Over the last 7 days, the Indian market has dropped 1.0%, driven by losses in the Energy and Industrials sectors of 3.7% and 1.8%. However, over the longer term, the market has risen by 39% in the last year with earnings forecasted to grow by 17% annually. In this context, dividend stocks can provide a stable income stream and potential for capital appreciation, making them an attractive option for investors seeking steady returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.12% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 3.92% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.22% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.10% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 7.98% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.10% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.19% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.10% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.23% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.66% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Indian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms for news and event management businesses in India and internationally, with a market cap of ₹58.06 billion.

Operations: D. B. Corp Limited's revenue segments include ₹1.62 billion from radio and ₹22.77 billion from printing, publishing, and allied businesses.

Dividend Yield: 5.2%

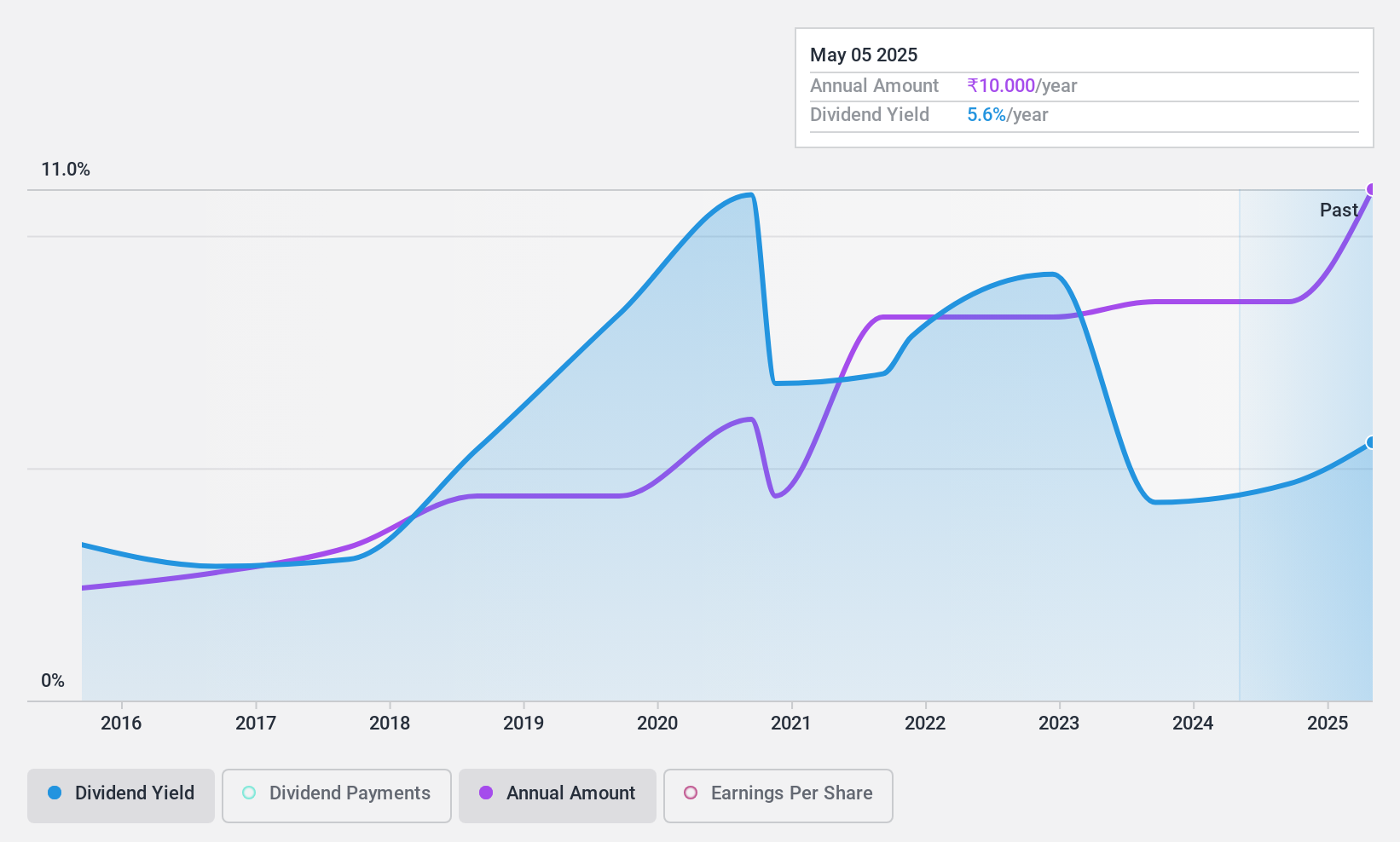

D. B. Corp Limited's dividend payments are well-covered by earnings (65.2% payout ratio) and free cash flows (57% cash payout ratio). The company's dividend yield of 5.22% places it in the top 25% of Indian market payers, although its dividend track record has been unstable over the past decade with occasional volatility. Recently, DBCORP declared an interim dividend of ₹7 per share for FY2024-25, amidst reporting strong Q1 earnings growth with net income rising to ₹1.18 billion from ₹787.59 million a year ago.

- Click to explore a detailed breakdown of our findings in D. B's dividend report.

- According our valuation report, there's an indication that D. B's share price might be on the cheaper side.

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, with a market cap of ₹63.15 billion, engages in the trading of power across India, Nepal, Bhutan, and Bangladesh through its subsidiaries.

Operations: PTC India Limited generates revenue primarily from its power trading segment, which accounts for ₹159.67 billion, and its financing business, which contributes ₹7.35 billion.

Dividend Yield: 3.7%

PTC India's dividend payments are well-covered by earnings (54% payout ratio) and cash flows (9.4% cash payout ratio). The company offers a competitive dividend yield of 3.66%, placing it in the top 25% of Indian market payers. However, its dividend track record has been unstable over the past decade with occasional volatility. Recent Q1 FY2025 results showed net income rising to ₹1.74 billion from ₹1.30 billion a year ago, indicating solid financial performance amidst executive changes.

- Get an in-depth perspective on PTC India's performance by reading our dividend report here.

- Our expertly prepared valuation report PTC India implies its share price may be too high.

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited, with a market cap of ₹21.42 billion, manufactures and sells engineering systems, solutions, and assemblies primarily for off-highway vehicles in India and internationally.

Operations: Uniparts India Limited generates revenue of ₹11.04 billion from the sale of linkage parts and components for off-highway vehicles.

Dividend Yield: 4.3%

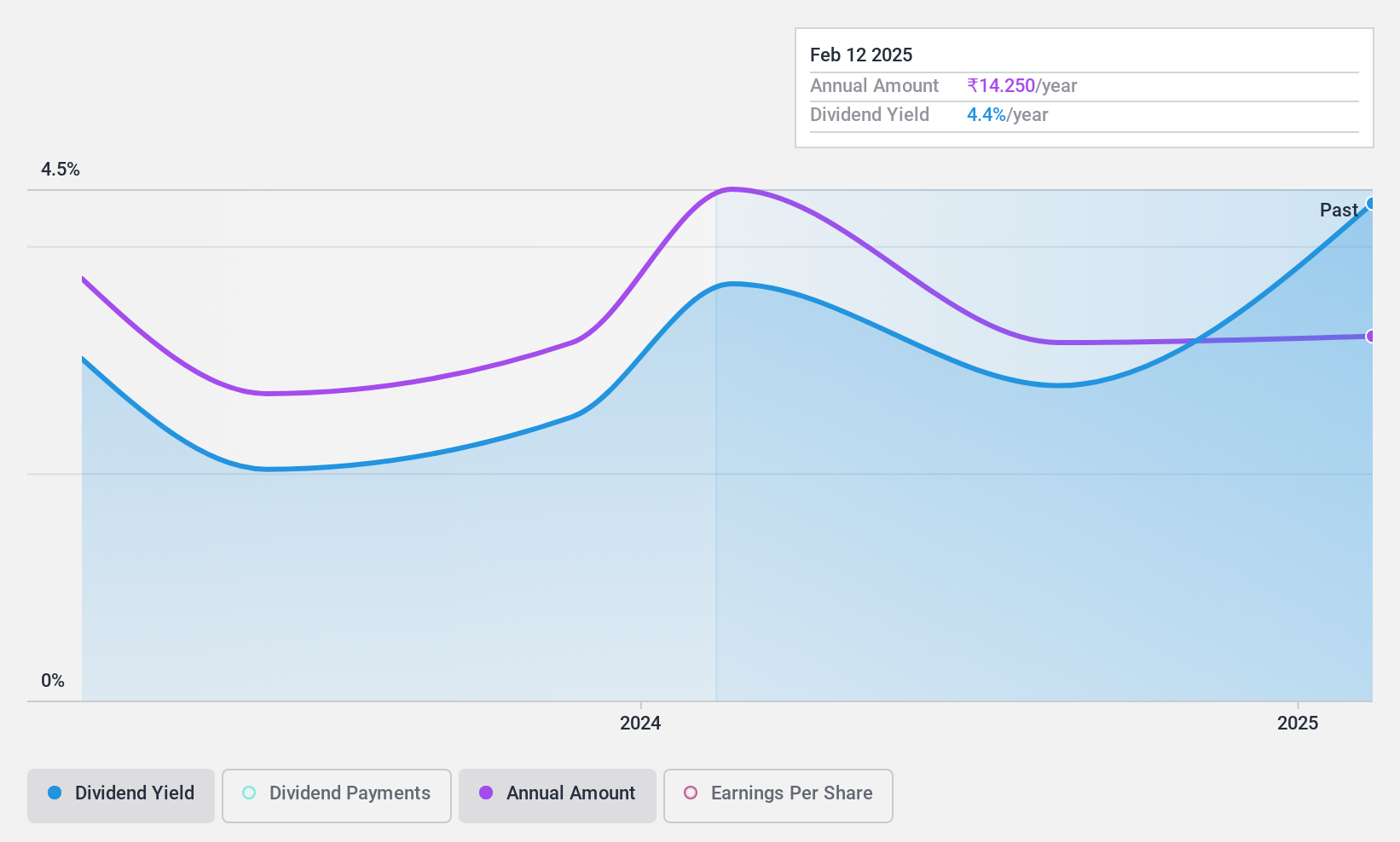

Uniparts India offers a dividend yield of 4.34%, ranking it in the top 25% of Indian market payers. Although its Price-to-Earnings ratio (19x) suggests good value, its dividends have been volatile and only paid for two years. The payout ratios are reasonable, with earnings coverage at 73.8% and cash flow coverage at 56.7%. Recent Q1 FY2025 results showed a decline in revenue to ₹2.65 billion and net income to ₹248.92 million amidst board changes and an interim dividend announcement of ₹6.75 per share.

- Take a closer look at Uniparts India's potential here in our dividend report.

- The analysis detailed in our Uniparts India valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Click through to start exploring the rest of the 15 Top Indian Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DBCORP

D. B

Engages in the business of publishing newspapers, radio broadcasting, and digital platforms for news and event management in India and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives