As European markets navigate a mixed landscape with the pan-European STOXX Europe 600 Index slightly down amid global growth concerns and a stronger euro, investors are turning their attention to dividend stocks as a potential source of steady income. In such uncertain times, selecting dividend stocks with strong fundamentals and consistent payout histories can offer stability and resilience in an investor's portfolio.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.32% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.89% | ★★★★★☆ |

| Swiss Re (SWX:SREN) | 4.20% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.40% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.60% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.91% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.24% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.66% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.53% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.96% | ★★★★★☆ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

BPER Banca (BIT:BPE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BPER Banca SpA offers a range of banking products and services to individuals, businesses, and professionals both in Italy and internationally, with a market cap of €17.75 billion.

Operations: BPER Banca SpA generates revenue through its diverse offerings of banking products and services tailored for individuals, businesses, and professionals across Italy and international markets.

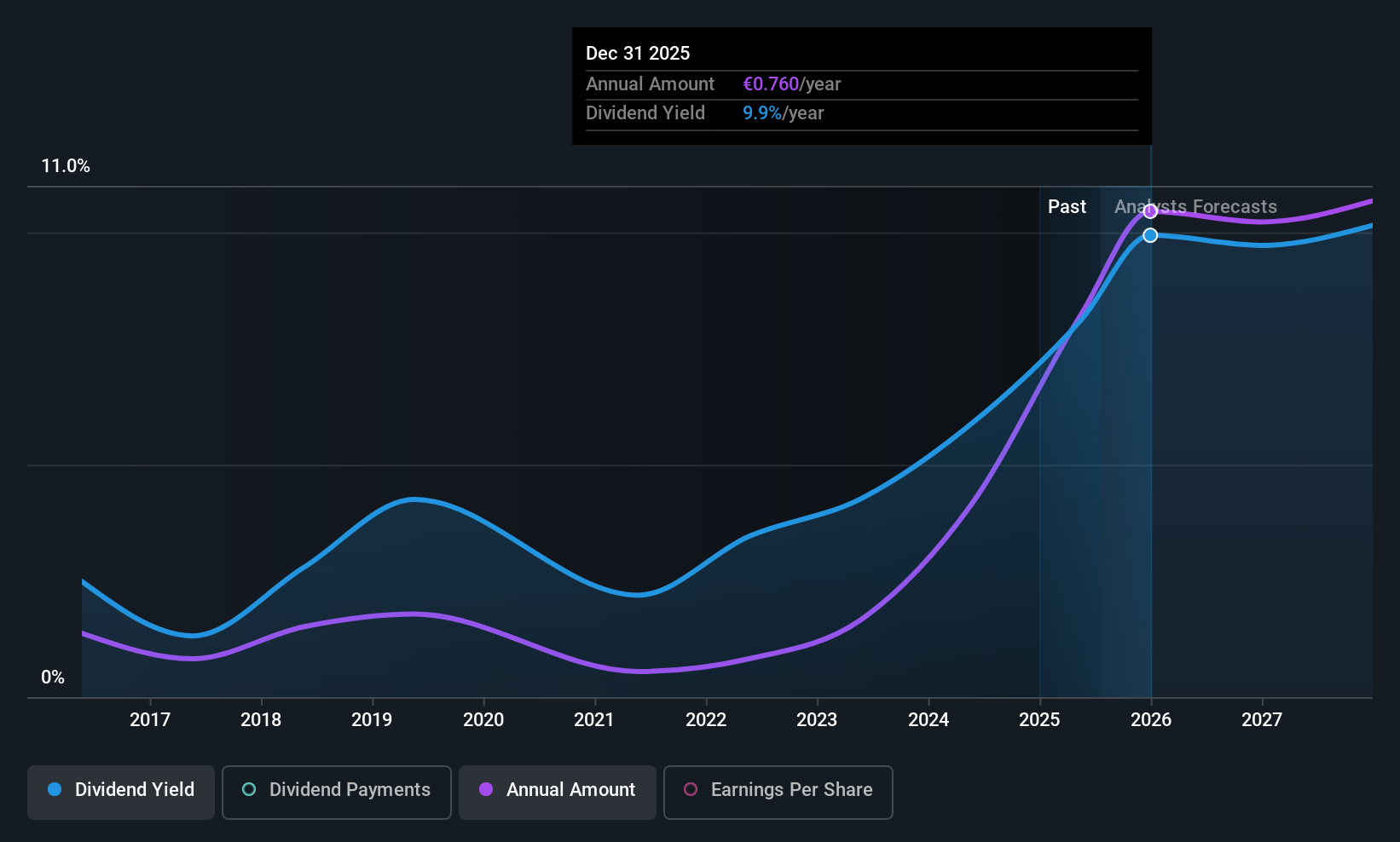

Dividend Yield: 6.6%

BPER Banca has demonstrated a capacity for dividend growth over the past decade, although its payments have been volatile and deemed unreliable. Despite this, its current payout ratio of 53.7% suggests dividends are covered by earnings and are forecast to remain sustainable with an 84.7% payout in three years. Recent guidance upgrades indicate revenue expectations of €5.5 billion for 2025, while net income rose significantly to €903.47 million in H1 2025, enhancing dividend prospects further despite high bad loans at 2.2%.

- Click here and access our complete dividend analysis report to understand the dynamics of BPER Banca.

- Our expertly prepared valuation report BPER Banca implies its share price may be too high.

Semapa - Sociedade de Investimento e Gestão SGPS (ENXTLS:SEM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Semapa - Sociedade de Investimento e Gestão, SGPS, S.A. operates through its subsidiaries to produce and sell pulp, printing and writing papers, and tissues across various regions including Portugal, Europe, the United States, Africa, Asia, and Oceania with a market cap of €1.43 billion.

Operations: Semapa - Sociedade de Investimento e Gestão SGPS generates revenue through its subsidiaries by producing and selling pulp, printing and writing papers, and tissues in diverse global markets.

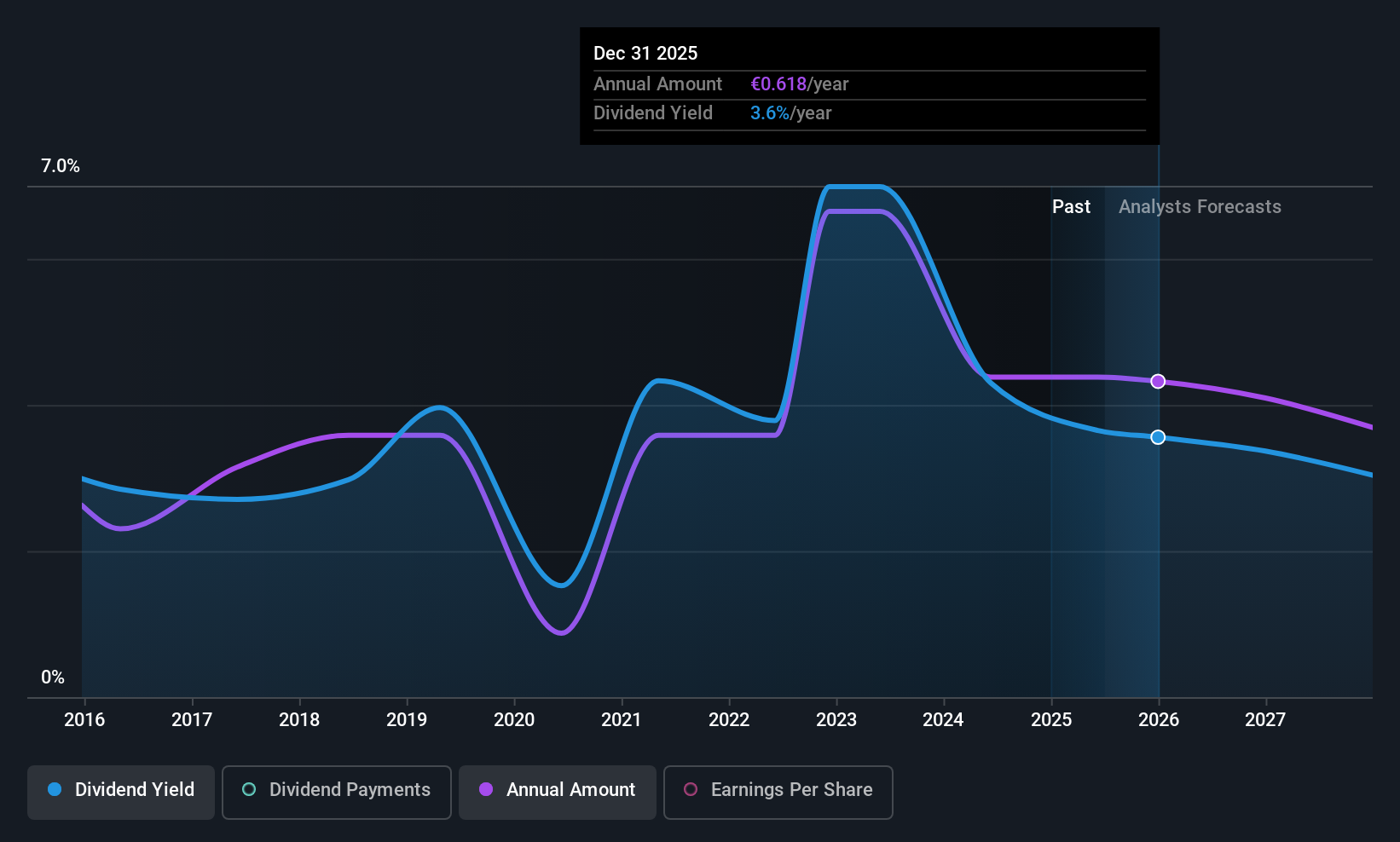

Dividend Yield: 3.5%

Semapa's dividend payments have been volatile over the past decade, with an annual drop exceeding 20% at times, making them unreliable. Despite this, the dividends are well-covered by earnings and cash flows due to a low payout ratio of 21.5% and cash payout ratio of 20%. Trading at a significant discount to its estimated fair value, Semapa offers a potential upside in stock price but carries high debt levels and lower profit margins compared to last year.

- Dive into the specifics of Semapa - Sociedade de Investimento e Gestão SGPS here with our thorough dividend report.

- Our valuation report unveils the possibility Semapa - Sociedade de Investimento e Gestão SGPS' shares may be trading at a discount.

Neurones (ENXTPA:NRO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services both in France and internationally, with a market cap of €996.06 million.

Operations: Neurones S.A.'s revenue is derived from three primary segments: Application Services (€257.51 million), Infrastructure Services (€499.74 million), and Council (€53.10 million).

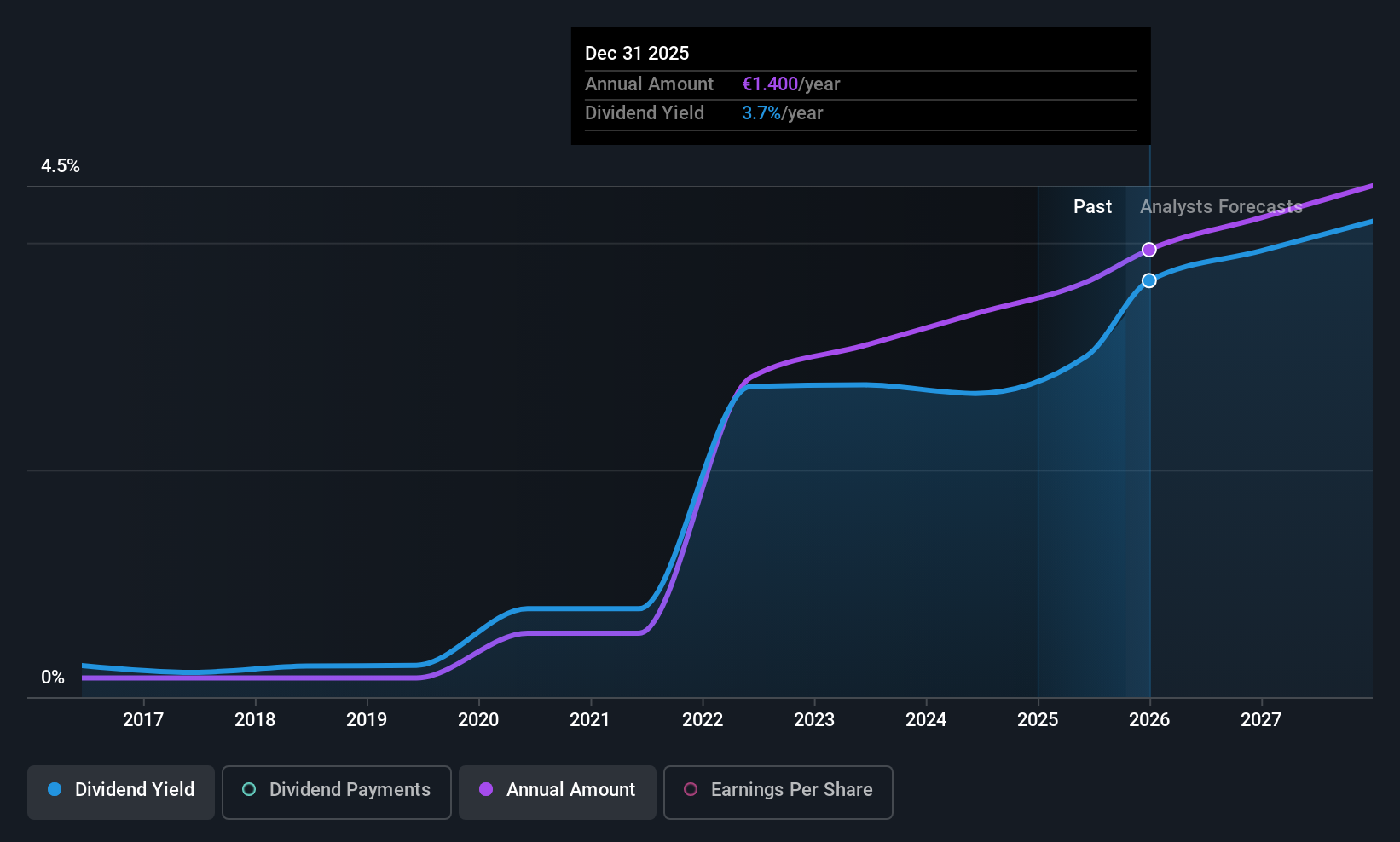

Dividend Yield: 3.2%

Neurones S.A. offers a stable dividend profile, with payments reliably increasing over the past decade and well-covered by both earnings (payout ratio: 60%) and cash flows (cash payout ratio: 43.7%). Despite a lower-than-top-tier yield of 3.17%, its dividends are consistent and supported by recent financial performance, including half-year sales growth to €424.3 million from €402.4 million year-on-year, though net income slightly decreased to €22.7 million from €24.5 million.

- Click here to discover the nuances of Neurones with our detailed analytical dividend report.

- According our valuation report, there's an indication that Neurones' share price might be on the expensive side.

Summing It All Up

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 220 more companies for you to explore.Click here to unveil our expertly curated list of 223 Top European Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BPER Banca might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BPE

BPER Banca

Provides banking products and services for individuals, and businesses and professionals in Italy and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives