- Italy

- /

- Diversified Financial

- /

- BIT:BFF

Analysts Have Made A Financial Statement On Banca Farmafactoring S.p.A.'s (BIT:BFF) Yearly Report

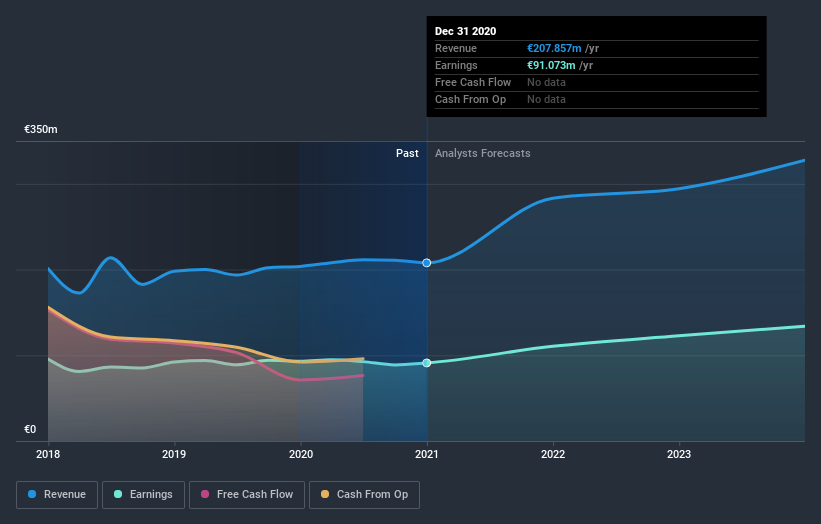

It's been a pretty great week for Banca Farmafactoring S.p.A. (BIT:BFF) shareholders, with its shares surging 16% to €5.68 in the week since its latest yearly results. The result was fairly weak overall, with revenues of €208m being 7.2% less than what the analysts had been modelling. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Banca Farmafactoring

Following the latest results, Banca Farmafactoring's three analysts are now forecasting revenues of €283.3m in 2021. This would be a sizeable 36% improvement in sales compared to the last 12 months. Per-share earnings are expected to increase 7.6% to €0.58. In the lead-up to this report, the analysts had been modelling revenues of €292.5m and earnings per share (EPS) of €0.95 in 2021. The analysts seem less optimistic after the recent results, reducing their sales forecasts and making a pretty serious reduction to earnings per share numbers.

The analysts made no major changes to their price target of €6.89, suggesting the downgrades are not expected to have a long-term impact on Banca Farmafactoring's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Banca Farmafactoring, with the most bullish analyst valuing it at €7.25 and the most bearish at €6.30 per share. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Banca Farmafactoring is an easy business to forecast or the the analysts are all using similar assumptions.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that Banca Farmafactoring's rate of growth is expected to accelerate meaningfully, with the forecast 36% revenue growth noticeably faster than its historical growth of 6.8%p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue shrink 37% per year. So it's clear with the acceleration in growth, Banca Farmafactoring is expected to grow meaningfully faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Unfortunately, they also downgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. The consensus price target held steady at €6.89, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Banca Farmafactoring going out to 2023, and you can see them free on our platform here..

You still need to take note of risks, for example - Banca Farmafactoring has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

If you’re looking to trade Banca Farmafactoring, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BFF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:BFF

BFF Bank

Engages in non-recourse factoring and credit management activities towards public administration bodies and private hospitals in Italy, Croatia, the Czech Republic, France, Greece, Poland, Portugal, Slovakia, and Spain.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives