- Canada

- /

- Metals and Mining

- /

- TSX:SSL

3 Stocks That May Be Priced Below Their Estimated Value In February 2025

Reviewed by Simply Wall St

As global markets navigate a volatile landscape marked by fluctuating corporate earnings and geopolitical concerns, investors are keenly observing the impact of AI competition and central bank policies on stock performance. With the Federal Reserve holding rates steady amid persistent inflation and European markets buoyed by interest rate cuts, there is an ongoing search for stocks that may be trading below their estimated value. In such an environment, identifying undervalued stocks requires a careful analysis of financial fundamentals and market sentiment to uncover potential opportunities amidst uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wistron (TWSE:3231) | NT$99.00 | NT$197.62 | 49.9% |

| Alltop Technology (TPEX:3526) | NT$265.00 | NT$528.78 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.90 | CA$11.79 | 50% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.31 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.72 | €5.43 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.22 | SEK165.90 | 49.8% |

| Spin Master (TSX:TOY) | CA$30.23 | CA$60.17 | 49.8% |

| Coastal Financial (NasdaqGS:CCB) | US$86.74 | US$172.68 | 49.8% |

| Equifax (NYSE:EFX) | US$266.77 | US$531.78 | 49.8% |

| Facephi Biometria (BME:FACE) | €2.23 | €4.45 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

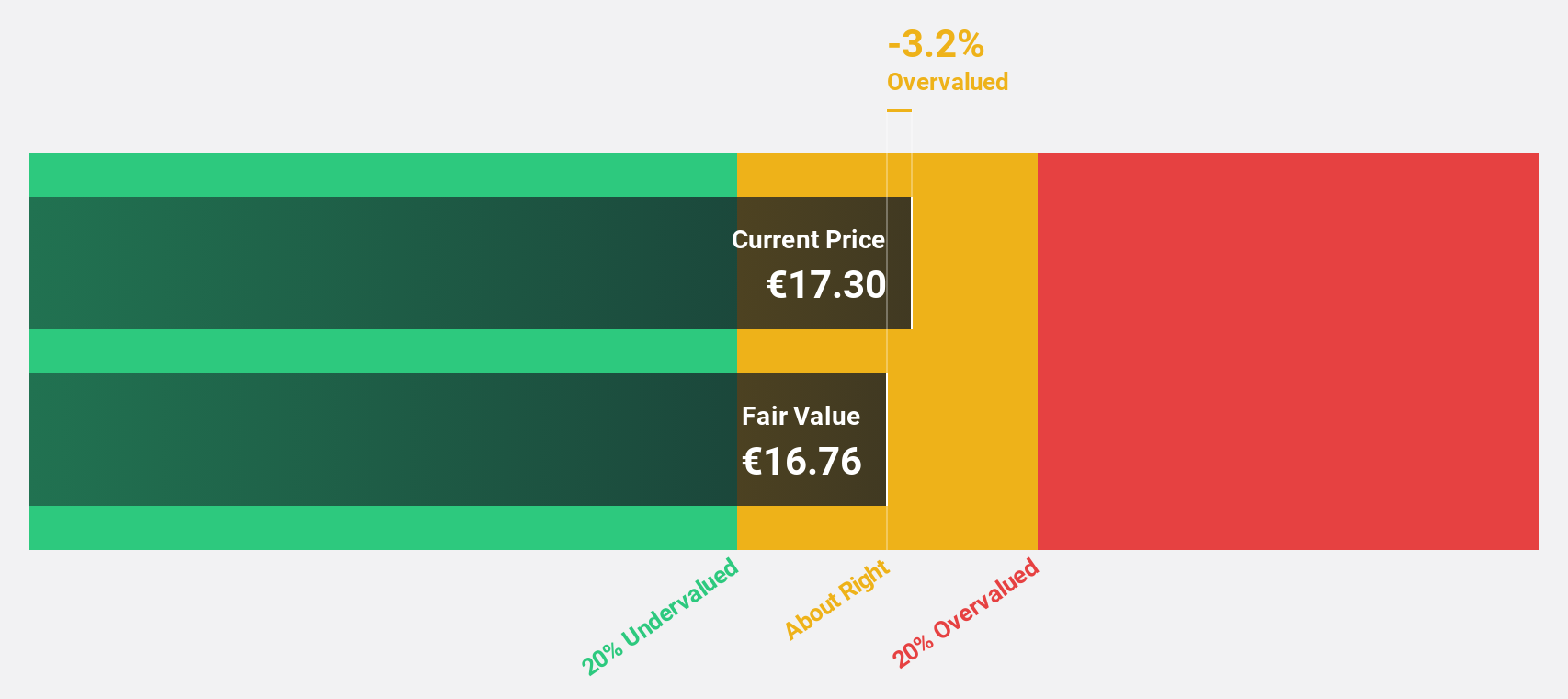

Iveco Group (BIT:IVG)

Overview: Iveco Group N.V. is involved in the design, production, marketing, sale, servicing, and financing of trucks, commercial vehicles, buses, and specialty vehicles for various applications globally with a market cap of €3.06 billion.

Operations: The company's revenue segments include Powertrain at €3.75 billion and Financial Services at €570 million.

Estimated Discount To Fair Value: 19.5%

Iveco Group is trading at €11.66, below its estimated fair value of €14.48, suggesting it may be undervalued based on cash flows. Despite a lower net profit margin compared to last year, earnings are forecasted to grow significantly at 37.2% annually, outpacing the Italian market's 6.8%. Recent contracts with the Italian Ministry of Defence and a German bus consortium highlight potential revenue streams but high debt levels remain a concern for financial stability.

- The analysis detailed in our Iveco Group growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Iveco Group's balance sheet health report.

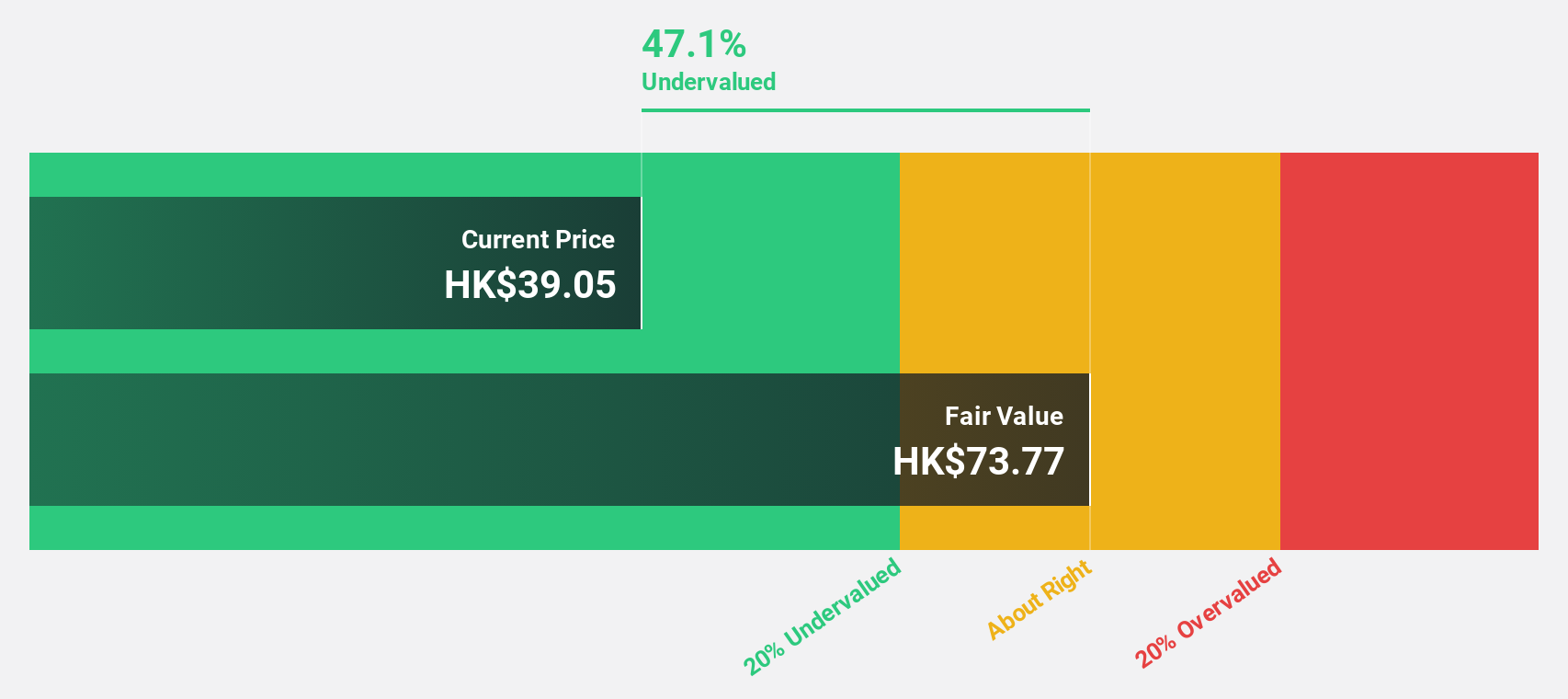

Shanghai Conant Optical (SEHK:2276)

Overview: Shanghai Conant Optical Co., Ltd. manufactures and sells resin spectacle lenses across Mainland China, the Americas, Asia, Europe, Oceania, and Africa with a market cap of HK$12.65 billion.

Operations: The company's revenue primarily comes from the manufacturing and sales of resin spectacle lenses, totaling CN¥1.90 billion.

Estimated Discount To Fair Value: 47.8%

Shanghai Conant Optical is trading at HK$26.35, significantly below its fair value estimate of HK$50.47, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow 16.51% annually, surpassing the Hong Kong market average of 11.3%. Recent guidance indicates a net profit increase of no less than 30% for 2024 due to business expansion and improved profit margins, despite recent share price volatility and a follow-on equity offering raising HK$845.73 million.

- Our growth report here indicates Shanghai Conant Optical may be poised for an improving outlook.

- Get an in-depth perspective on Shanghai Conant Optical's balance sheet by reading our health report here.

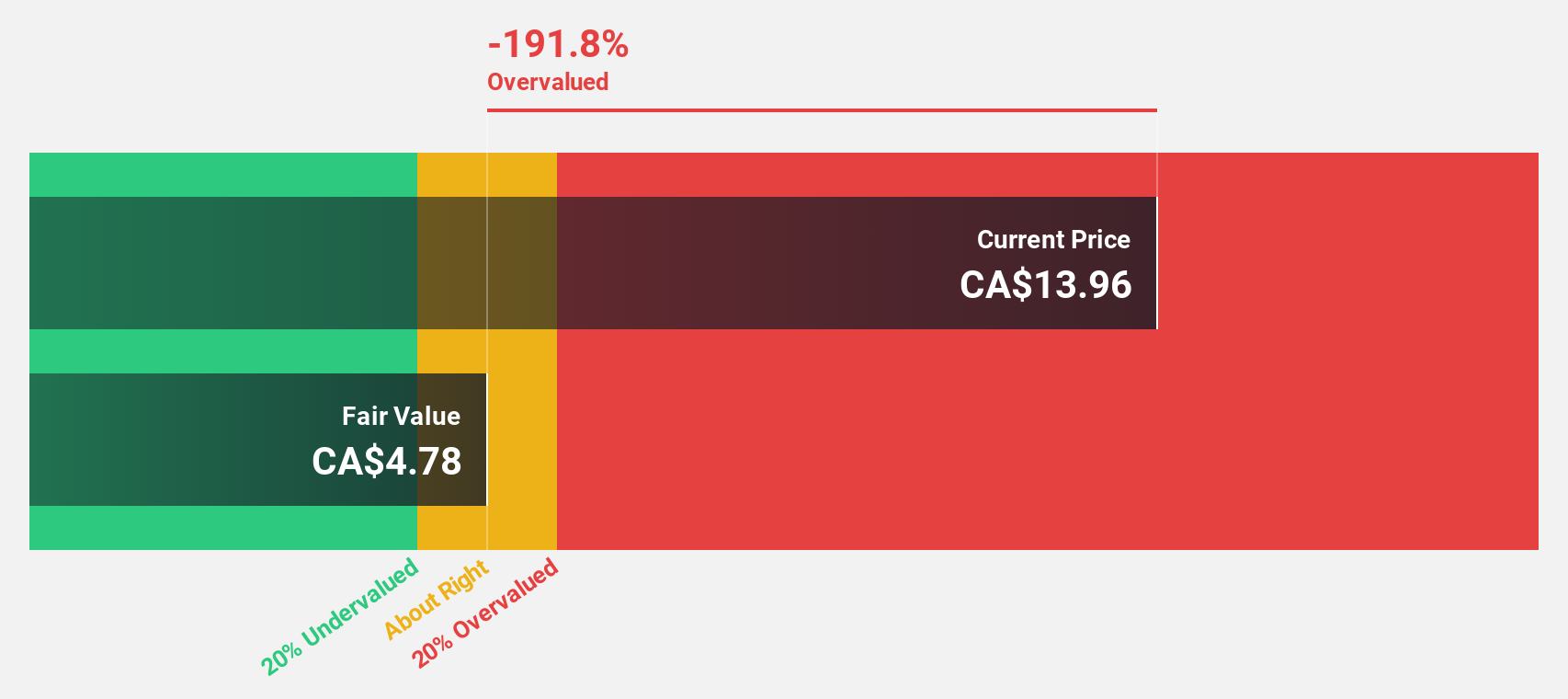

Sandstorm Gold (TSX:SSL)

Overview: Sandstorm Gold Ltd. operates as a gold royalty company with a market cap of CA$2.60 billion.

Operations: The company's revenue segments include earnings from Antamina, Peru ($8.47 million), Chapada, Brazil ($16.29 million), Aurizona, Brazil ($8.18 million), Caserones, Chile ($12.27 million), Mercedes, Mexico ($13.83 million), Cerro Moro Argentina ($19.29 million), Blyvoor, South Africa ($4.72 million), Houndé, Burkina Faso ($7.16 million), Bonikro, Cote D'Ivoire ($14.47 million), Vale Royalties, Brazil ($5.94 million), Fruta Del Norte, Ecuador ($8.63 million) and Relief Canyon in the United States with $16.04 million in revenue.

Estimated Discount To Fair Value: 30.8%

Sandstorm Gold is trading at CA$8.79, below its fair value estimate of CA$12.71, suggesting undervaluation based on cash flows. Earnings are forecast to grow significantly at 45.63% annually, outpacing the Canadian market's 16.3%. Despite a recent decline in gold sales and revenue for 2024 compared to the previous year, Sandstorm's renewed US$625 million credit facility with improved terms supports financial flexibility and potential growth through exploration advancements and strategic investments.

- Our expertly prepared growth report on Sandstorm Gold implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Sandstorm Gold.

Where To Now?

- Click this link to deep-dive into the 930 companies within our Undervalued Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SSL

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion