- Thailand

- /

- Real Estate

- /

- SET:PIN

3 Prominent Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

Amidst a backdrop of global market volatility driven by tariff uncertainties and mixed economic indicators, investors are increasingly seeking stable income sources to navigate these turbulent times. Dividend stocks often provide a reliable stream of income and can be an attractive option for those looking to balance their portfolios with consistent returns, especially when market conditions are unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.16% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1961 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

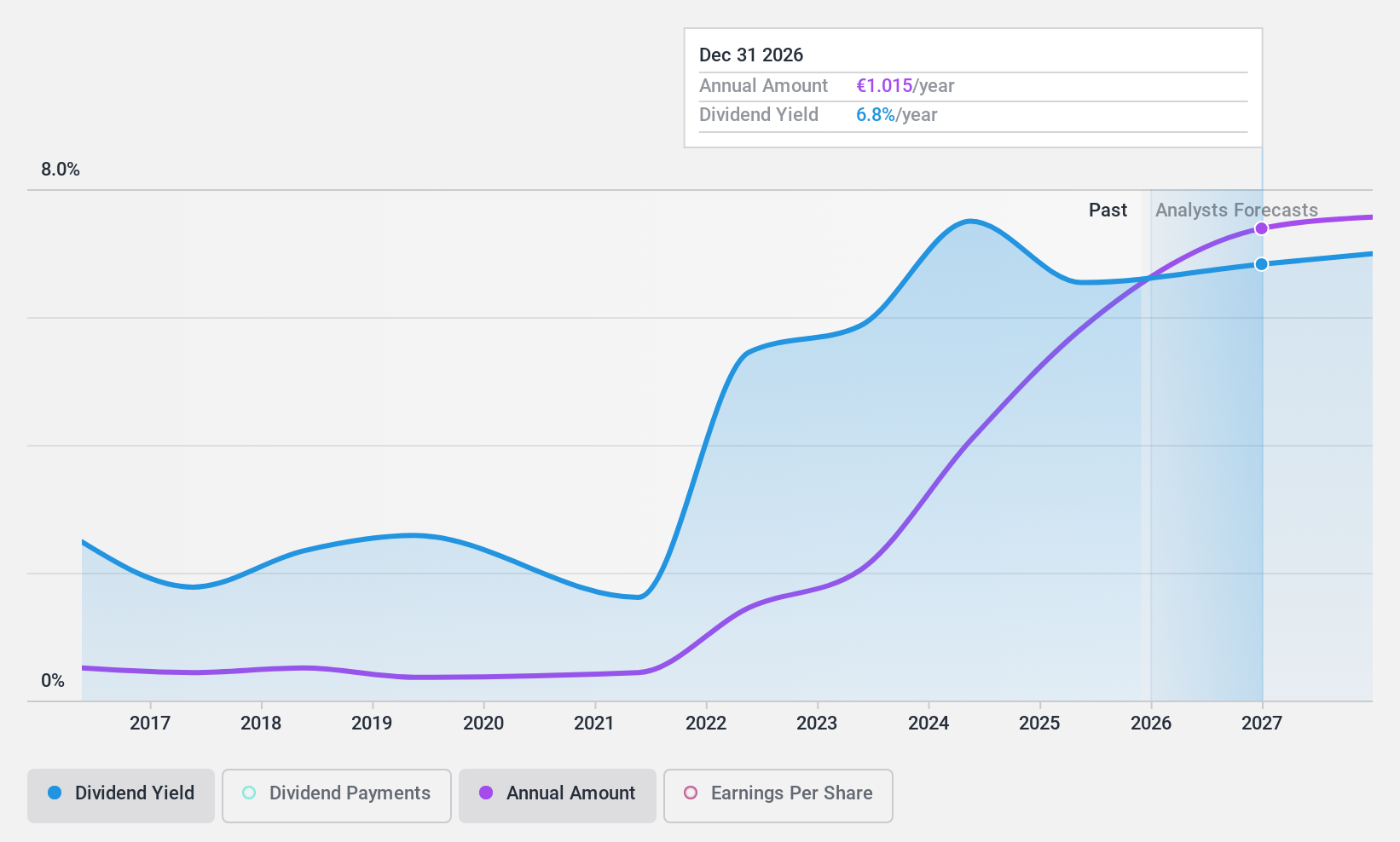

Banca Popolare di Sondrio (BIT:BPSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Popolare di Sondrio S.p.A., along with its subsidiaries, offers a range of banking products and services in Italy and has a market capitalization of approximately €4.21 billion.

Operations: Banca Popolare di Sondrio S.p.A. operates through various revenue segments, providing a diverse array of banking products and services across Italy.

Dividend Yield: 8.5%

Banca Popolare di Sondrio's dividend yield is among the top 25% in the Italian market, with a payout ratio of 62.6%, indicating dividends are well-covered by earnings. However, its dividend track record has been volatile and unreliable over the past decade. Recent earnings growth and a proposed acquisition by BPER Banca SpA valued at €4.32 billion could influence future dividend stability and growth potential, subject to regulatory approvals and integration success.

- Get an in-depth perspective on Banca Popolare di Sondrio's performance by reading our dividend report here.

- Our expertly prepared valuation report Banca Popolare di Sondrio implies its share price may be too high.

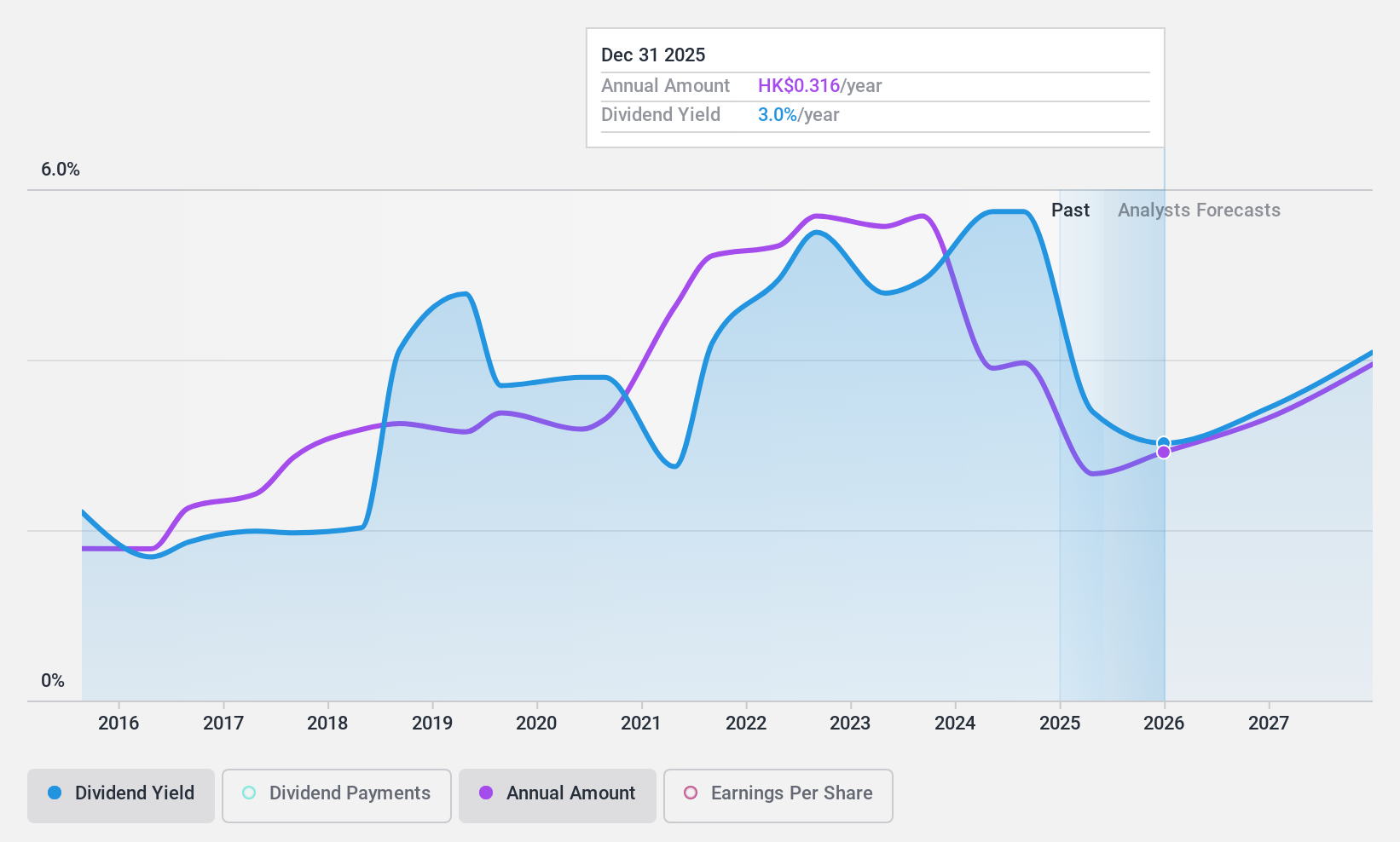

China Medical System Holdings (SEHK:867)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Medical System Holdings Limited is an investment holding company that manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China, with a market cap of HK$18.24 billion.

Operations: The company's revenue primarily comes from the marketing, promotion, sales, and manufacturing of pharmaceutical products, amounting to CN¥7.01 billion.

Dividend Yield: 5.5%

China Medical System Holdings has a payout ratio of 40.3%, suggesting dividends are covered by earnings, though past payments have been volatile. The dividend yield is lower than the top tier in Hong Kong. Recent collaborations, like with Mabgeek Biotechnology for MG-K10, aim to enhance its innovative drug pipeline and market presence. Despite trading below estimated fair value, the company's dividend reliability remains questionable due to an unstable track record.

- Click to explore a detailed breakdown of our findings in China Medical System Holdings' dividend report.

- Our valuation report unveils the possibility China Medical System Holdings' shares may be trading at a discount.

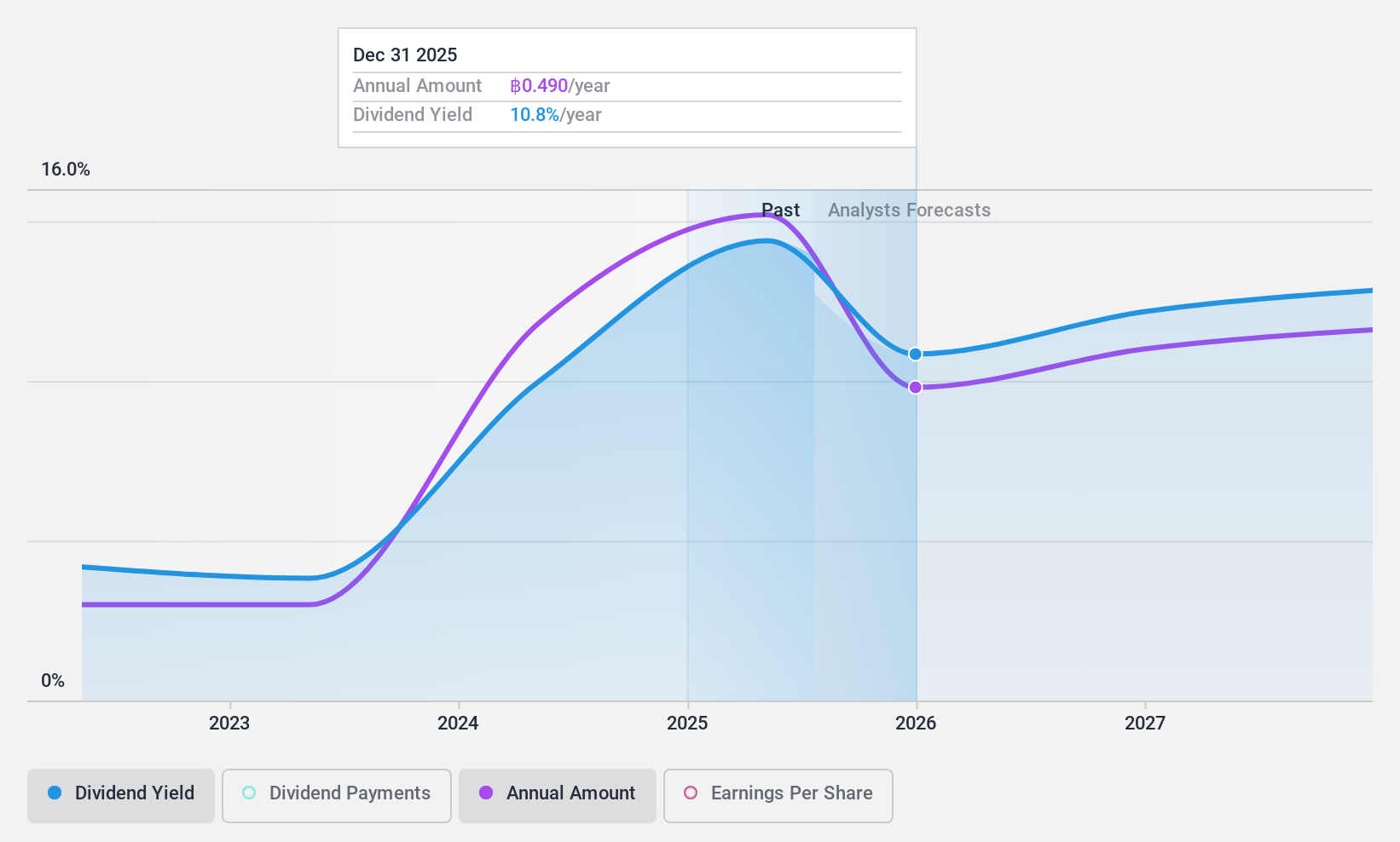

Pinthong Industrial Park (SET:PIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pinthong Industrial Park Public Company Limited, along with its subsidiaries, focuses on the development and rental of real estate projects in Thailand and has a market cap of THB7.89 billion.

Operations: Pinthong Industrial Park Public Company Limited generates revenue primarily from its industrial estate segment, which amounts to THB4.51 billion.

Dividend Yield: 8.7%

Pinthong Industrial Park's dividend yield is among the top 25% in Thailand, supported by a low payout ratio of 33.8%, ensuring sustainability through earnings and cash flows. Despite only three years of dividend history, payments have been stable with growth potential. The company trades below estimated fair value and reported significant revenue growth to THB 3.16 billion for the first nine months of 2024, showcasing robust financial health despite anticipated future earnings decline.

- Dive into the specifics of Pinthong Industrial Park here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Pinthong Industrial Park shares in the market.

Seize The Opportunity

- Gain an insight into the universe of 1961 Top Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PIN

Pinthong Industrial Park

Engages in the development and rental of real estate projects in Thailand.

Outstanding track record, undervalued and pays a dividend.

Market Insights

Community Narratives