- Denmark

- /

- Medical Equipment

- /

- CPSE:COLO B

European Stocks That May Be Trading Below Estimated Value In December 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with major indices like the STOXX Europe 600 and Germany’s DAX posting notable gains, investors are keenly observing economic indicators such as inflation trends that suggest stability around the ECB's target. In this environment, identifying stocks that may be undervalued can offer potential opportunities for growth, especially when these companies demonstrate strong fundamentals and a capacity to thrive amid evolving market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

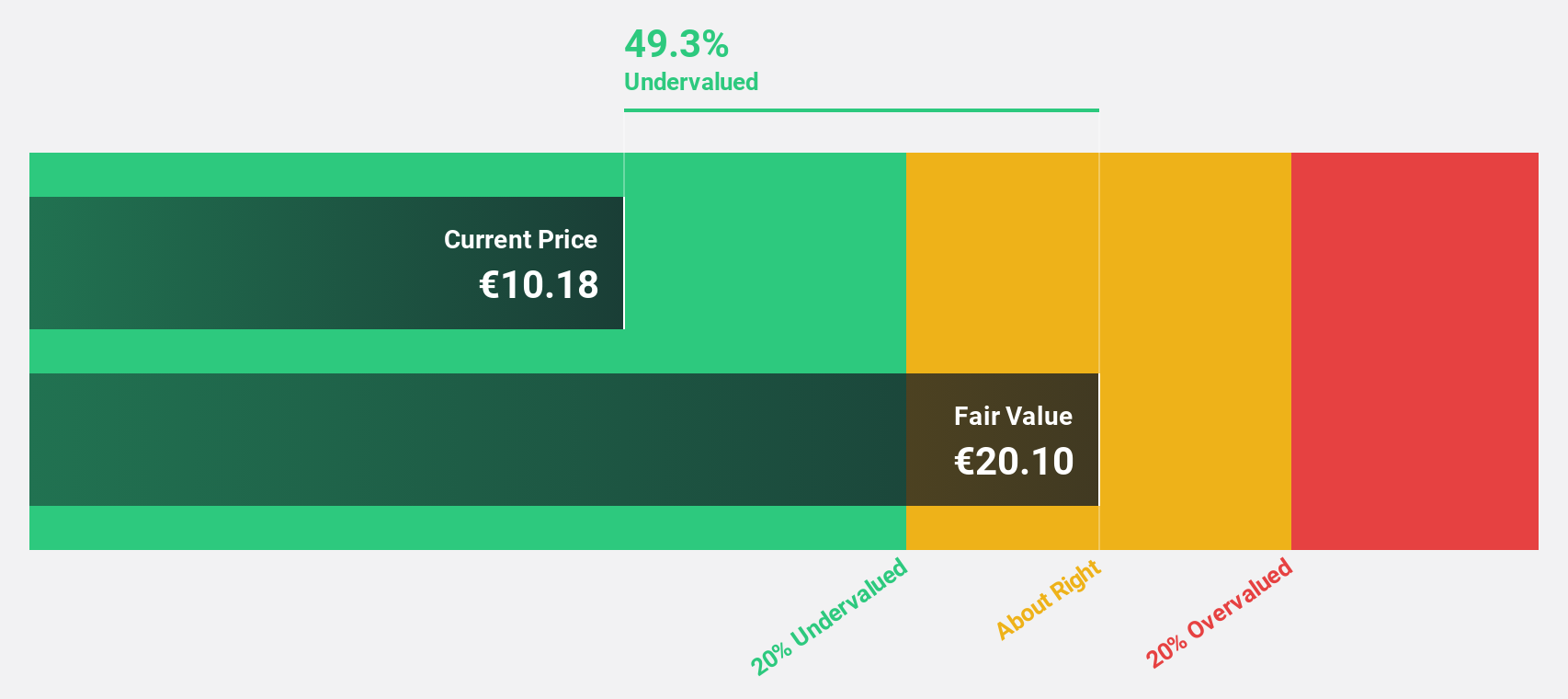

| Stellantis (BIT:STLAM) | €10.184 | €20.10 | 49.3% |

| Sanoma Oyj (HLSE:SANOMA) | €9.46 | €18.52 | 48.9% |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €68.97 | 49.3% |

| Micro Systemation (OM:MSAB B) | SEK64.40 | SEK126.75 | 49.2% |

| KB Components (OM:KBC) | SEK42.00 | SEK83.11 | 49.5% |

| Jæren Sparebank (OB:JAREN) | NOK385.00 | NOK752.01 | 48.8% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.39 | €0.77 | 49.5% |

| Exail Technologies (ENXTPA:EXA) | €82.80 | €161.75 | 48.8% |

| Atea (OB:ATEA) | NOK152.60 | NOK300.04 | 49.1% |

| Allcore (BIT:CORE) | €1.34 | €2.65 | 49.5% |

Here's a peek at a few of the choices from the screener.

Stellantis (BIT:STLAM)

Overview: Stellantis N.V. operates globally in the design, engineering, manufacturing, and sale of automobiles, light commercial vehicles, and related products and services with a market cap of approximately €29.42 billion.

Operations: The company's revenue segments include North America (€53.30 billion), South America (€16.27 billion), Enlarged Europe (€58.28 billion), Middle East and Africa (€10.04 billion), China and India & Asia Pacific (€1.84 billion), and Maserati (€778 million).

Estimated Discount To Fair Value: 49.3%

Stellantis, trading at €10.18, is significantly undervalued compared to its estimated fair value of €20.1, with cash flows suggesting potential upside. However, its dividend yield of 6.68% isn't well covered by earnings or free cash flow. Despite a volatile share price recently and low forecasted return on equity (7.7%), Stellantis shows promising revenue growth exceeding the Italian market average and is expected to become profitable within three years.

- Insights from our recent growth report point to a promising forecast for Stellantis' business outlook.

- Dive into the specifics of Stellantis here with our thorough financial health report.

Coloplast (CPSE:COLO B)

Overview: Coloplast A/S develops and sells intimate healthcare products and services across Denmark, the United States, the United Kingdom, France, and internationally, with a market cap of DKK131.88 billion.

Operations: The company's revenue segments include Chronic Care (DKK18.88 billion), Interventional Urology (DKK2.78 billion), Advanced Wound Dressings (DKK2.68 billion), Voice and Respiratory Care (DKK2.28 billion), and Biologics (DKK1.25 billion).

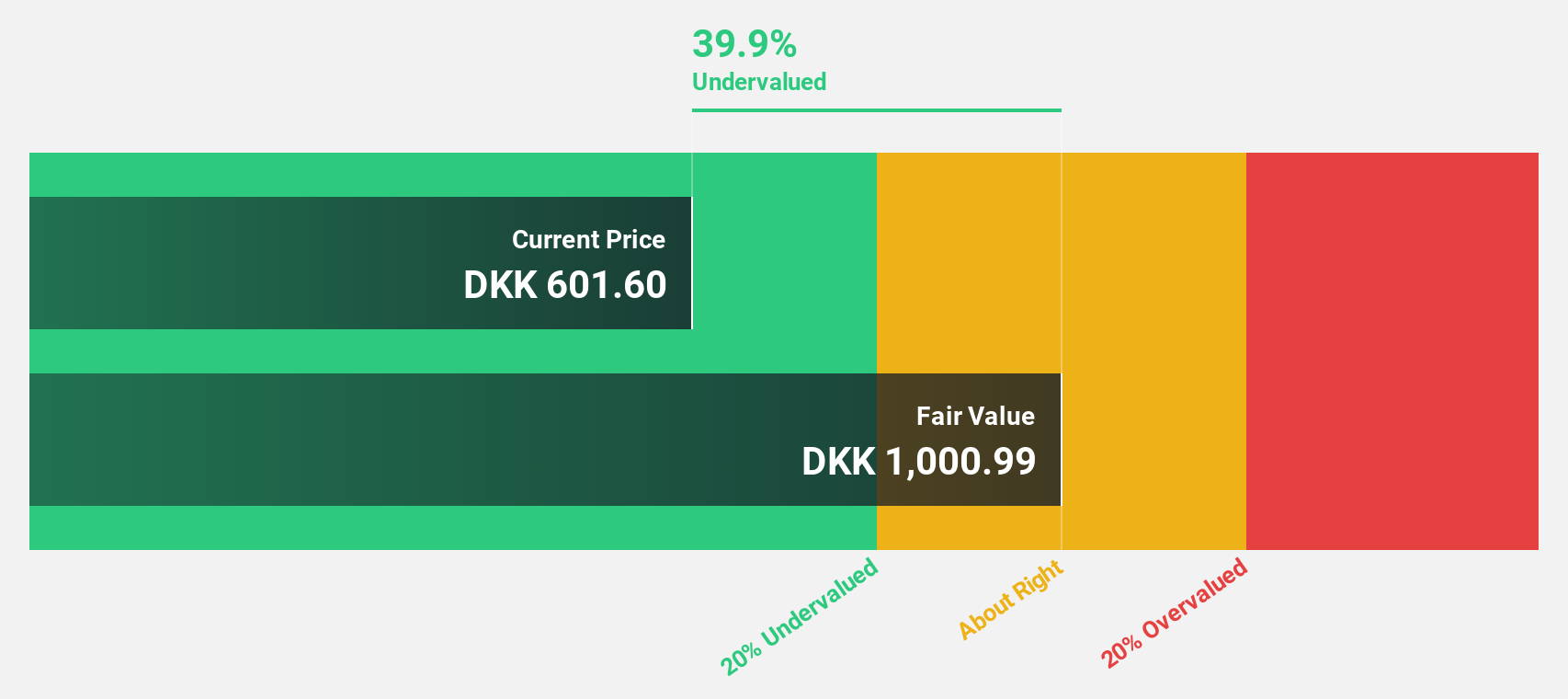

Estimated Discount To Fair Value: 27.1%

Coloplast, trading at DKK 585.2, is undervalued with a fair value estimate of DKK 803.04 based on cash flow analysis. Despite having a high debt level and reduced profit margins compared to last year, its earnings are projected to grow faster than the Danish market at 14.8% annually. Recent board changes and dividend increases highlight strategic shifts, though dividends remain poorly covered by earnings or free cash flow.

- The analysis detailed in our Coloplast growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Coloplast.

AlzChem Group (XTRA:ACT)

Overview: AlzChem Group AG, with a market cap of €1.36 billion, develops, produces, and markets a range of chemical specialties across Germany, the European Union, the rest of Europe, Asia, the NAFTA region, and internationally.

Operations: The company's revenue is primarily derived from its Specialty Chemicals segment, which accounts for €370.59 million, and the Basics & Intermediates segment, contributing €163.48 million.

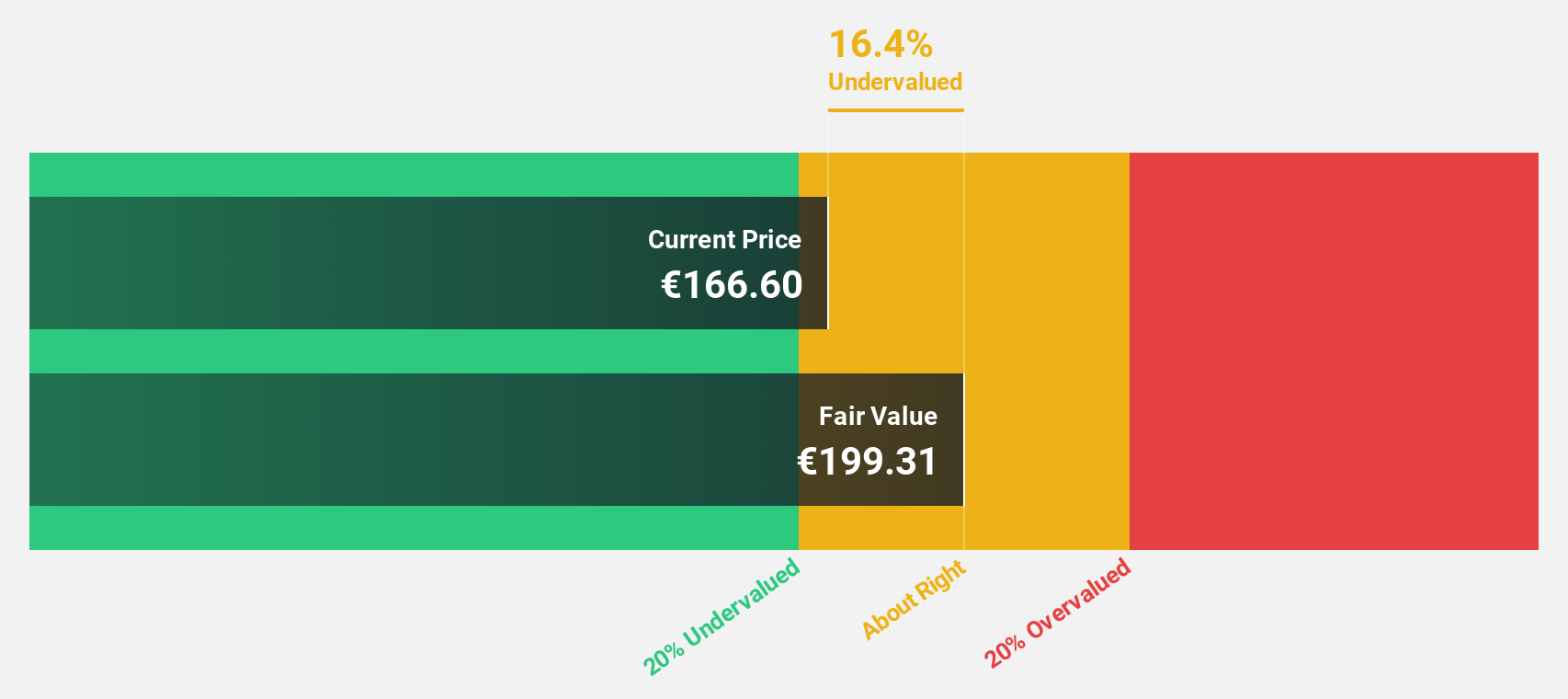

Estimated Discount To Fair Value: 41.8%

AlzChem Group, trading below its estimated fair value of €231.37 at €134.6, shows potential as an undervalued stock based on cash flows. With earnings growth forecasted at 17.7% annually—exceeding the German market's average—and recent sales increases to €137.27 million for Q3 2025, the company demonstrates robust financial health. However, revenue growth is expected to be moderate at 9.2% annually compared to significant earnings expansion forecasts and high projected return on equity of 26.5%.

- Upon reviewing our latest growth report, AlzChem Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of AlzChem Group with our comprehensive financial health report here.

Key Takeaways

- Click this link to deep-dive into the 198 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:COLO B

Coloplast

Engages in the development and sale of intimate healthcare products and services in Denmark, the United States, the United Kingdom, France, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026