As European markets experience a pullback with major indices like Germany's DAX and France's CAC 40 facing declines, investors are increasingly drawn to the stability offered by dividend stocks. In such uncertain times, a good dividend stock is characterized by its ability to provide consistent income through reliable payouts, offering a buffer against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.28% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 3.86% | ★★★★★☆ |

| Sanok Rubber Company Spólka Akcyjna (WSE:SNK) | 7.25% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.21% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.01% | ★★★★★★ |

| Evolution (OM:EVO) | 4.71% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.23% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.14% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.65% | ★★★★★★ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

UniCredit (BIT:UCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UniCredit S.p.A. is a commercial banking provider operating in Italy, Germany, Central Europe, and Eastern Europe with a market cap of €106.02 billion.

Operations: UniCredit S.p.A.'s revenue is primarily derived from its operations in Italy (€10.71 billion), Germany (€5.28 billion), and Russia (€1.32 billion).

Dividend Yield: 4.3%

UniCredit's dividend payments, while having increased over the past decade, have been volatile and are considered unreliable. The current payout ratio of 42.7% indicates dividends are well covered by earnings, with future coverage expected to remain sustainable at 54.1%. Despite a high level of bad loans at 2.3%, recent earnings reports show robust net income growth, supporting its EUR 2.2 billion interim dividend payment confirmed for November 2025.

- Dive into the specifics of UniCredit here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of UniCredit shares in the market.

Cheffelo (OM:CHEF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cheffelo AB (publ) is involved in supplying and delivering meal kits to customers in Sweden, Norway, and Denmark, with a market cap of SEK1.08 billion.

Operations: Cheffelo AB (publ) generates revenue of SEK1.16 billion from its online retail segment.

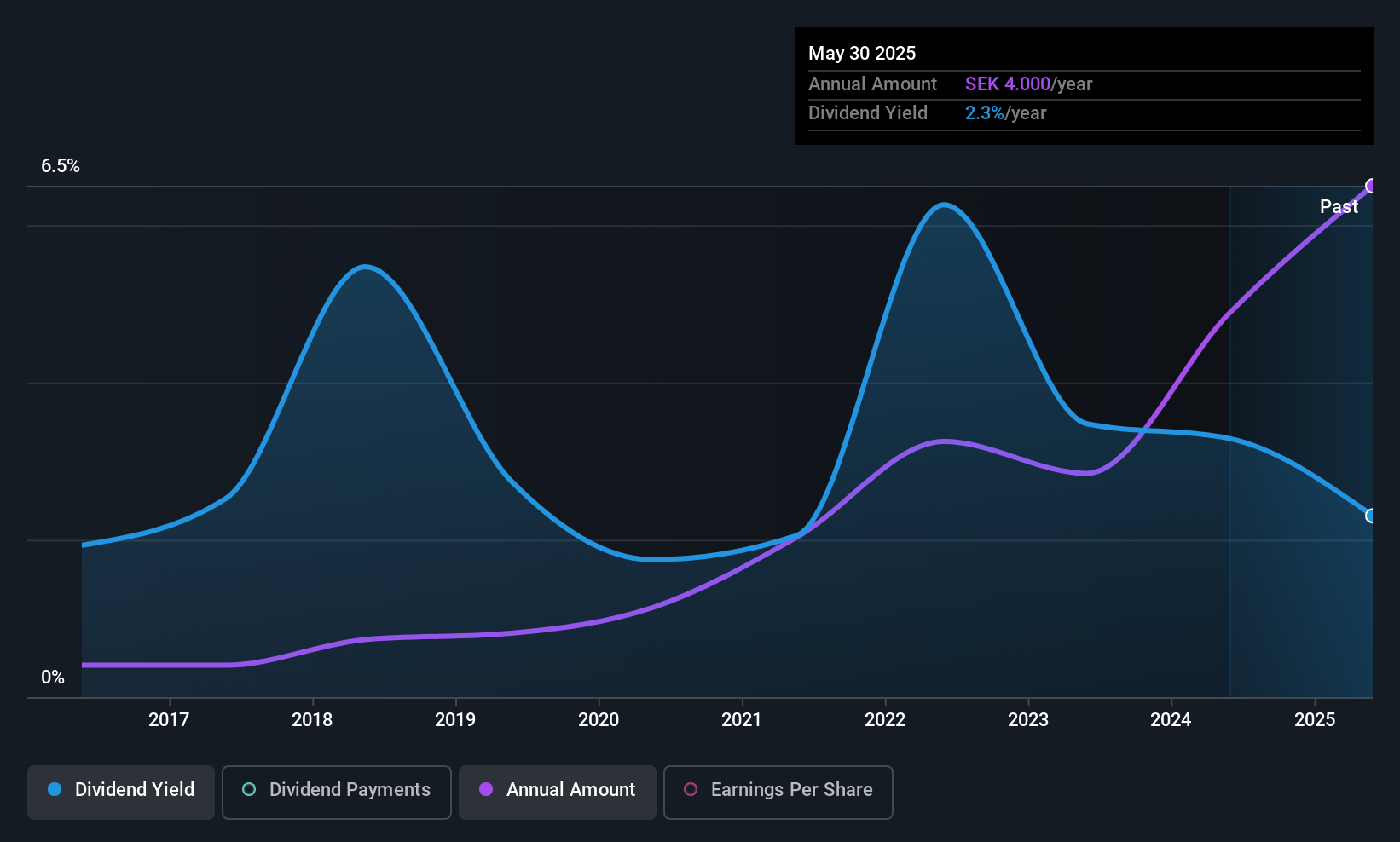

Dividend Yield: 4%

Cheffelo's dividend payments have been inconsistent, with a history of volatility and only four years of distributions. Despite this, dividends are well covered by earnings (81% payout ratio) and cash flows (42.9% cash payout ratio). The company reported a significant improvement in net income for the first nine months of 2025, reaching SEK 27.89 million compared to SEK 7.96 million last year, but faces challenges from recent insider selling and share price volatility.

- Click here and access our complete dividend analysis report to understand the dynamics of Cheffelo.

- According our valuation report, there's an indication that Cheffelo's share price might be on the cheaper side.

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company offering dietary supplements and skincare products both in Sweden and internationally, with a market cap of SEK4.32 billion.

Operations: Zinzino AB (publ) generates revenue primarily from its Zinzino segment, including VMA Life, which accounts for SEK2.68 billion, and Faun contributes SEK177.77 million.

Dividend Yield: 3.4%

Zinzino offers a reliable dividend yield of 3.36%, supported by a stable history over the past decade and covered by both earnings and cash flows, with payout ratios at 70.5% and 52.1%, respectively. Recent sales growth is robust, with revenues for January to October 2025 rising by 55% to SEK 2.63 billion, enhancing its financial position despite share price volatility. The innovative gut Health Test launch could further diversify revenue streams, supporting future dividend sustainability.

- Click to explore a detailed breakdown of our findings in Zinzino's dividend report.

- The valuation report we've compiled suggests that Zinzino's current price could be quite moderate.

Seize The Opportunity

- Gain an insight into the universe of 223 Top European Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:UCG

UniCredit

Provides commercial banking services in Italy, Germany, Central Europe, and Eastern Europe.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives