- Iceland

- /

- Specialty Stores

- /

- ICSE:FESTI

Investors Continue Waiting On Sidelines For Festi hf. (ICE:FESTI)

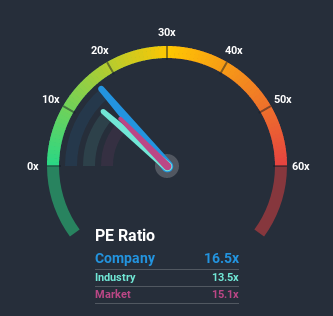

It's not a stretch to say that Festi hf.'s (ICE:FESTI) price-to-earnings (or "P/E") ratio of 16.5x right now seems quite "middle-of-the-road" compared to the market in Iceland, where the median P/E ratio is around 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Earnings have risen firmly for Festi hf recently, which is pleasing to see. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Festi hf

Is There Some Growth For Festi hf?

Festi hf's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 22% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for a contraction of 11% shows the market is even less attractive on an annualised basis.

With this information, it's perhaps curious but not a major surprise that Festi hf is trading at a fairly similar P/E in comparison. Even if the company's recent growth rates continue outperforming the market, shrinking earnings are unlikely to lead to a stable P/E long-term. Even just maintaining these prices will be difficult to achieve as recent earnings trends are already weighing down the shares.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Festi hf currently trades on a lower than expected P/E since its recent three-year earnings aren't as bad as the forecasts for a struggling market. There could be some unobserved threats to earnings preventing the P/E ratio from matching this more attractive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and resist the broader market turmoil. It appears some are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Festi hf that you need to be mindful of.

You might be able to find a better investment than Festi hf. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you decide to trade Festi hf, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Festi hf, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ICSE:FESTI

Festi hf

Engages in the retail sale of fuel, goods, groceries and related products, and electronic equipment in Iceland.

Solid track record average dividend payer.