Tesmec S.p.A. (BIT:TES) Stock Rockets 25% But Many Are Still Ignoring The Company

Tesmec S.p.A. (BIT:TES) shares have continued their recent momentum with a 25% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

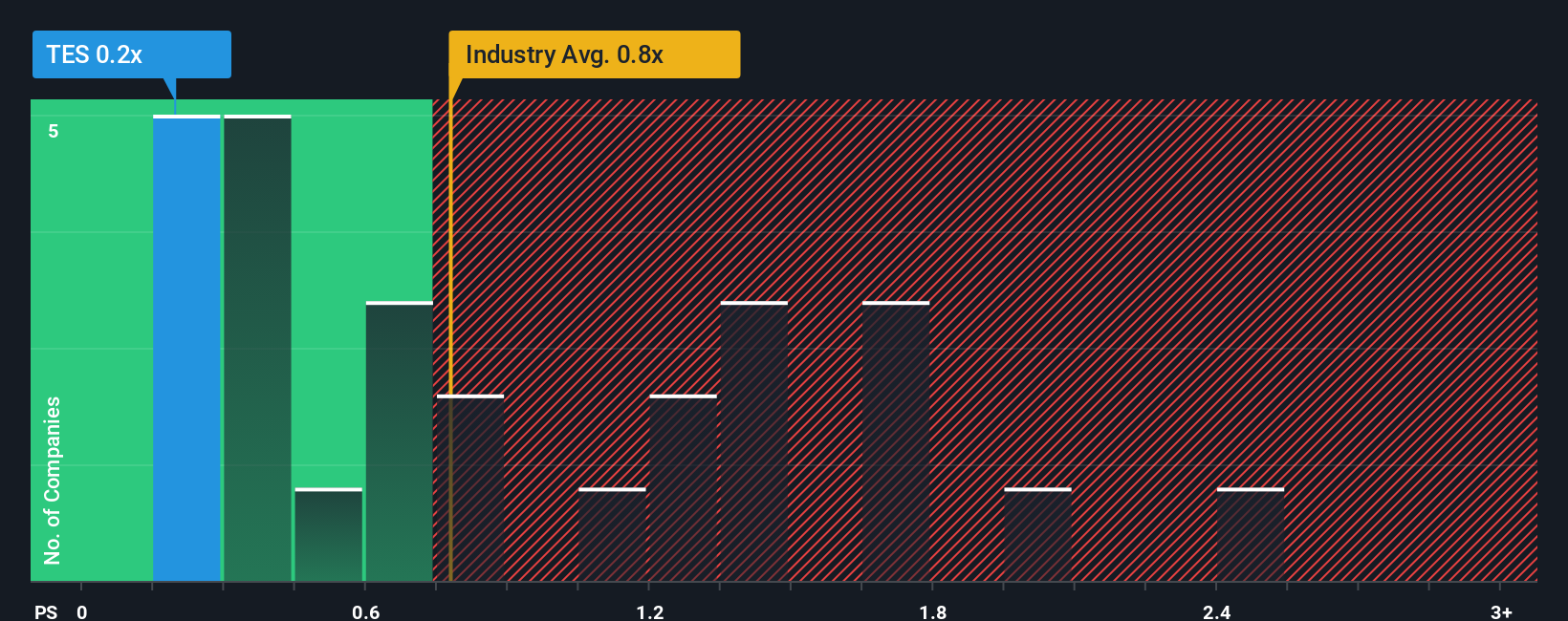

Although its price has surged higher, considering around half the companies operating in Italy's Machinery industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Tesmec as an solid investment opportunity with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tesmec

How Tesmec Has Been Performing

With revenue growth that's superior to most other companies of late, Tesmec has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Tesmec will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Tesmec?

Tesmec's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.6%. Revenue has also lifted 19% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 5.9% over the next year. With the industry predicted to deliver 4.5% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Tesmec's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Tesmec's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Tesmec's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Tesmec's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Tesmec (1 shouldn't be ignored!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tesmec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:TES

Tesmec

Designs, manufactures, and sells products, technologies, and integrated solutions for the construction, maintenance, and efficiency of infrastructures related to the transport and distribution of energy, data, and material.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives