Top Dividend Stocks On The Indian Exchange For September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.1%, driven by losses in the Financials and Energy sectors of 2.1% and 5.2%, respectively. Despite this short-term dip, the market is up 40% over the past year with earnings expected to grow by 17% per annum over the next few years, making it crucial to identify stocks that offer stability through consistent dividend payouts amidst such fluctuations.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.07% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 3.90% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.07% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.16% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.08% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.23% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.10% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.04% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.56% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.21% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Indian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

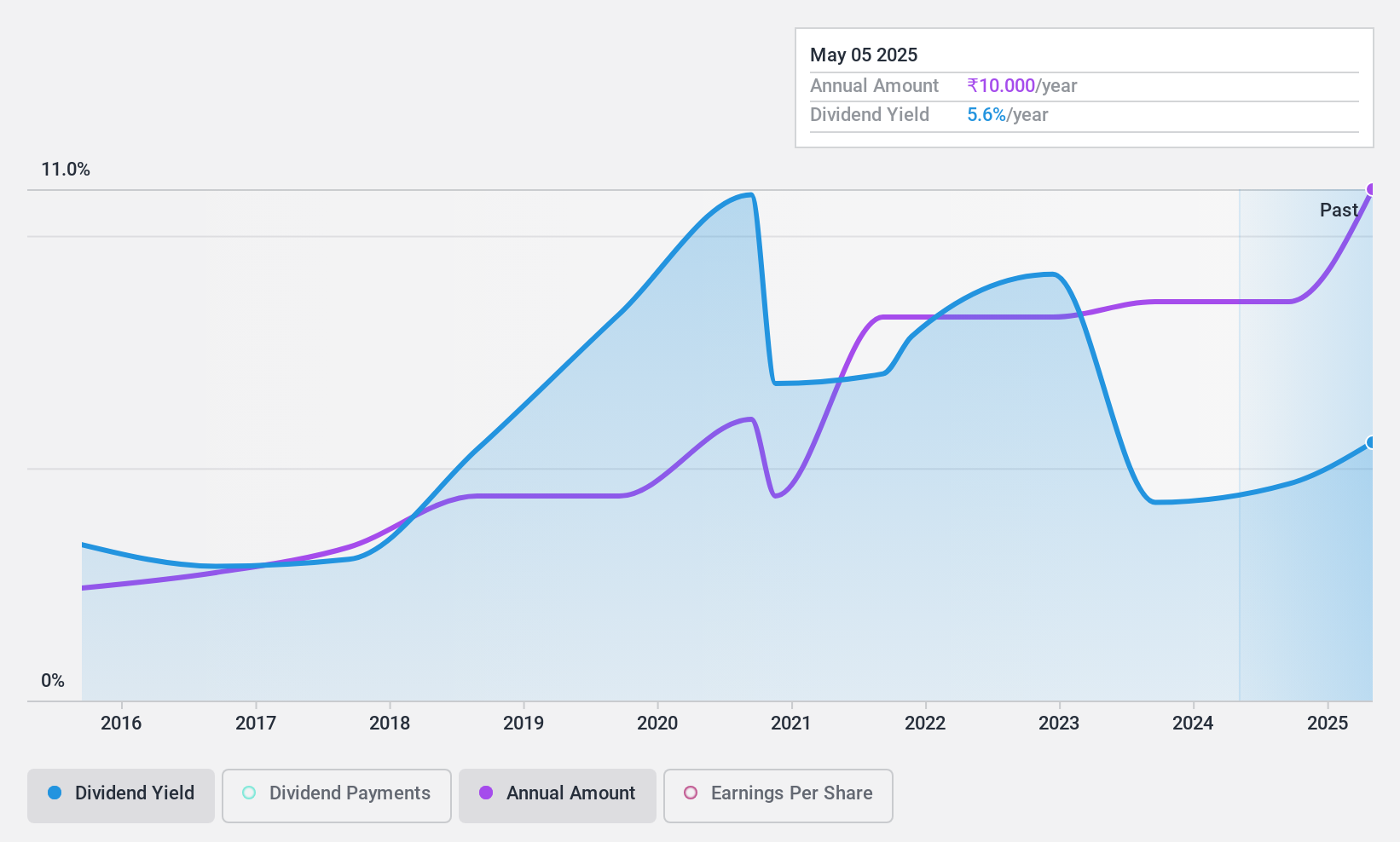

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms for news and event management in India and internationally, with a market cap of ₹59.43 billion.

Operations: D. B. Corp Limited generates revenue primarily from its printing, publishing, and allied business segment (₹22.77 billion) and radio broadcasting segment (₹1.62 billion).

Dividend Yield: 5.1%

D. B. Corp's dividend payments have grown over the past decade but have been unstable with significant drops exceeding 20%. The company's dividends are well-covered by earnings (65.2% payout ratio) and cash flows (57% cash payout ratio), making them sustainable despite volatility. Trading at 13.1% below its fair value, DBCORP offers a competitive dividend yield in India's top quartile at 5.07%. Recent earnings growth of 114.3% bolsters its financial position, though dividend reliability remains a concern.

- Click to explore a detailed breakdown of our findings in D. B's dividend report.

- Our valuation report here indicates D. B may be undervalued.

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, with a market cap of ₹64.92 billion, engages in the trading of power across India, Nepal, Bhutan, and Bangladesh through its subsidiaries.

Operations: PTC India Limited generates revenue primarily from power trading, amounting to ₹159.67 billion, and its financing business, contributing ₹7.35 billion.

Dividend Yield: 3.6%

PTC India's dividend payments have been volatile over the past decade, with significant annual drops exceeding 20%. Despite this instability, dividends are well-covered by earnings (54% payout ratio) and cash flows (9.4% cash payout ratio). The company's recent Q1 2024 net income of ₹1.74 billion marks an improvement from ₹1.30 billion a year ago. Trading at 88.7% below its estimated fair value, PTC offers a competitive dividend yield in the top quartile of Indian stocks at 3.56%.

- Get an in-depth perspective on PTC India's performance by reading our dividend report here.

- Our expertly prepared valuation report PTC India implies its share price may be lower than expected.

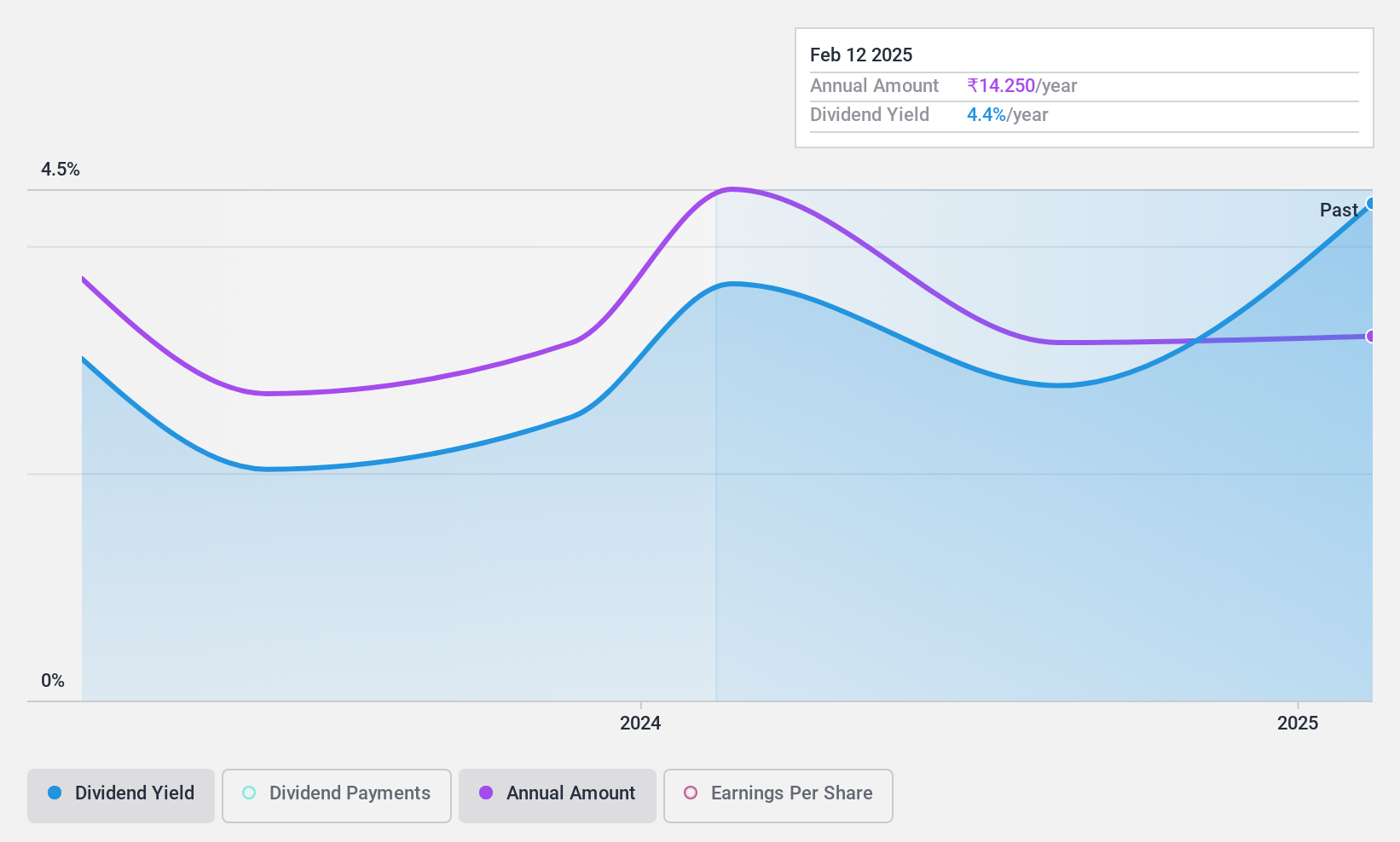

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited, with a market cap of ₹21.88 billion, manufactures and sells engineering systems, solutions, and assemblies primarily for off-highway vehicles across India, the United States, the Asia Pacific, Europe, Japan, and other international markets.

Operations: Uniparts India's revenue primarily comes from the sale of linkage parts and components for off-highway vehicles, amounting to ₹11.04 billion.

Dividend Yield: 4.2%

Uniparts India's dividend payments have been volatile over the past two years, with a recent interim dividend of ₹6.75 per share declared on August 8, 2024. Despite this instability, dividends are covered by earnings (73.8% payout ratio) and cash flows (56.7% cash payout ratio). The company trades at a favorable P/E ratio of 19.5x compared to the Indian market's 34.2x and offers a competitive dividend yield in the top quartile at 4.24%.

- Delve into the full analysis dividend report here for a deeper understanding of Uniparts India.

- The valuation report we've compiled suggests that Uniparts India's current price could be quite moderate.

Seize The Opportunity

- Click through to start exploring the rest of the 16 Top Indian Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UNIPARTS

Uniparts India

Manufactures and sells engineering systems, solutions, and assemblies primarily for off-highway vehicles in India, the United States, the Asia Pacific, Europe, Japan, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives