- Italy

- /

- Construction

- /

- BIT:RWY

European Stocks Possibly Trading Below Intrinsic Value Estimates In December 2025

Reviewed by Simply Wall St

As of late November 2025, European markets have seen a notable upswing, with the pan-European STOXX Europe 600 Index rising by 2.35% and major single-country indexes also posting gains. This positive momentum comes amid subdued inflation levels across the eurozone, suggesting stability around the European Central Bank's target and providing a conducive environment for identifying stocks that may be trading below their intrinsic value estimates. In such conditions, investors often seek out companies with strong fundamentals and potential for growth that might be overlooked in broader market trends.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN131.40 | PLN257.25 | 48.9% |

| Truecaller (OM:TRUE B) | SEK23.04 | SEK46.05 | 50% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.49 | €4.88 | 48.9% |

| Micro Systemation (OM:MSAB B) | SEK63.40 | SEK126.73 | 50% |

| KB Components (OM:KBC) | SEK42.60 | SEK83.33 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.77 | 49.4% |

| Exail Technologies (ENXTPA:EXA) | €81.90 | €161.83 | 49.4% |

| Circle (BIT:CIRC) | €8.00 | €15.68 | 49% |

| Atea (OB:ATEA) | NOK151.00 | NOK300.55 | 49.8% |

| Aker BioMarine (OB:AKBM) | NOK88.70 | NOK175.95 | 49.6% |

Let's dive into some prime choices out of the screener.

Reway Group (BIT:RWY)

Overview: Reway Group S.p.A. operates through its subsidiaries in the rehabilitation of road and motorway infrastructure in Italy, with a market cap of €405.51 million.

Operations: Reway Group S.p.A. generates revenue primarily from services, amounting to €230.51 million, and from the sale of goods/materials, totaling €1.72 million.

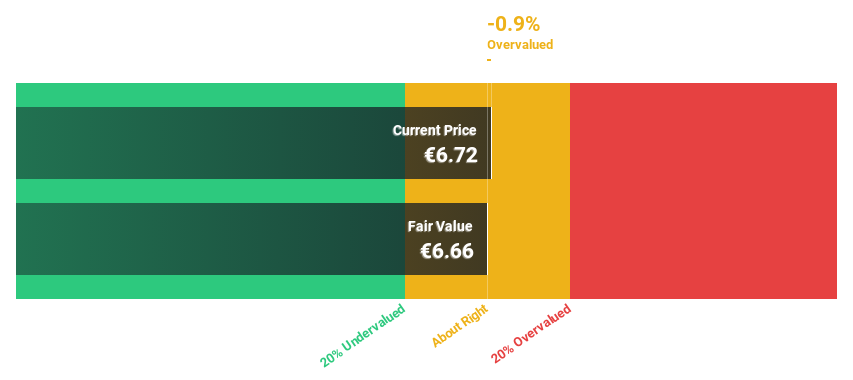

Estimated Discount To Fair Value: 26.5%

Reway Group appears undervalued based on cash flows, trading at €10.45, below its estimated fair value of €14.22. Despite debt concerns, revenue and earnings are projected to outpace the Italian market with growth rates of 8.7% and 12.36% annually, respectively. Recent half-year results show improved financial performance with sales rising to €109.77 million from €93.47 million and net income increasing to €11.83 million from €8.48 million year-over-year.

- In light of our recent growth report, it seems possible that Reway Group's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Reway Group.

Aker BioMarine (OB:AKBM)

Overview: Aker BioMarine ASA is a biotech innovator that develops and supplies krill-derived products for consumer health and wellness globally, with a market cap of NOK7.78 billion.

Operations: Aker BioMarine ASA generates revenue through the development and supply of krill-derived products aimed at enhancing consumer health and wellness on a global scale.

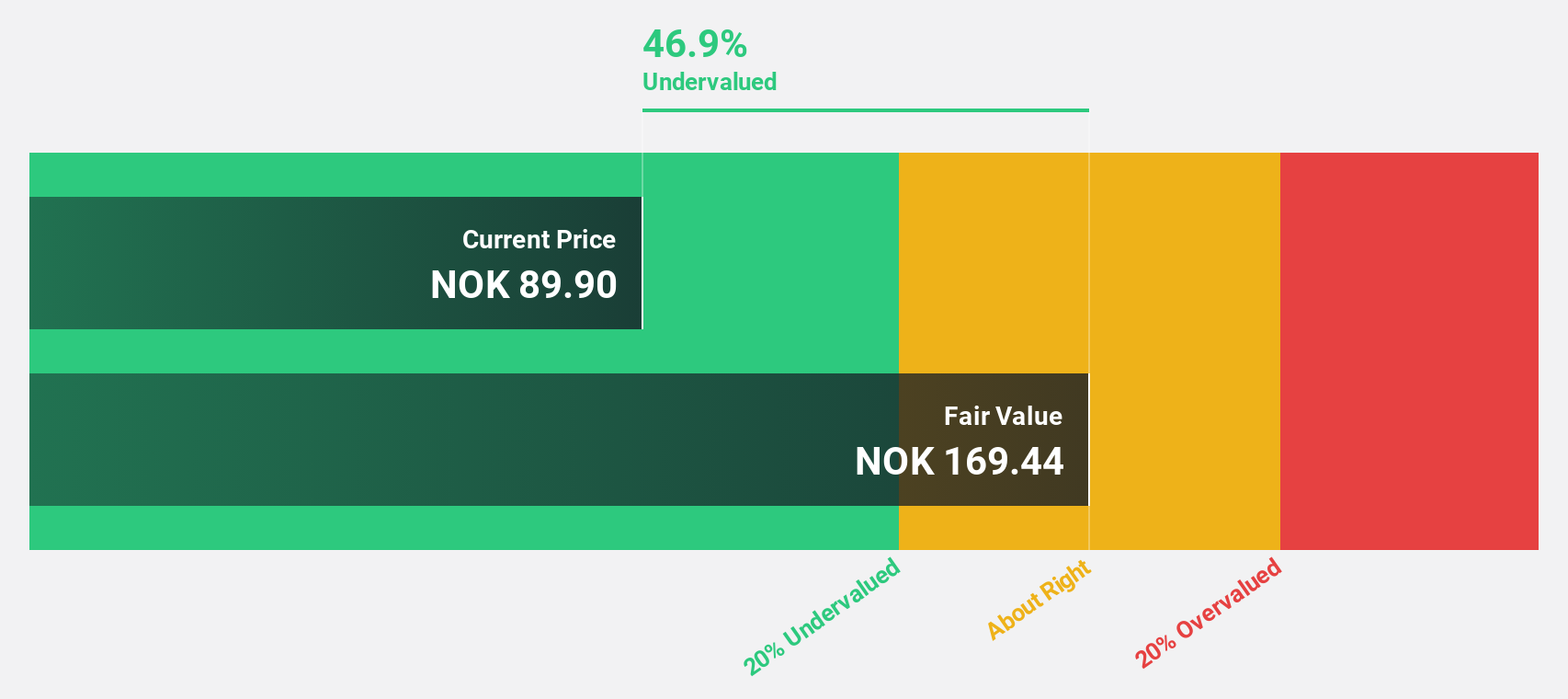

Estimated Discount To Fair Value: 49.6%

Aker BioMarine is trading at NOK88.7, significantly below its estimated fair value of NOK175.95, indicating potential undervaluation based on cash flows. Despite a forecasted low return on equity of 15.9% in three years, the company is expected to achieve profitability with earnings projected to grow substantially at 110.42% annually and revenue growth outpacing the Norwegian market at 10.7%. Recent Q3 results showed sales increased to US$56.8 million, though net income declined sharply year-over-year.

- The growth report we've compiled suggests that Aker BioMarine's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Aker BioMarine stock in this financial health report.

Atea (OB:ATEA)

Overview: Atea ASA provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK16.83 billion.

Operations: The company's revenue segments include NOK9.27 billion from Norway, NOK13.73 billion from Sweden, NOK8.56 billion from Denmark, NOK3.48 billion from Finland, and NOK1.90 billion from the Baltics, along with Group Shared Services contributing NOK11.86 billion.

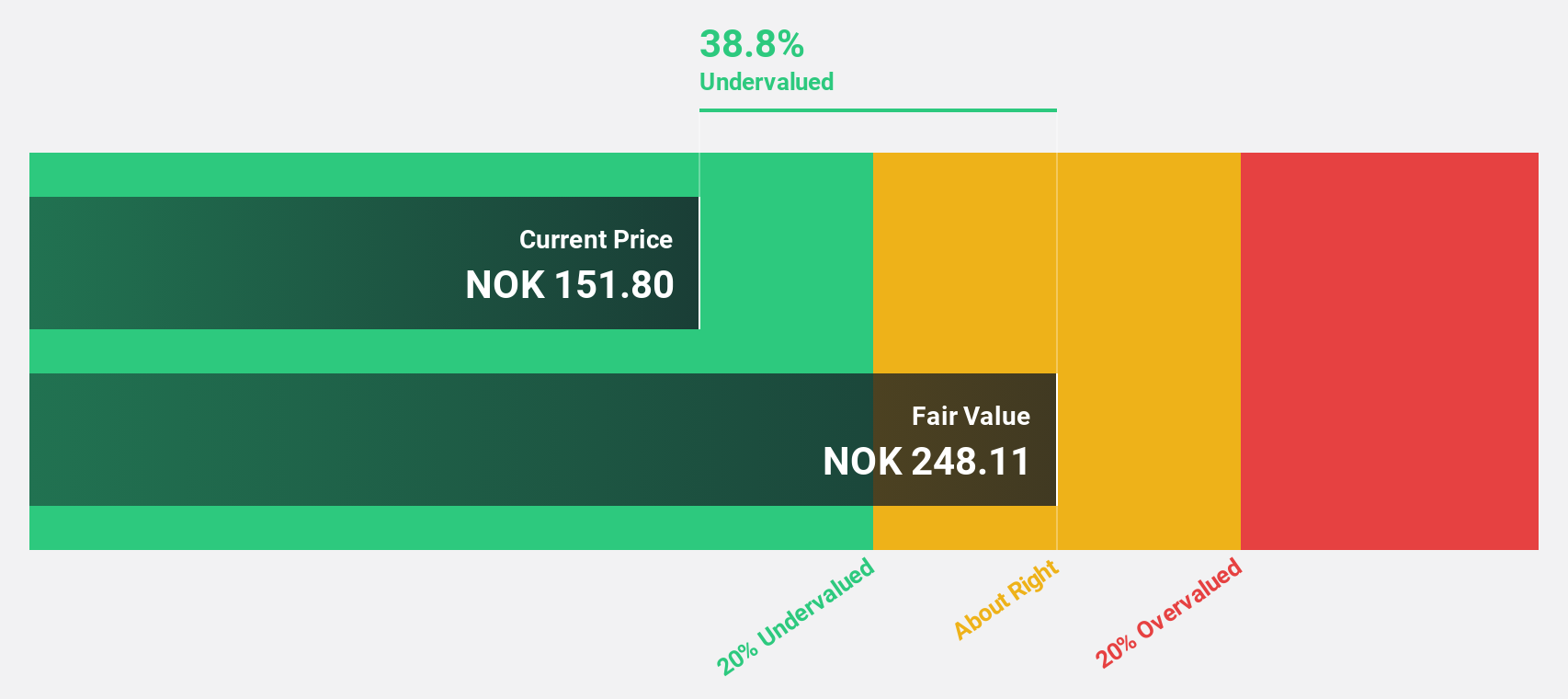

Estimated Discount To Fair Value: 49.8%

Atea is trading at NOK151, considerably below its estimated fair value of NOK300.55, suggesting it may be undervalued based on cash flows. Earnings are projected to grow 18.5% annually, outpacing the Norwegian market's growth rate of 15.2%. Recent developments include a significant Euro 130 million contract with NATO for device management across member countries, potentially enhancing revenue streams. However, the dividend yield of 4.64% is not well covered by earnings.

- Our expertly prepared growth report on Atea implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Atea's balance sheet by reading our health report here.

Next Steps

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 197 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RWY

Reway Group

Through its subsidiaries, engages in the road and motorway infrastructure rehabilitation activities in Italy.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026