Could Ferrari’s New Credit Line And PMI Deal Refocus Its Brand Strategy Beyond Cars (BIT:RACE)?

Reviewed by Sasha Jovanovic

- In early December 2025, Ferrari N.V. arranged a new €350 million unsecured, five-year revolving credit facility at a lower cost of capital and renewed its multi-year motorsport partnership with Philip Morris International, effective from 2026.

- The strengthened Philip Morris International collaboration, spanning Scuderia Ferrari HP and the Ferrari Challenge, underlines how commercial sponsorships support Ferrari’s racing presence and broader brand monetization beyond car sales.

- Next, we’ll examine how this reinforced Philip Morris International partnership fits into Ferrari’s investment narrative around high-margin sponsorship and brand revenues.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ferrari Investment Narrative Recap

To own Ferrari, you need to believe the brand can keep converting scarcity and racing prestige into resilient, high-margin cash flows, even as the auto industry shifts toward electrification and shifting luxury tastes. The renewed Philip Morris International partnership and cheaper revolving credit facility both modestly support near term flexibility, but they do not materially change the key short term catalyst around sustaining pricing power or the main risk of evolving demand and regulatory pressure on high performance vehicles.

Among recent announcements, the renewed and strengthened multi year partnership with Philip Morris International stands out as most relevant here, because it reinforces Ferrari’s sponsorship and racing economics rather than its car volumes. As the company balances product cycle transitions and potential ASP pressure, incremental, higher visibility sponsorship income can help offset some revenue or margin bumpiness, while still leaving investors exposed to broader shifts in customer behavior and regulatory requirements.

Yet even with these long standing sponsorship tailwinds, investors should be aware that...

Read the full narrative on Ferrari (it's free!)

Ferrari's narrative projects €8.8 billion revenue and €2.1 billion earnings by 2028. This requires 8.1% yearly revenue growth and about a €0.5 billion earnings increase from €1.6 billion today.

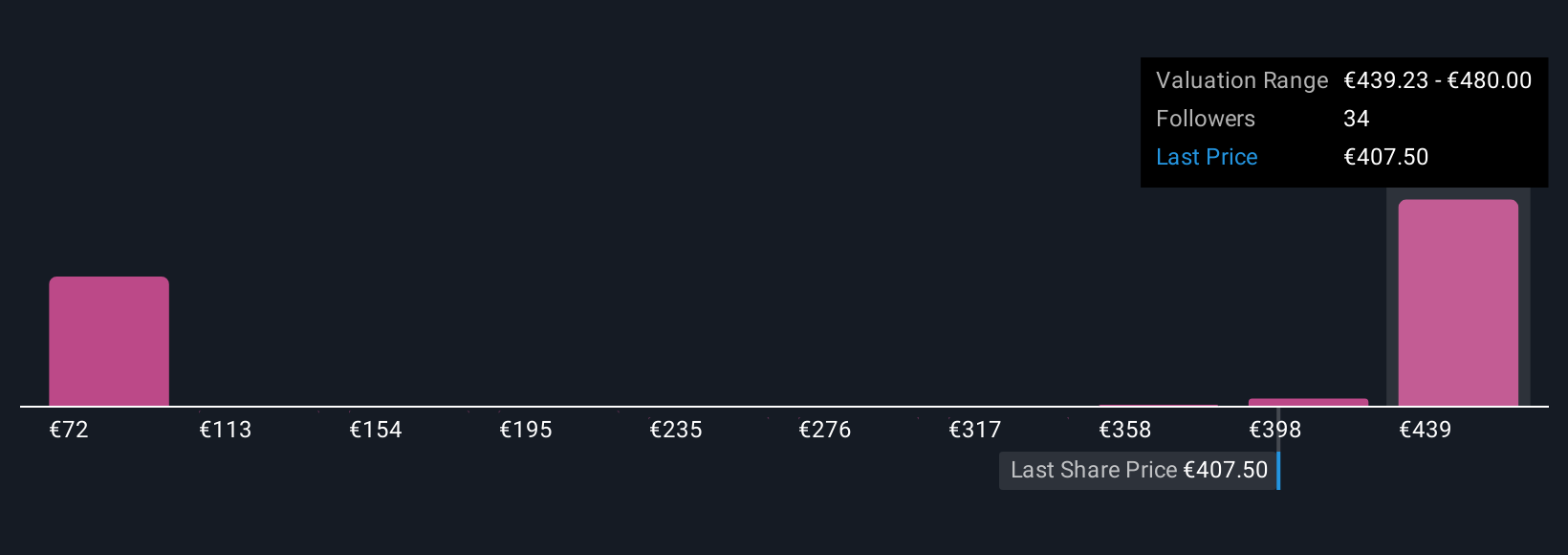

Uncover how Ferrari's forecasts yield a €404.24 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community span about €89.92 to roughly €545.09, showing how far apart individual expectations can be. When you weigh that spread against Ferrari’s reliance on maintaining demand for ultra high end vehicles amid changing luxury and regulatory trends, it becomes clear why comparing several independent viewpoints may help frame the company’s possible paths ahead.

Explore 16 other fair value estimates on Ferrari - why the stock might be worth less than half the current price!

Build Your Own Ferrari Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ferrari research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ferrari research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ferrari's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026