- Italy

- /

- Construction

- /

- BIT:RWY

Reway Group (BIT:RWY) Profit Margin Decline Reinforces Market Debate on Valuation Premium

Reviewed by Simply Wall St

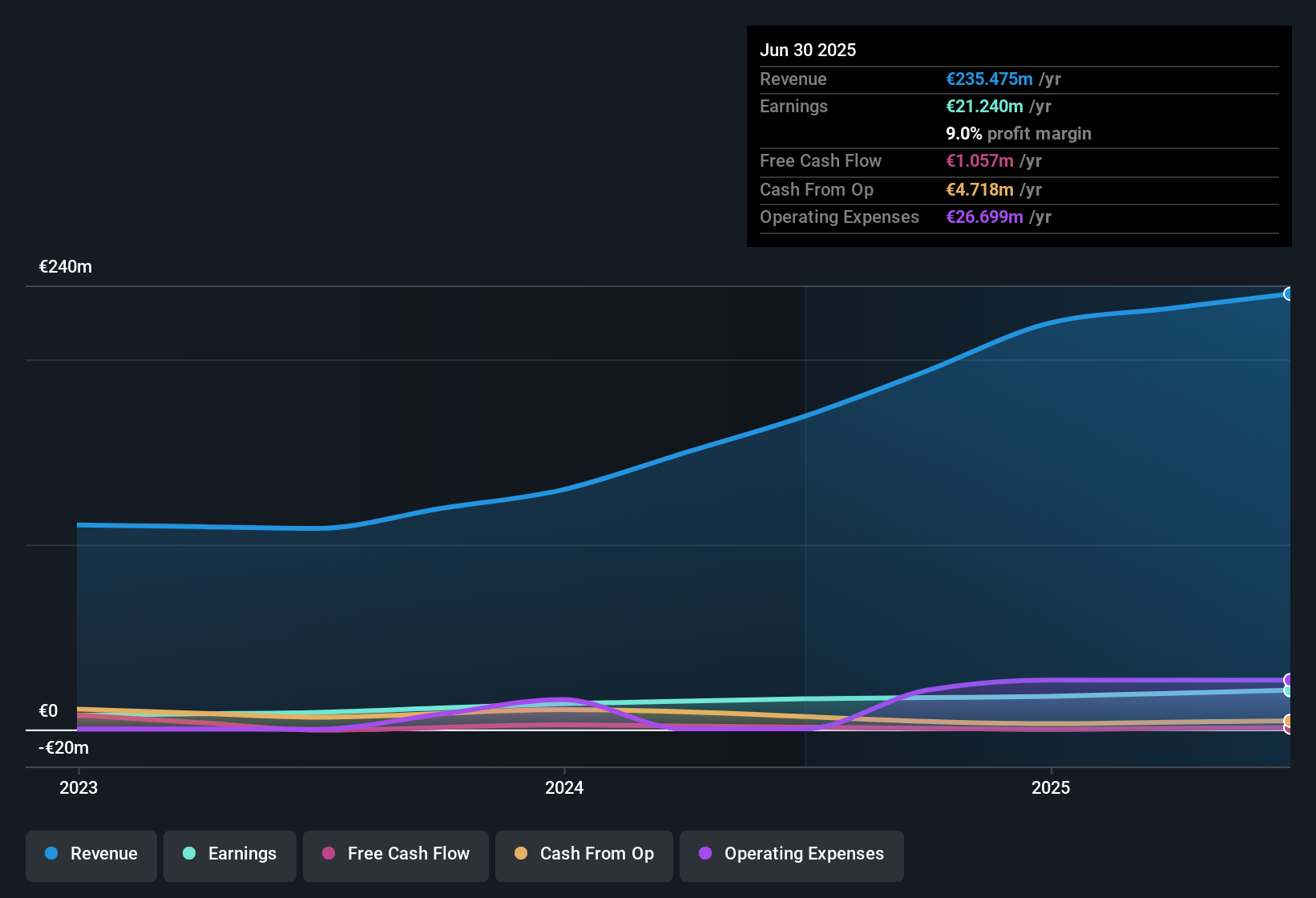

Reway Group (BIT:RWY) is forecasting revenue growth of 9.3% per year, well ahead of the Italian market average of 4.9%. EPS is expected to grow at 17.5% annually, outpacing the market’s 9.4% rate but not crossing the bar for “significantly” high growth. The company’s net profit margin stands at 9%, down from 9.8% in the previous year, highlighting steady growth but a slight squeeze on profitability.

See our full analysis for Reway Group.The next section measures these earnings numbers against the broader market narratives, highlighting where the consensus holds strong and where new questions are raised.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slips, But Quality of Earnings Remains

- Net profit margin narrowed to 9% from 9.8% last year, showing a slight contraction in the company’s take-home share of revenue even as growth continues.

- Sustained profit margins reinforce the view that Reway Group is delivering “high quality earnings” with consistent results, according to the prevailing market analysis.

- Despite the dip from 9.8%, stable margins above sector averages highlight the company’s resilience and ability to defend profitability.

- Market sentiment leans constructive, as the most recent results support Reway’s reputation as a reliable performer in its sector.

Balance Sheet Raises Red Flags

- The principal risk flagged in filings is that Reway Group is not in a strong financial position, standing in contrast to its record of consistent profit and revenue gains.

- Concerns about the company’s finances keep some investors cautious, especially given the rapid growth rates elsewhere in the financial statements.

- The prevailing market view notes a tension between the robust growth outlook and the flagged weakness in financial health.

- Investors are likely to keep a close eye on upcoming balance sheet disclosures to see if this risk persists even as operating metrics impress.

Valuation Well Above Peers and DCF Fair Value

- Reway Group trades at a 17.5x price-to-earnings ratio, a premium to both the peer group (16.2x) and the wider European Construction industry (14.8x). The current share price of €9.60 is also well above its DCF fair value estimate of €3.95.

- This premium valuation is the clearest point of divergence versus fundamentals, according to the prevailing market analysis.

- Punters who expect the company to keep outgrowing the sector may see the higher multiple as justified, but those focused on intrinsic value will note the wide gap to estimated fair value.

- Broader sector dynamics help explain some of the premium. However, the share price distance from DCF fair value sets a high bar for future performance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Reway Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Reway Group’s premium share price and elevated valuation multiples stand in stark contrast to its flagged financial position and weaker balance sheet strength.

If you want more confidence in the fundamentals, use our solid balance sheet and fundamentals stocks screener to uncover companies with healthier financials and lower risk exposure right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RWY

Reway Group

Through its subsidiaries, engages in the infrastructure preservation and restoration activities in Italy.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives