- Italy

- /

- Aerospace & Defense

- /

- BIT:LDO

Leonardo's (BIT:LDO) five-year earnings growth trails the massive shareholder returns

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. For example, the Leonardo S.p.a. (BIT:LDO) share price is up a whopping 727% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 42% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. It really delights us to see such great share price performance for investors.

Since the stock has added €2.1b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

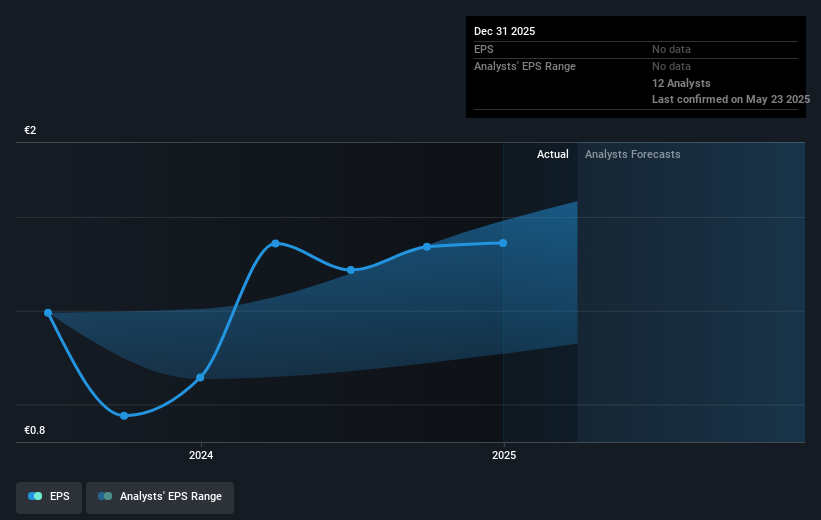

During five years of share price growth, Leonardo achieved compound earnings per share (EPS) growth of 11% per year. This EPS growth is slower than the share price growth of 53% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Leonardo has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Leonardo will grow revenue in the future.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Leonardo the TSR over the last 5 years was 779%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Leonardo has rewarded shareholders with a total shareholder return of 143% in the last twelve months. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 54% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Leonardo you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:LDO

Leonardo

An industrial and technological company, engages in the helicopters, defense electronics and security, cyber security and solutions, aircraft, aerostructures, and space sectors in Italy, the United Kingdom, rest of Europe, the United States of America, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives