- Italy

- /

- Oil and Gas

- /

- BIT:DIS

Brokers Are Upgrading Their Views On d'Amico International Shipping S.A. (BIT:DIS) With These New Forecasts

Celebrations may be in order for d'Amico International Shipping S.A. (BIT:DIS) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The market seems to be pricing in some improvement in the business too, with the stock up 8.5% over the past week, closing at €5.74. Whether the upgrade is enough to drive the stock price higher is yet to be seen, however.

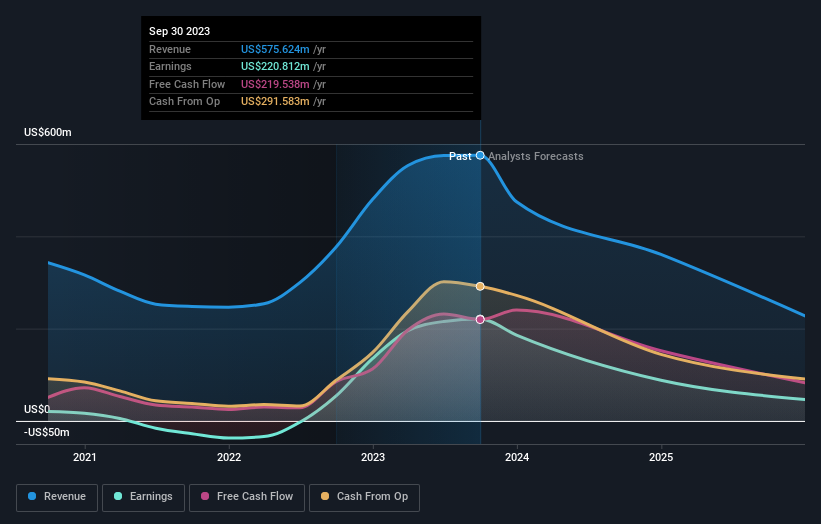

Following the latest upgrade, the three analysts covering d'Amico International Shipping provided consensus estimates of US$361m revenue in 2024, which would reflect a concerning 37% decline on its sales over the past 12 months. Statutory earnings per share are supposed to crater 61% to US$0.71 in the same period. Previously, the analysts had been modelling revenues of US$315m and earnings per share (EPS) of US$0.59 in 2024. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

See our latest analysis for d'Amico International Shipping

With these upgrades, we're not surprised to see that the analysts have lifted their price target 5.9% to US$6.96 per share. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on d'Amico International Shipping, with the most bullish analyst valuing it at US$7.29 and the most bearish at US$6.75 per share. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 31% by the end of 2024. This indicates a significant reduction from annual growth of 5.9% over the last five years. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 3.5% per year. The forecasts do look bearish for d'Amico International Shipping, since they're expecting it to shrink faster than the industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for next year, expecting improving business conditions. Notably, analysts also upgraded their revenue estimates, with sales performing well although d'Amico International Shipping's revenue growth is expected to trail that of the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, d'Amico International Shipping could be worth investigating further.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for d'Amico International Shipping going out to 2025, and you can see them free on our platform here..

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:DIS

d'Amico International Shipping

Through its subsidiaries, operates as a marine transportation company worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)