Investors Appear Satisfied With Iveco Group N.V.'s (BIT:IVG) Prospects

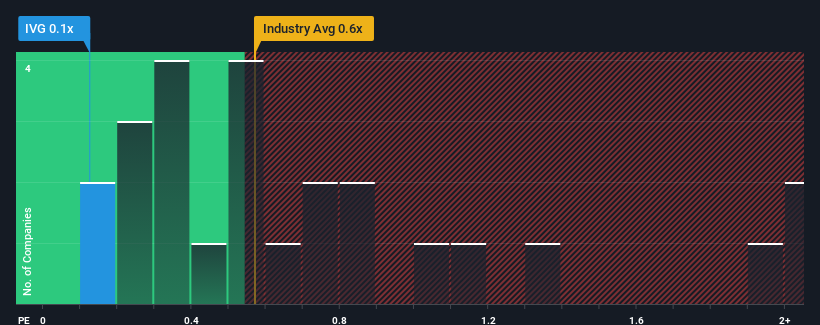

With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Machinery industry in Italy, you could be forgiven for feeling indifferent about Iveco Group N.V.'s (BIT:IVG) P/S ratio of 0.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Iveco Group

What Does Iveco Group's P/S Mean For Shareholders?

Iveco Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Iveco Group.Is There Some Revenue Growth Forecasted For Iveco Group?

The only time you'd be comfortable seeing a P/S like Iveco Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The strong recent performance means it was also able to grow revenue by 51% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 2.5% per year over the next three years. With the industry predicted to deliver 3.2% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Iveco Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Iveco Group's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Iveco Group's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Iveco Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:IVG

Iveco Group

Engages in the design, production, marketing, sale, servicing, and financing of trucks, commercial vehicles, buses and specialty vehicles for firefighting, defense, and other applications worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives