In a week marked by busy earnings reports and fluctuating economic indicators, global markets experienced mixed results, with small-cap stocks showing resilience compared to their larger counterparts. This environment underscores the potential of penny stocks—an investment area that, despite its name's vintage feel, continues to capture interest for its blend of affordability and growth potential. By focusing on companies with solid financials and clear growth paths, investors can uncover opportunities in these smaller or emerging firms that might offer both stability and upside potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £489.64M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.00 | MYR2.07B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.80 | £384.4M | ★★★★☆☆ |

Click here to see the full list of 5,770 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ariston Holding (BIT:ARIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ariston Holding N.V., with a market cap of €1.33 billion, operates globally through its subsidiaries to produce and distribute hot water and space heating solutions.

Operations: The company's revenue is primarily derived from its Thermal Comfort segment, generating €2.67 billion, followed by Burners at €92 million and Components at €81.8 million.

Market Cap: €1.33B

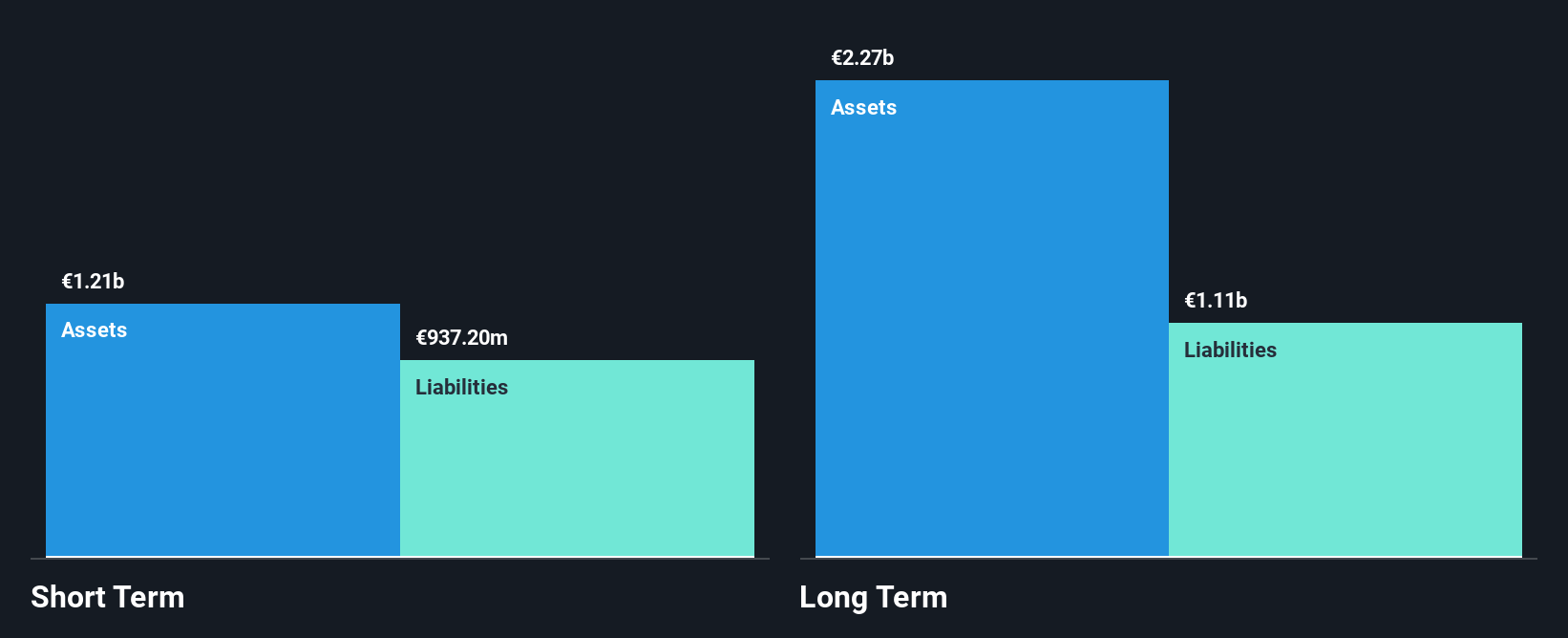

Ariston Holding N.V. operates with a market cap of €1.33 billion, generating significant revenue primarily from its Thermal Comfort segment (€2.67 billion). Despite its stable weekly volatility, the company's profit margins have decreased to 2% from 6.2% last year, and it has experienced negative earnings growth over the past year (-67.1%). The dividend yield of 4.35% is not well covered by earnings, indicating potential sustainability issues. However, Ariston's debt is well managed with operating cash flow covering it by 32.3%, and interest payments are adequately covered by EBIT (4x). Analysts forecast a stock price rise of approximately 20%.

- Click here to discover the nuances of Ariston Holding with our detailed analytical financial health report.

- Examine Ariston Holding's earnings growth report to understand how analysts expect it to perform.

Kairuide HoldingLtd (SZSE:002072)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kairuide Holding Co., Ltd. operates in the coal trading sector in China with a market capitalization of CN¥1.80 billion.

Operations: Kairuide Holding Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥1.8B

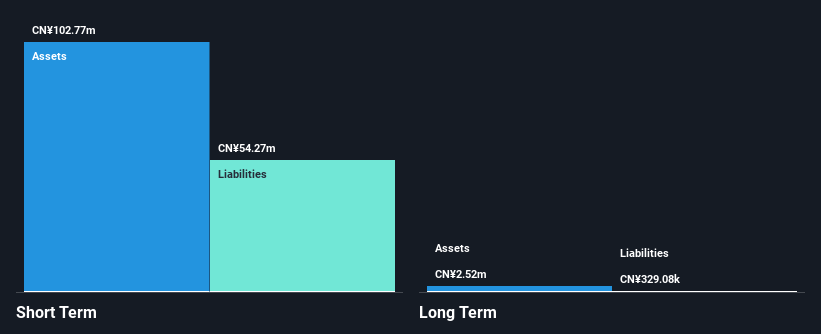

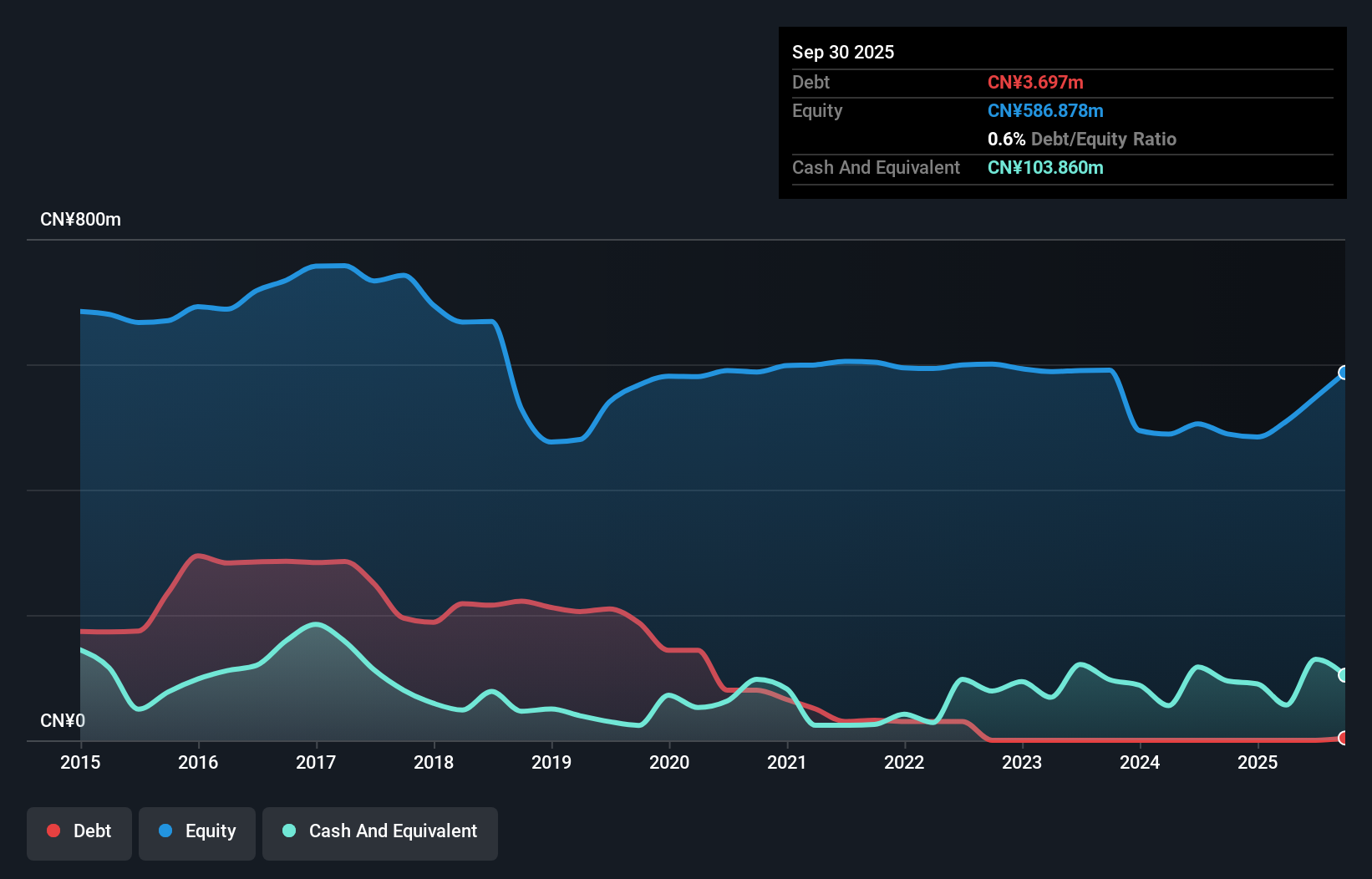

Kairuide Holding Co., Ltd. operates in the coal trading sector with a market cap of CN¥1.80 billion, showing substantial revenue growth from CN¥215.34 million to CN¥501.78 million year-over-year for the nine months ending September 2024. Despite this increase, the company remains unprofitable, with a net loss widening to CN¥2.53 million from CN¥0.43 million in the previous year. However, Kairuide has improved its financial stability by maintaining more cash than total debt and having sufficient short-term assets to cover liabilities while reducing losses over five years at an impressive rate of 42% annually.

- Navigate through the intricacies of Kairuide HoldingLtd with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Kairuide HoldingLtd's track record.

Ningbo Xianfeng New MaterialLtd (SZSE:300163)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ningbo Xianfeng New Material Co., Ltd develops and manufactures screen fabrics globally, with a market cap of CN¥1.05 billion.

Operations: Ningbo Xianfeng New Material Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥1.05B

Ningbo Xianfeng New Material Co., Ltd, with a market cap of CN¥1.05 billion, reported modest revenue growth to CN¥190.32 million for the nine months ending September 2024 but remains unprofitable with a net loss of CN¥5.53 million. The company benefits from having no debt and sufficient short-term assets (CN¥321.4M) to cover liabilities, indicating financial stability despite increased losses over five years at an annual rate of 75.6%. Its management team is relatively experienced, though the board lacks tenure depth, contributing to high share price volatility over recent months.

- Jump into the full analysis health report here for a deeper understanding of Ningbo Xianfeng New MaterialLtd.

- Examine Ningbo Xianfeng New MaterialLtd's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Gain an insight into the universe of 5,770 Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Xianfeng New MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300163

Ningbo Xianfeng New MaterialLtd

Develops and manufactures screen fabrics in worldwide.

Flawless balance sheet minimal.