With A 34% Price Drop For Aquafil S.p.A. (BIT:ECNL) You'll Still Get What You Pay For

To the annoyance of some shareholders, Aquafil S.p.A. (BIT:ECNL) shares are down a considerable 34% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

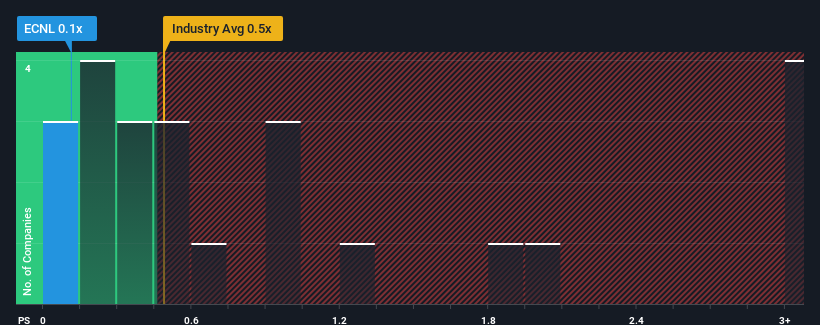

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Aquafil's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Luxury industry in Italy is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Aquafil

What Does Aquafil's P/S Mean For Shareholders?

Aquafil could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Aquafil will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Aquafil?

The only time you'd be comfortable seeing a P/S like Aquafil's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.5%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 8.1% per year over the next three years. With the industry predicted to deliver 7.4% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Aquafil's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Aquafil's P/S

With its share price dropping off a cliff, the P/S for Aquafil looks to be in line with the rest of the Luxury industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Aquafil's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Aquafil (2 make us uncomfortable!) that you should be aware of before investing here.

If you're unsure about the strength of Aquafil's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ECNL

Aquafil

Engages in the production, reprocessing, and sale of polyamide 6 fibers and polymers in Europe, the Middle East, Africa, Asia, Oceania, and the United States.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026