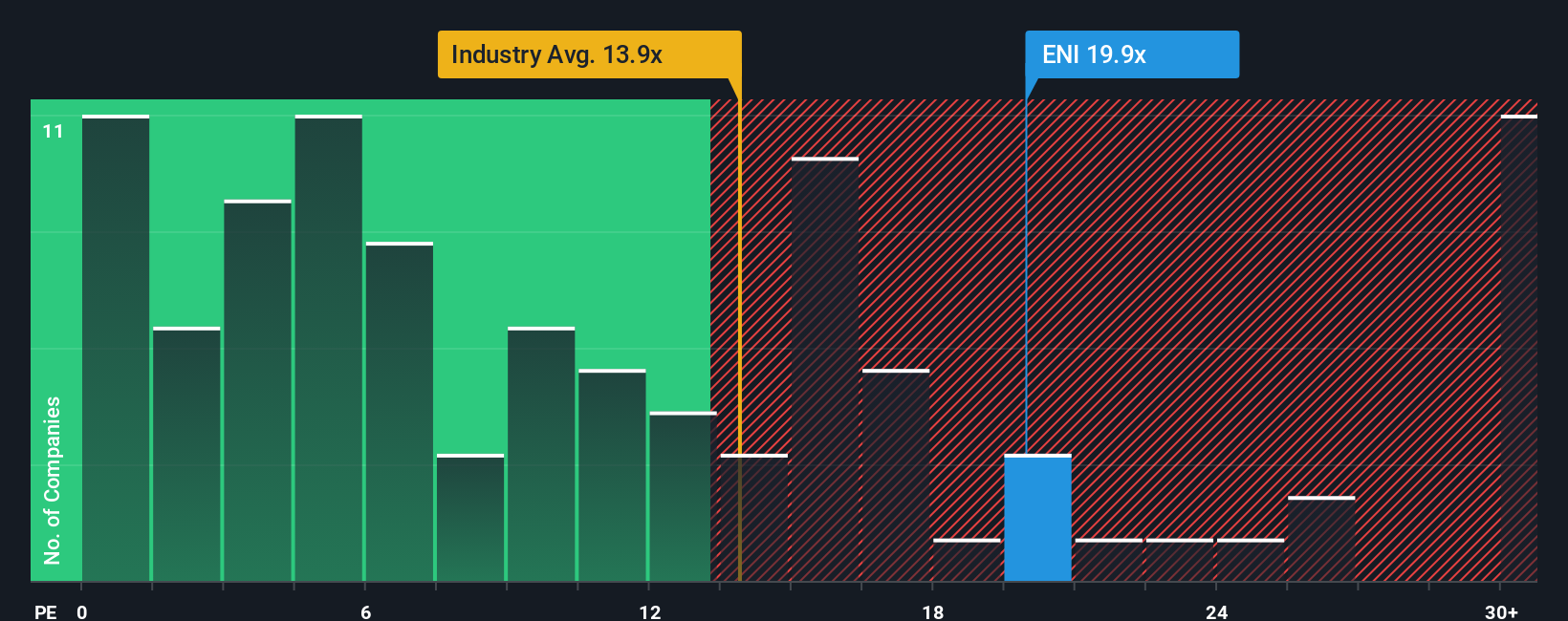

While analyst forecasts suggest Eni may be undervalued, evaluating current market pricing against other energy companies presents a different perspective. Eni actually appears expensive by this measure. This raises the question of whether sentiment is outpacing reality, or if the market is pricing in new opportunities.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eni Narrative

If you have your own take or want to dig into the numbers on your terms, the tools are here to help you shape your unique story in a matter of minutes. So why not Do it your way?

A great starting point for your Eni research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Expand your portfolio with fresh investment themes and uncover promising stocks that could be your next big win. These tailored lists can help you focus your search where it matters most.

- Earn steady returns as you sift through market leaders offering dividend stocks with yields > 3% with robust income potential.

- Ride the surge in tech innovation by targeting breakthrough companies at the forefront of AI penny stocks.

- Supercharge your watchlist with shares that show the greatest value upside on our exclusive list of undervalued stocks based on cash flows stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)