Mediobanca (BIT:MB): Exploring Valuation as Analysts See Potential Upside for Italian Bank

Reviewed by Kshitija Bhandaru

See our latest analysis for Mediobanca Banca di Credito Finanziario.

Over the past year, Mediobanca's shares have shown modest momentum, with price movements staying mostly steady and a 12-month total shareholder return just above breakeven. While the latest trading days saw slight dips, overall market confidence appears unchanged. The longer-term return figures signal stability rather than major shifts.

Curious what other strategies investors are putting to work? Use this moment to broaden your horizons and discover fast growing stocks with high insider ownership

But with Mediobanca still trading below analyst price targets and showing steady fundamental growth, is the market overlooking its potential, or have investors already accounted for the bank’s future prospects in today’s price?

Most Popular Narrative: 17.9% Undervalued

Mediobanca’s latest fair value estimate is notably higher than the last close price, highlighting a view among analysts that the market is leaving room for further upside. This gap in valuation hinges on a few pivotal business pivots and forward-looking financial expectations.

The significant and ongoing expansion of Wealth Management and Private Banking, supported by strong net new money inflows, increased hiring in sales/advisory roles, and the possibility of a transformative Banca Generali deal, positions Mediobanca to capture rising demand for asset and wealth management services. This is likely to boost fee income and support revenue and earnings stability.

Curious how this narrative arrives at its bullish stance? The driving force is a set of forward-looking projections that hint at earnings growth and a business mix shift. These numbers could justify the higher price if delivered. The full story unveils projections and business pivots that most investors have yet to uncover.

Result: Fair Value of €20.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on wealth management and uncertain M&A outcomes could challenge Mediobanca’s growth trajectory and put pressure on its margins moving forward.

Find out about the key risks to this Mediobanca Banca di Credito Finanziario narrative.

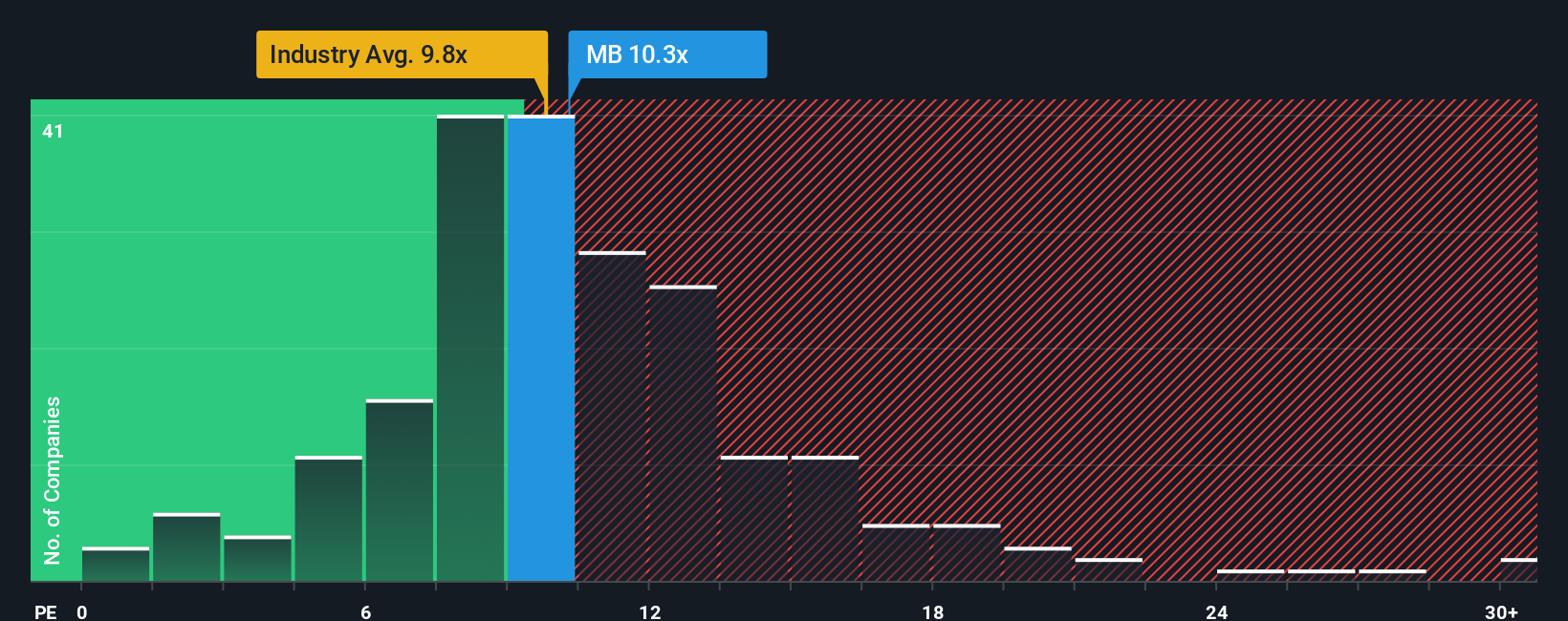

Another View: Looking Through the Lens of Price-to-Earnings

Taking a step back from analyst price targets, let's look at Mediobanca's valuation based on its price-to-earnings ratio. At 10.1x, it sits higher than the European Banks industry average of 9.8x, but below its peer group average of 12.2x and just under the fair ratio of 10.3x. This mix of signals suggests the market is pricing in some optimism yet not without restraint. Could this balanced position hint at untapped upside, or is the stock’s value already fully reflected?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mediobanca Banca di Credito Finanziario Narrative

If you’d rather form your own conclusions or take a hands-on approach, you can craft your own Mediobanca narrative in just a few minutes, so Do it your way.

A great starting point for your Mediobanca Banca di Credito Finanziario research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count. Broaden your investing playbook by tapping into these forward-thinking stock opportunities. Each one could offer a path to stronger returns or new growth stories if you act before the crowd.

- Tap into tomorrow’s breakthroughs and find opportunities ahead of the curve by checking out these 24 AI penny stocks.

- Secure your portfolio’s cash flow with reliable income potential. Start your hunt with these 19 dividend stocks with yields > 3%.

- Ride the wave of financial innovation and keep your finger on the pulse with these 78 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MB

Mediobanca Banca di Credito Finanziario

Provides various banking products and services in Italy and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives