- India

- /

- Water Utilities

- /

- NSEI:WABAG

VA Tech Wabag Limited's (NSE:WABAG) Shares Climb 33% But Its Business Is Yet to Catch Up

VA Tech Wabag Limited (NSE:WABAG) shares have continued their recent momentum with a 33% gain in the last month alone. The last month tops off a massive increase of 132% in the last year.

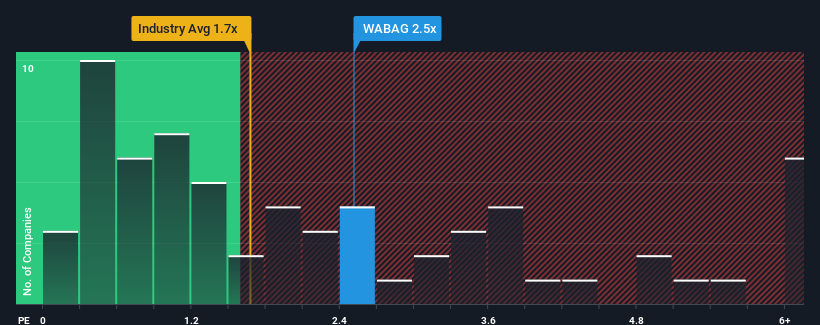

Following the firm bounce in price, you could be forgiven for thinking VA Tech Wabag is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in India's Water Utilities industry have P/S ratios below 1.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for VA Tech Wabag

What Does VA Tech Wabag's Recent Performance Look Like?

While the industry has experienced revenue growth lately, VA Tech Wabag's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on VA Tech Wabag will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, VA Tech Wabag would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.5%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 15% over the next year. That's shaping up to be similar to the 16% growth forecast for the broader industry.

In light of this, it's curious that VA Tech Wabag's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

VA Tech Wabag shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting VA Tech Wabag's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 1 warning sign for VA Tech Wabag you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WABAG

VA Tech Wabag

Engages in the design, supply, installation, construction, operation, and maintenance of drinking water, waste and industrial water treatment, and desalination plants in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives