February 2025's Top Stocks Estimated To Be Trading Below Their True Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by geopolitical tensions, consumer spending concerns, and fluctuating indices, investors are increasingly focused on identifying opportunities amidst uncertainty. In this environment, stocks estimated to be trading below their true value present a compelling case for consideration, as they may offer potential resilience against broader market volatility and the chance for growth when conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.26 | CN¥52.18 | 49.7% |

| Hibino (TSE:2469) | ¥2795.00 | ¥5546.91 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK270.00 | SEK535.44 | 49.6% |

| Nuvoton Technology (TWSE:4919) | NT$95.80 | NT$191.46 | 50% |

| América Móvil. de (BMV:AMX B) | MX$14.89 | MX$29.71 | 49.9% |

| Neosem (KOSDAQ:A253590) | ₩12050.00 | ₩23935.35 | 49.7% |

| CD Projekt (WSE:CDR) | PLN221.70 | PLN441.47 | 49.8% |

| Siam Wellness Group (SET:SPA) | THB5.35 | THB10.69 | 49.9% |

| Sandfire Resources (ASX:SFR) | A$10.53 | A$20.98 | 49.8% |

| Integral Diagnostics (ASX:IDX) | A$2.89 | A$5.77 | 49.9% |

Let's uncover some gems from our specialized screener.

Antares Vision (BIT:AV)

Overview: Antares Vision S.p.A. specializes in the production, installation, and maintenance of inspection systems for quality control, with a market cap of €272.62 million.

Operations: The company generates revenue from its Industrial Automation & Controls segment, which amounted to €205.38 million.

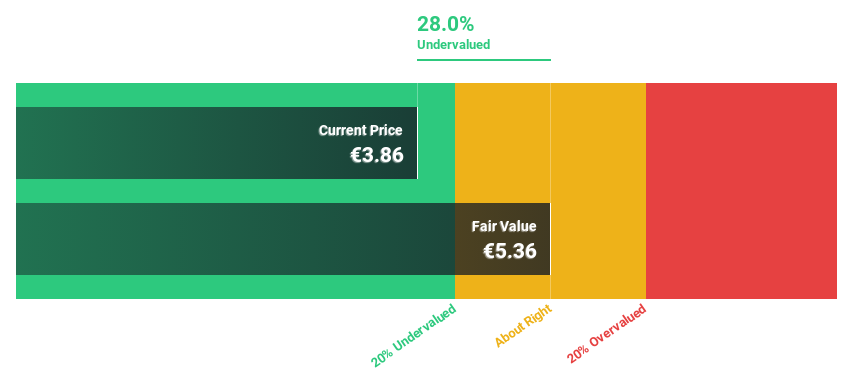

Estimated Discount To Fair Value: 28.0%

Antares Vision, trading at €3.86, is considered undervalued with a fair value estimate of €5.36, representing a 28% discount. While its revenue is projected to grow at 5.5% annually—outpacing the Italian market—it remains below the 20% benchmark for high growth. Profitability is expected within three years with earnings forecasted to grow significantly each year, though Return on Equity may remain modest at 8.6%.

- The analysis detailed in our Antares Vision growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Antares Vision.

Lifedrink Company (TSE:2585)

Overview: Lifedrink Company, Inc. manufactures and sells beverages in Japan with a market capitalization of approximately ¥94.91 billion.

Operations: The primary revenue segment for Lifedrink Company, Inc. is the Beverage and Leaf Business, generating ¥43.40 billion.

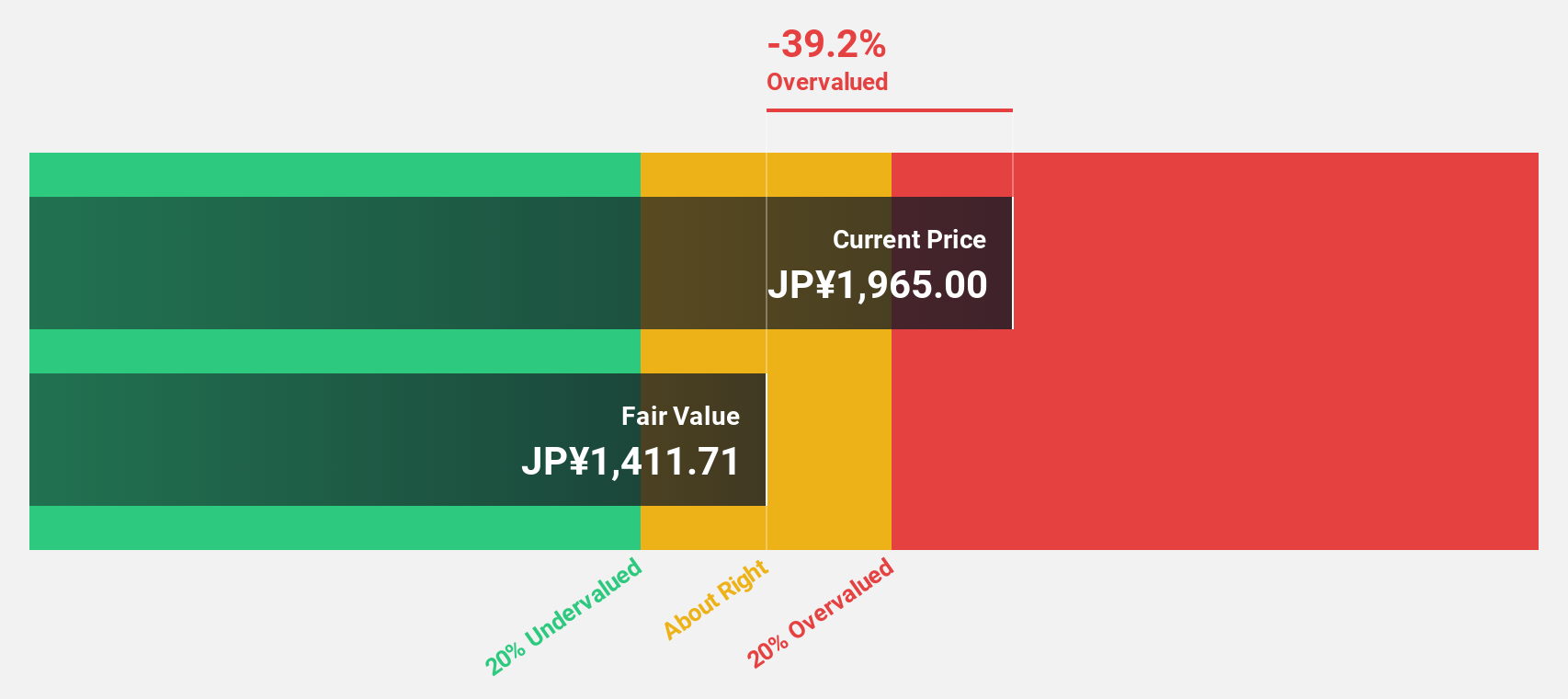

Estimated Discount To Fair Value: 26.9%

Lifedrink Company, trading at ¥1816, is undervalued with a fair value estimate of ¥2484.5, offering a discount over 20%. Despite high debt levels and recent share price volatility, its earnings grew 14.7% last year and are expected to grow 16.55% annually—surpassing the JP market's growth rate. Revenue is set to increase by 8.9% per year, faster than the market average of 4.2%, while Return on Equity could reach a robust 24.2%.

- Upon reviewing our latest growth report, Lifedrink Company's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Lifedrink Company with our detailed financial health report.

Kinsus Interconnect Technology (TWSE:3189)

Overview: Kinsus Interconnect Technology Corp., along with its subsidiaries, manufactures and sells electronic products in Taiwan and internationally, with a market cap of NT$47.49 billion.

Operations: The company's revenue is derived from its Optical Department, generating NT$7.06 billion, and its Substrate Division, contributing NT$22.92 billion.

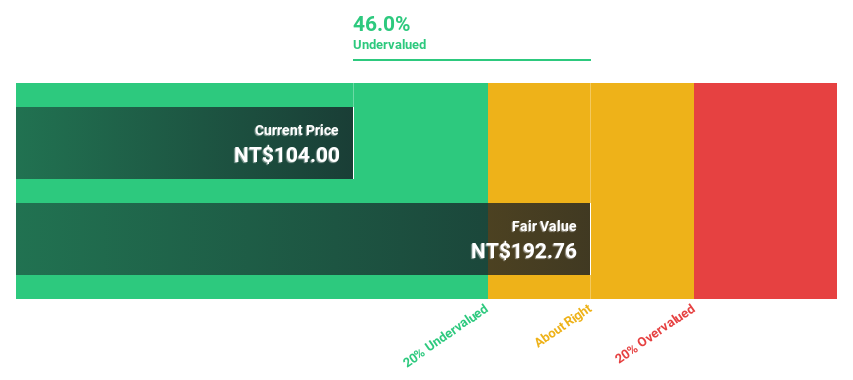

Estimated Discount To Fair Value: 46%

Kinsus Interconnect Technology, trading at NT$104, is significantly undervalued with a fair value estimate of NT$192.76. Despite recent share price volatility, its earnings are projected to grow substantially at 61.4% annually, outpacing the TW market's growth rate of 17.9%. Revenue growth is expected at 12.6% per year, slightly above the market average of 12%. However, Return on Equity is forecasted to remain low at 6.5% in three years.

- Our growth report here indicates Kinsus Interconnect Technology may be poised for an improving outlook.

- Take a closer look at Kinsus Interconnect Technology's balance sheet health here in our report.

Next Steps

- Get an in-depth perspective on all 916 Undervalued Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2585

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives