3 European Growth Companies With High Insider Ownership Growing Earnings At 71%

Reviewed by Simply Wall St

Amidst ongoing concerns about U.S. trade tariffs and economic growth, European markets have faced challenges, with the pan-European STOXX Europe 600 Index recently ending lower due to these uncertainties. In this climate, identifying companies with strong insider ownership can be crucial as it often indicates confidence in the business's potential to weather market fluctuations and sustain growth.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| CD Projekt (WSE:CDR) | 29.7% | 41.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Devyser Diagnostics (OM:DVYSR) | 35.6% | 94.7% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Here we highlight a subset of our preferred stocks from the screener.

Tamburi Investment Partners (BIT:TIP)

Simply Wall St Growth Rating: ★★★★★☆

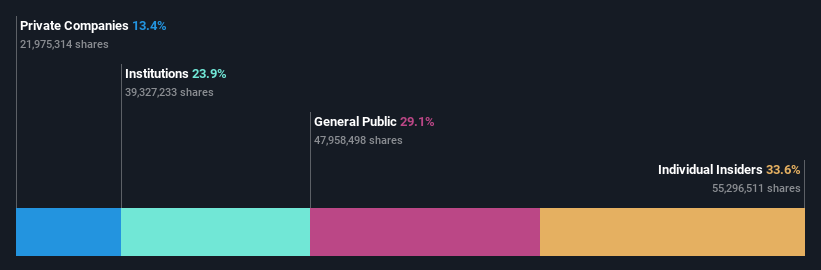

Overview: Tamburi Investment Partners S.p.A. is a private equity firm that specializes in direct and secondary direct investments, with a market cap of €1.32 billion.

Operations: Tamburi Investment Partners S.p.A. generates its revenue primarily through private equity activities, focusing on direct and secondary direct investments.

Insider Ownership: 33.2%

Earnings Growth Forecast: 30% p.a.

Tamburi Investment Partners is poised for significant growth, with revenue forecast to increase by 38.6% annually, outpacing the Italian market's 4.6%. Earnings are expected to grow at 30% per year, surpassing the broader market's 7.7%. Despite recent declines in sales and net income—€1.09 million and €38.23 million respectively—the company remains a strong contender due to its high growth potential and alignment with analyst expectations of a stock price rise by 57.3%.

- Unlock comprehensive insights into our analysis of Tamburi Investment Partners stock in this growth report.

- Our valuation report here indicates Tamburi Investment Partners may be overvalued.

Ponsse Oyj (HLSE:PON1V)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ponsse Oyj is a manufacturer of cut-to-length forest machines with operations in Northern, Central, and Southern Europe, as well as North and South America, and has a market cap of €747.55 million.

Operations: The company's revenue is primarily derived from its Forest Machines and Maintenance Services segment, amounting to €750.43 million.

Insider Ownership: 14.8%

Earnings Growth Forecast: 30.8% p.a.

Ponsse Oyj is set for substantial growth, with earnings projected to increase by 30.8% annually, outpacing the Finnish market's 11.3%. Despite a recent sales decline to €750.43 million for 2024 and lower profit margins at 1.7%, insider ownership remains high, aligning interests with shareholders. The company trades at a significant discount to its estimated fair value and anticipates slightly higher operating profits in 2025 than the previous year's €36.8 million.

- Delve into the full analysis future growth report here for a deeper understanding of Ponsse Oyj.

- Our valuation report unveils the possibility Ponsse Oyj's shares may be trading at a premium.

Rieter Holding (SWX:RIEN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rieter Holding AG, with a market cap of CHF371.58 million, supplies systems for manufacturing yarn from staple fibers in spinning mills both in Switzerland and internationally.

Operations: The company's revenue is derived from three main segments: Components (CHF303 million), After Sales (CHF186.60 million), and Machines & Systems (CHF424.90 million).

Insider Ownership: 35.1%

Earnings Growth Forecast: 71.4% p.a.

Rieter Holding is positioned for significant growth, with earnings forecasted to rise by 71.4% annually, surpassing the Swiss market's 11.2%. Despite a drop in sales to CHF 859.1 million and lower profit margins at 1.2%, the stock trades well below its estimated fair value, suggesting potential upside. Insider ownership remains strong, aligning management interests with shareholders amid an unstable dividend history and low return on equity projections of 10.5%.

- Click here to discover the nuances of Rieter Holding with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Rieter Holding's current price could be quite moderate.

Next Steps

- Access the full spectrum of 229 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Ponsse Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:PON1V

Ponsse Oyj

Operates as manufacturer of cut-to-length forest machines Nordic and Baltic countries, Central and Southern Europe, South America and North America, Asia, Australia, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives