Is Danieli (BIT:DAN) Undervalued? A Fresh Look at the Machinery Maker’s Recent Stock Momentum and Valuation

Reviewed by Simply Wall St

Price-to-Earnings of 10.7x: Is it justified?

Danieli’s valuation stands out when measured by its price-to-earnings ratio. At 10.7x, the company looks undervalued relative to peers and the wider machinery industry, both of which command higher multiples.

The price-to-earnings (P/E) ratio compares the company's current share price to its per-share earnings. It is a popular yardstick for appraising whether investors are paying too much, too little, or just about the right amount for future earnings potential, especially in capital goods sectors like machinery where earning consistency matters.

What sets Danieli apart is its ratio, which is significantly below both the estimated fair P/E (16.1x) and the peer group average (16.3x). This suggests that the market might not be fully reflecting its ability to generate profits. Even compared to the broader European Machinery industry average (20.3x), Danieli trades at a meaningful discount. Whether this gap is justified depends on how sustainable its earnings growth proves to be in the quarters ahead.

Result: Fair Value of €70.52 (UNDERVALUED)

See our latest analysis for Danieli & C. Officine Meccaniche.However, risks remain, such as shifts in industry demand or a slowdown in revenue growth. These factors could quickly challenge the current optimism.

Find out about the key risks to this Danieli & C. Officine Meccaniche narrative.Another View: SWS DCF Model

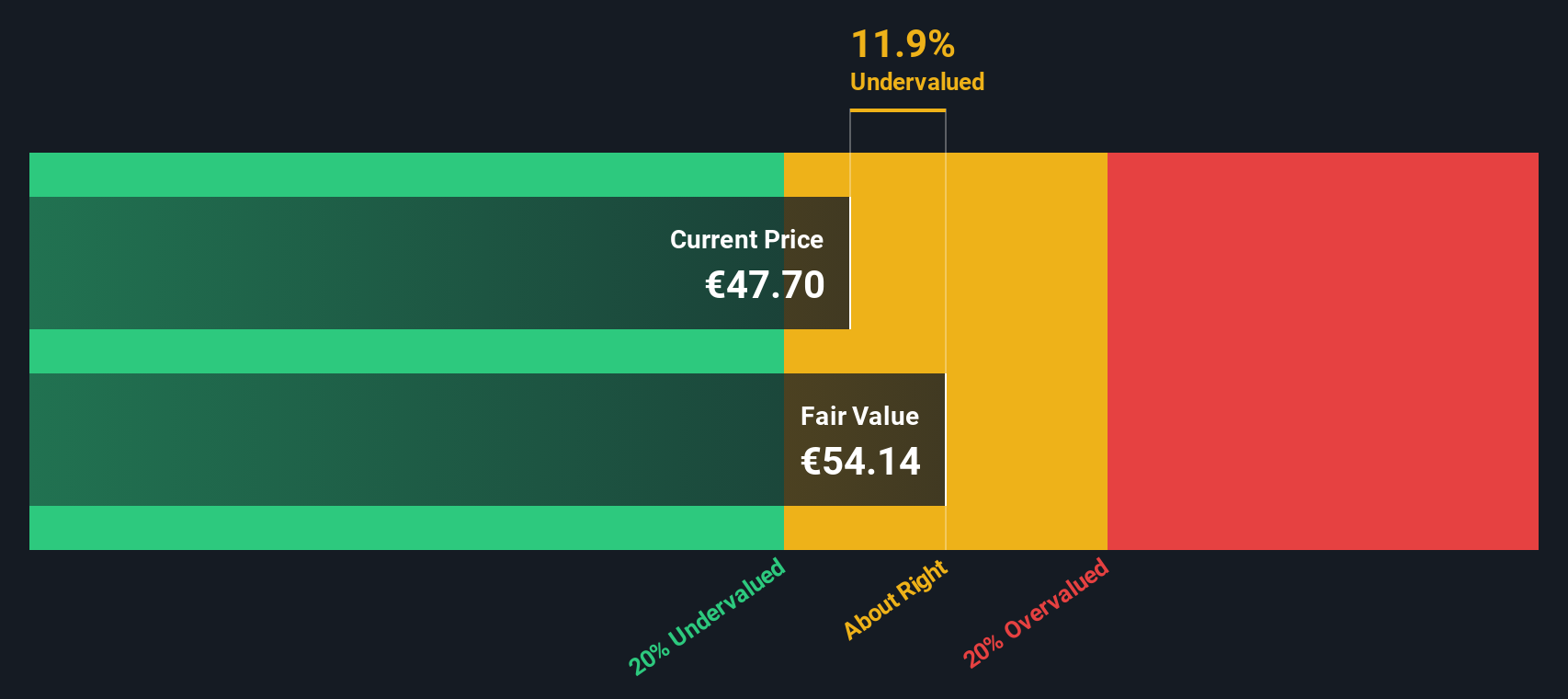

Taking a look from a different angle, the SWS DCF model also indicates that Danieli is undervalued. This method focuses on future cash flows to estimate value and challenges the assumptions of the multiples approach.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Danieli & C. Officine Meccaniche Narrative

If you see things differently or want to dig deeper into the numbers, you can build your own view in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Danieli & C. Officine Meccaniche.

Looking for more investment ideas?

Don’t let great stocks pass you by. Expand your portfolio with handpicked opportunities other investors are watching, tailored for different strategies and goals.

- Discover resilient income opportunities to enhance your dividend strategy by starting with dividend stocks with yields > 3%.

- Explore the next wave of artificial intelligence breakthroughs from fast-moving innovators by checking out AI penny stocks.

- Identify rare value gems trading below their true worth and give yourself an edge using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DAN

Danieli & C. Officine Meccaniche

Designs, builds, and sells plants for the iron and steel industry in Europe, Russia, the Middle East, the Americas, and South East Asia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion