- Italy

- /

- Oil and Gas

- /

- BIT:ENI

A Look at Eni (BIT:ENI) Valuation Following Major Low-Carbon Hub Plans in Sicily

Reviewed by Kshitija Bhandaru

Eni (BIT:ENI) is moving ahead with plans to transform its Priolo site in Sicily, launching the official environmental approval process for what could become a major low-carbon hub. The project includes both a cutting-edge biorefinery and Italy’s first industrial-scale chemical recycling plant for plastics.

See our latest analysis for Eni.

Eni has stayed in the spotlight thanks to major moves such as resuming exploration offshore Libya, new investments in Mozambique, a high-profile appearance at Italian Tech Week, and ongoing share buybacks. The company’s latest environmental push in Sicily comes as shares deliver a robust 11% year-to-date price return. The 1-year total shareholder return of 12% hints at steady momentum. Over the past five years, long-term holders have seen a remarkable 213% total return, signaling that confidence in Eni’s strategy is building.

If you’re looking beyond oil majors reinventing themselves, now is a perfect moment to discover fast growing stocks with high insider ownership.

With Eni’s shares trading at a discount to both analyst targets and intrinsic value, the key question is whether the market is underestimating future upside or if all this progress is already reflected in the price.

Most Popular Narrative: 3.8% Undervalued

Eni last closed at €14.95, just below the narrative's fair value of €15.54. This difference signals a market that is closely tuned in to future prospects and sets the stage for a deeper look at what drives this current pricing.

Eni's strategic expansion in LNG, highlighted by leading floating LNG investments in Africa, the Eastern Mediterranean, and new ventures in Argentina and Southeast Asia, positions the company to capture rising global demand for diverse and secure natural gas supplies. This geographic and product diversification is expected to drive future revenue and stabilize earnings amid energy transition volatility.

Curious what underpins this tight fair value gap? The narrative focuses on rising profits, evolving gas portfolios, and bolder margin expectations. Want the full inside story? See the powerful projections shaping this consensus view.

Result: Fair Value of €15.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Eni still faces pressure from legacy business losses and delayed returns from renewables, which could affect its ambitious outlook.

Find out about the key risks to this Eni narrative.

Another View: Multiples Paint a Pricier Picture

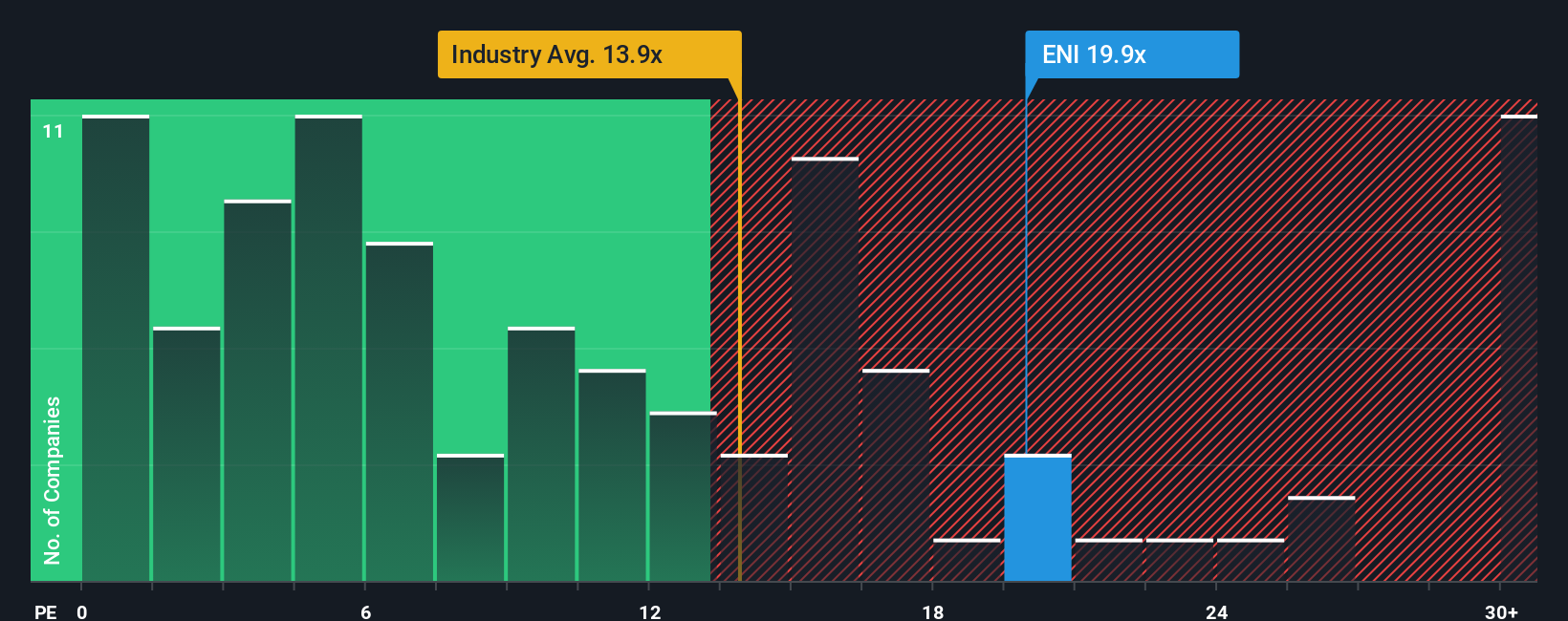

While the fair value analysis flags Eni as undervalued, a look at the price-to-earnings ratio tells a different story. Eni trades at 19.9 times earnings, which is meaningfully higher than the industry average of 13.9 and peer average of 14.1. It is also above its fair ratio of 18.1. This raises questions about how much optimism the market is already pricing in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eni Narrative

If these perspectives don’t fit your own outlook, why not take a hands-on approach and see what your analysis reveals? Your narrative can be built in just a few minutes. Do it your way.

A great starting point for your Eni research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Jump on unique opportunities by using the Simply Wall Street Screener. These handpicked ideas have powered strong portfolios. Don’t let a great find pass you by.

- Unlock big yields for your income portfolio by checking out these 19 dividend stocks with yields > 3%, which delivers over 3% returns from companies with reliable track records.

- Spot tomorrow’s market leaders early by browsing these 24 AI penny stocks, a collection of high-potential businesses leveraging artificial intelligence breakthroughs.

- Find remarkable bargains others might overlook with these 891 undervalued stocks based on cash flows, featuring stocks offering strong value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives