Reflecting on Somec's (BIT:SOM) Share Price Returns Over The Last Year

Somec S.p.A. (BIT:SOM) shareholders will doubtless be very grateful to see the share price up 53% in the last quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 28% in one year, under-performing the market.

See our latest analysis for Somec

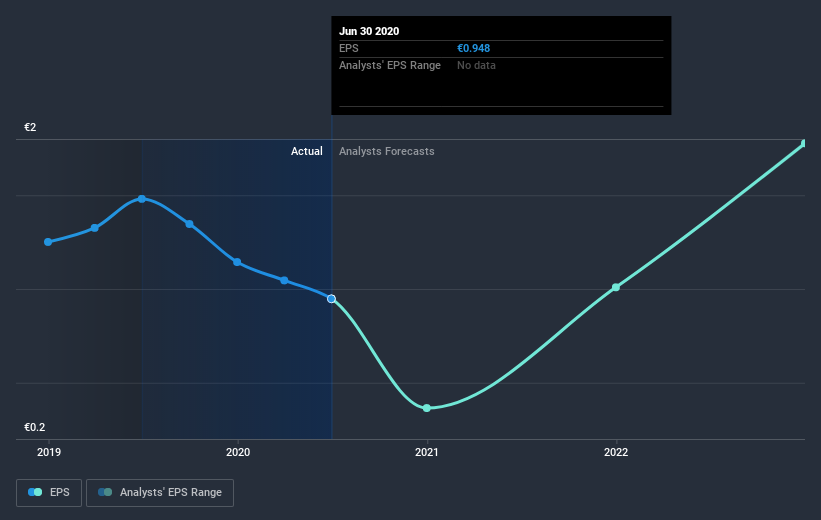

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unhappily, Somec had to report a 36% decline in EPS over the last year. This fall in the EPS is significantly worse than the 28% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Somec has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Somec's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Somec the TSR over the last year was -25%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We doubt Somec shareholders are happy with the loss of 25% over twelve months (even including dividends). That falls short of the market, which lost 8.1%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 53% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Somec better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Somec (including 1 which can't be ignored) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you decide to trade Somec, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:SOM

Somec

Somec S.p.A. engineers, designs, and deploys turnkey projects in the civil and naval engineering in Italy, rest of Europe, North America, and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.