As global markets continue to navigate mixed performances, with major U.S. indexes reaching record highs and European markets buoyed by easing political tensions, investors are exploring diverse opportunities. Penny stocks, often associated with smaller or newer companies, remain an intriguing area for those seeking potential growth beyond the well-known market giants. Despite the term's outdated connotations, these stocks can offer a blend of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £806.27M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$44.27B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$67.4M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.65 | £183.61M | ★★★★★★ |

Click here to see the full list of 5,697 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Farmacosmo (BIT:COSMO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Farmacosmo S.p.A. operates as an online pharmacy and beauty store company in Italy with a market cap of €25.23 million.

Operations: Farmacosmo S.p.A. does not have reported revenue segments.

Market Cap: €25.23M

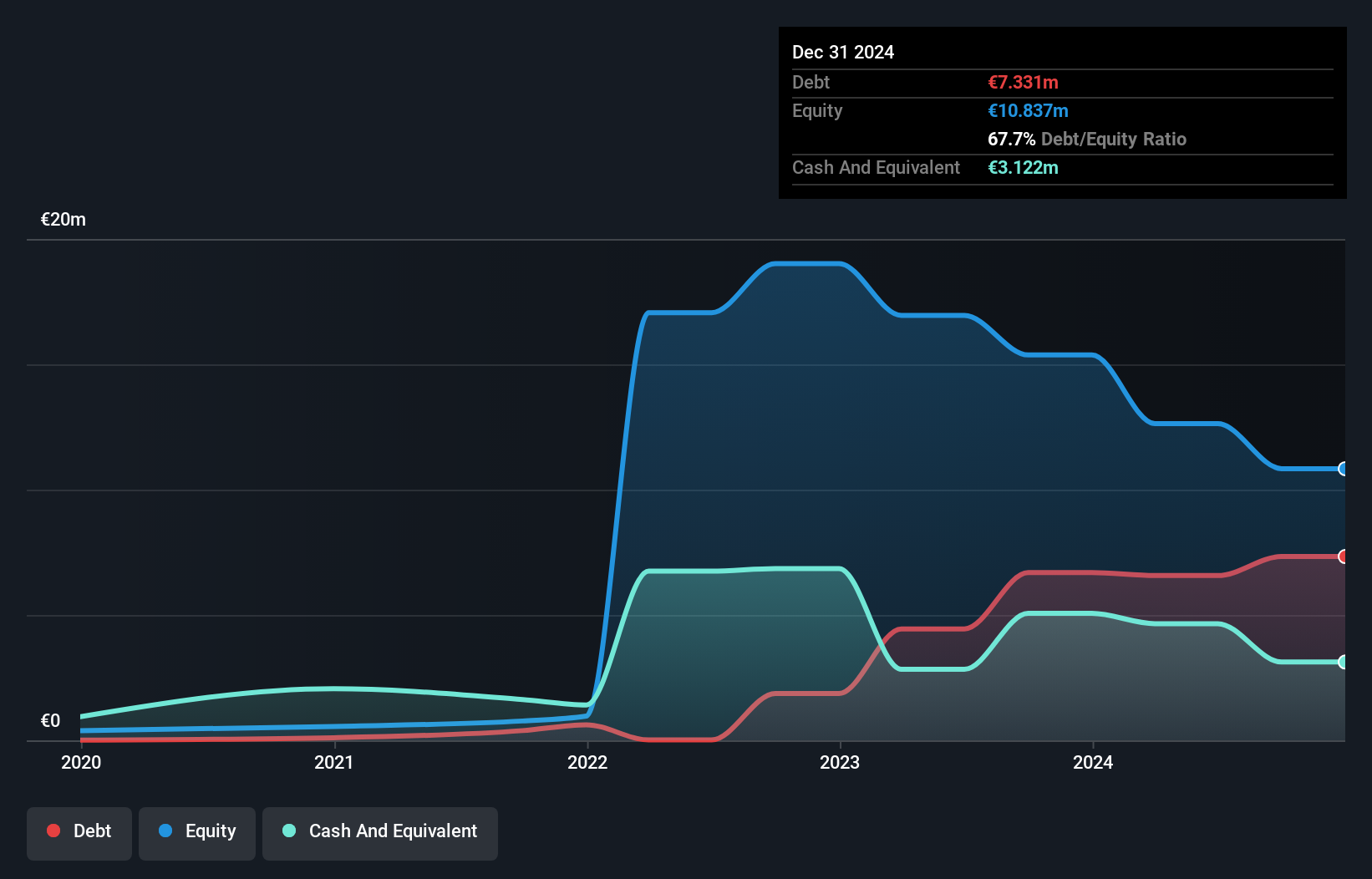

Farmacosmo S.p.A., with a market cap of €25.23 million, is navigating the challenges typical of smaller stocks. Despite being unprofitable and experiencing increased losses over five years, it maintains a satisfactory net debt to equity ratio of 15.2% and has sufficient cash runway for over three years. Recent earnings reported sales of €32.89 million for the half year ended June 30, 2024, down from €37.21 million the previous year, with a net loss widening to €1.08 million from €0.37 million previously. The stock trades significantly below its estimated fair value despite high volatility levels.

- Navigate through the intricacies of Farmacosmo with our comprehensive balance sheet health report here.

- Examine Farmacosmo's earnings growth report to understand how analysts expect it to perform.

Sciuker Frames (BIT:SCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sciuker Frames S.p.A. designs and manufactures wood-aluminum and wood-structural glass windows in Italy, with a market cap of €45.50 million.

Operations: The company generates revenue from its Building Products segment, totaling €119.11 million.

Market Cap: €45.5M

Sciuker Frames S.p.A., with a market cap of €45.50 million, presents a mixed picture for investors interested in smaller stocks. The company has strong financial health, with short-term assets exceeding liabilities and debt well-covered by cash flow. Its price-to-earnings ratio is notably lower than the Italian market average, suggesting potential undervaluation. However, recent earnings show significant volatility; net income dropped sharply to €0.08188 million from €9.11 million year-over-year despite revenue growth to €70.32 million from €64.96 million. High return on equity and reduced debt levels are positive signs amidst unstable dividends and high share price volatility.

- Get an in-depth perspective on Sciuker Frames' performance by reading our balance sheet health report here.

- Gain insights into Sciuker Frames' historical outcomes by reviewing our past performance report.

Tarya Israel (TASE:TRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tarya Israel Ltd operates a peer-to-peer (P2P) alternative investment platform in Israel with a market cap of ₪133.29 million.

Operations: TASE:TRA generates revenue through its Credit Brokerage segment, which accounts for ₪25.49 million, and its Credit Provision segment, contributing ₪1.25 million.

Market Cap: ₪133.29M

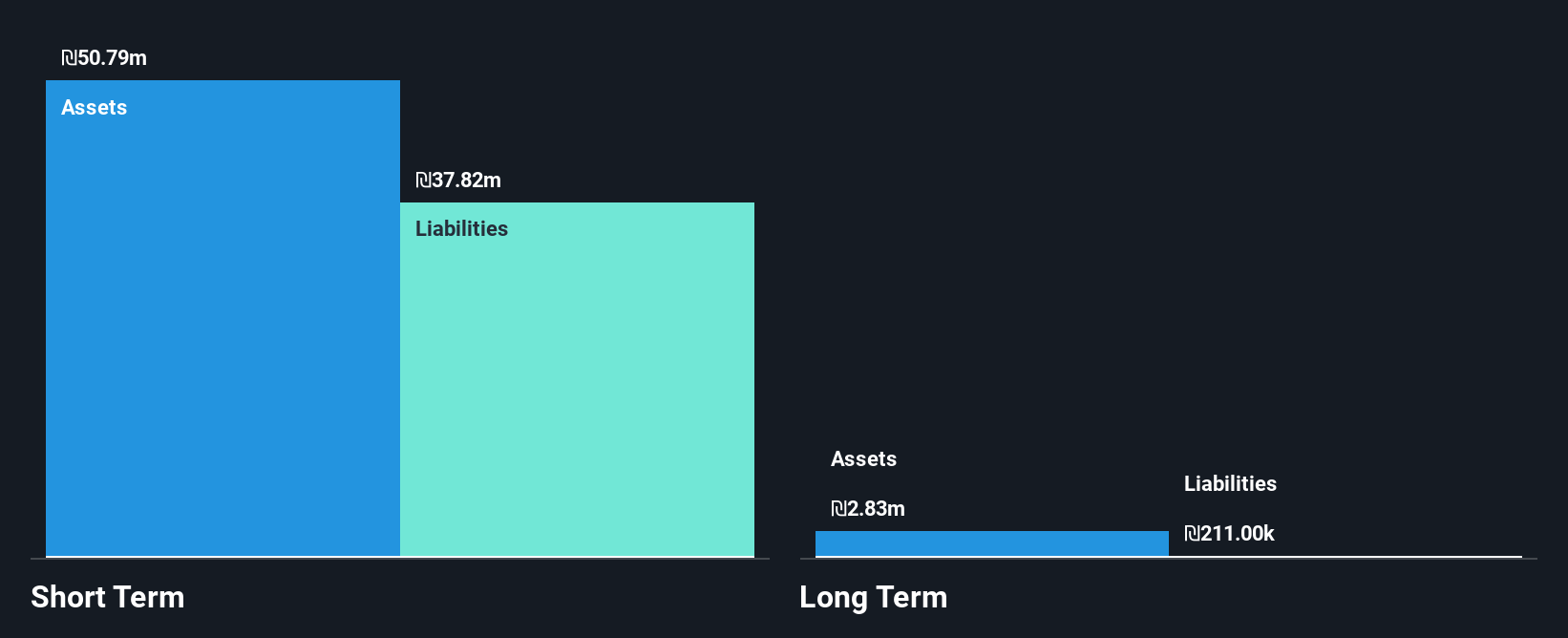

Tarya Israel Ltd, with a market cap of ₪133.29 million, operates in the P2P alternative investment space and has shown recent financial improvements despite ongoing challenges. The company reported a net income of ₪1.63 million for Q3 2024, reversing from a net loss of ₪13.61 million the previous year, indicating potential operational progress. However, Tarya remains unprofitable overall with negative return on equity and declining earnings over five years at 9.5% annually. While its short-term assets comfortably cover liabilities and cash exceeds debt levels, high share price volatility persists alongside an inexperienced board tenure averaging 2.5 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Tarya Israel.

- Explore historical data to track Tarya Israel's performance over time in our past results report.

Next Steps

- Reveal the 5,697 hidden gems among our Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SCK

Sciuker Frames

Designs and manufactures wood-aluminum and wood-structural glass windows in Italy.

Moderate and slightly overvalued.

Market Insights

Community Narratives